Deductions Management is a crucial part of Accounts Receivable Management, which can cost small and mid-market companies millions of dollars in yearly expenses if not managed efficiently. Effectively managing deductions is vital for businesses to maintain a steady cash flow and robust financial health. However, the traditional approach of deductions management is time-consuming and susceptible to errors.

In recent years, businesses have started adopting advanced technological solutions to enhance the efficiency of deduction management. In this blog, we will unravel the imperatives behind deduction management, delving into its role as a catalyst for elevating profits in B2B, and provide you with actionable strategies to improve deduction management.

Deduction Management: What is it and Why is it Essential?

When a company receives short payments from its customers against invoices or debit notes, the amount not paid is considered a deduction.

For example, if a customer has been invoiced for $500 but makes a payment of $300, that customer is said to be taking $200 as a deduction.

Deduction management is a process conducted by multiple teams, including finance teams, supply chain teams etc., in an organization that involves:

- Validating if a deduction is authorized or unauthorized (unidentified)

- Working with relevant stakeholders to handle unauthorized deductions

- Communicating with customers to resolve unauthorized deductions

- Modifying invoices in the ERP

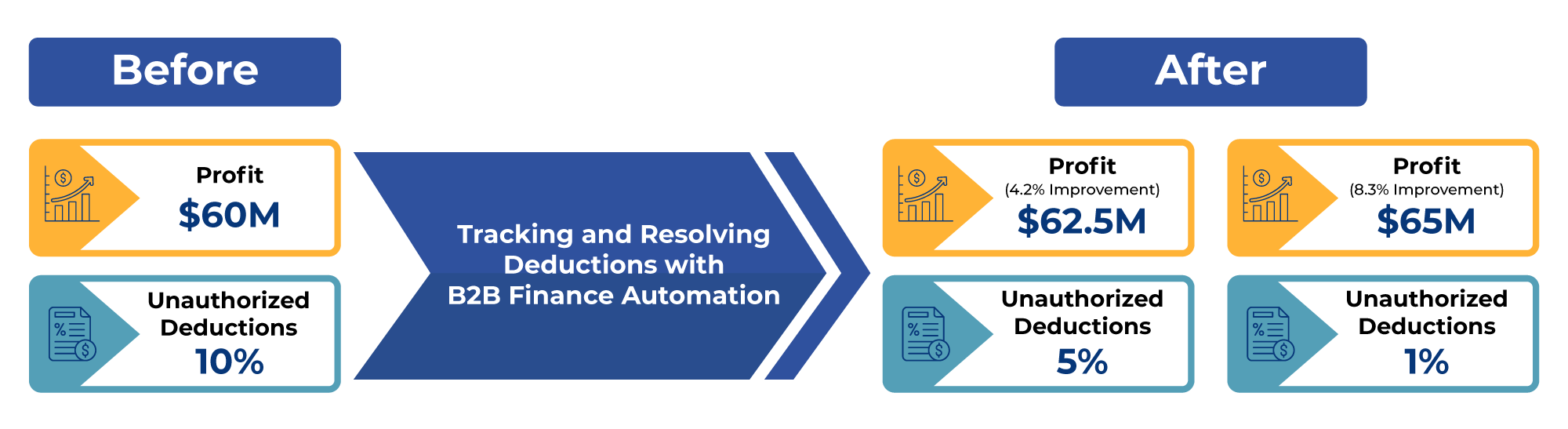

While deductions are more prevalent in goods-related industries, service-related industries also have several deduction types, which, if not actively tracked and resolved, could lead to significant margin/profit impact. Let us take an example:

In the above instance, a company with 10% unauthorized deductions implemented B2B finance automation solutions for deductions management. As a result of this implementation, the company successfully reduced unauthorized deductions to 1%, resulting in $5 million in profits.

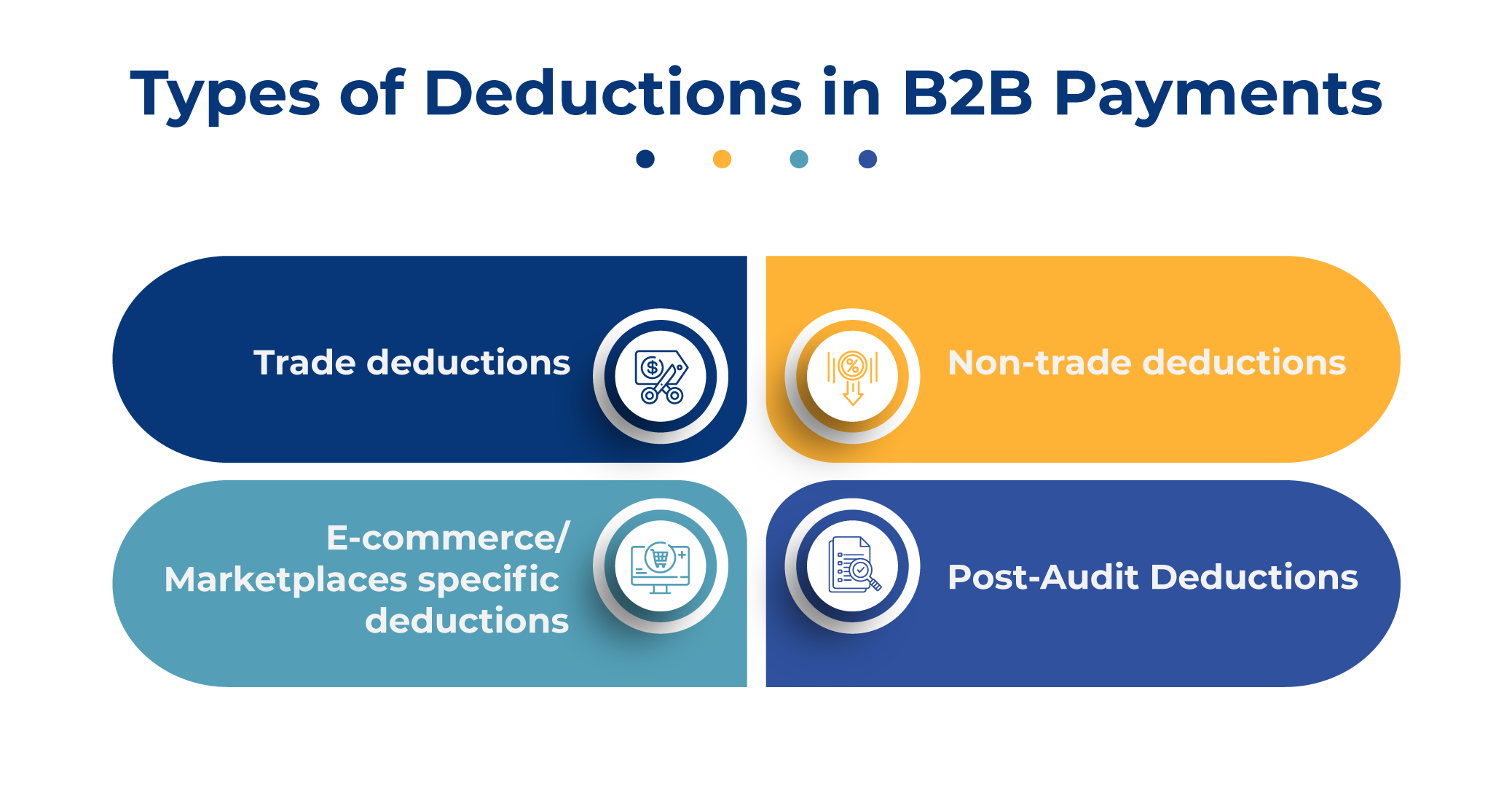

Types of Deductions in B2B Payments

- Trade deductions

Trade deductions are claimed for various reasons, including promotional or advertising costs, discounts, and markdowns. The seller and customer specifically agree on these based on parameters like volumes, date range, specific merchandising, etc.

For instance, the customer can claim trade deductions against a specific promotional offer or advertising in a particular aisle in a store or in an e-commerce marketplace.

- Non-trade deductions

Non-trade deductions are associated with goods shortages, damaged goods, delayed goods deliveries, price differences, etc.

- E-commerce/Marketplaces specific deductions

Deductions specific to the e-commerce/marketplaces include transportation charges, inventory holding, platform fees/commissions, returns processing fees, etc.

- Post-Audit Deductions

Post-audit deductions are commonly initiated/identified by internal or third-party auditors working on behalf of customers. These deductions are made based on issues such as trade promotions agreed upon but not taken and invoicing errors that were previously not identified. Post-audit deductions could also include claims for deductions on invoices that have exceeded a 12-month duration.

What are the Challenges in Deductions Management Process?

An active deductions management process includes the following steps:

Challenges in Each of These Steps:

- Identifying the deduction:

If customers don’t share remittance advice, sellers (mostly the collections or sales teams) need to reach out to the customer to understand the reasons for the deduction.

In the case of customers sharing remittance advice, there are other complexities involved:

– Customers share remittance advice in various formats: PDF, excel, email body, EDI etc.

– The definition or nomenclature of these deductions varies from customer to customer and may differ from the seller’s definition. For example, as a seller, Unilever might encounter different nomenclatures of deductions from its customers, such as Amazon, Walmart, and Target, which do not match Unilever’s pre-defined nomenclature of deductions. There is no specific standard that exists.

- Tagging the deduction:

Due to the diverse nomenclature of deductions, A/R teams require a lot of manual effort to read, identify and tag deductions according to the accounting/ERP deduction definitions.

- Resolving the deduction:

Given the complexities and different teams involved (e.g., supply chain, finance, and accounting teams) across the organization in resolving different deduction types, resolution workflow management has several challenges.

- Keeping track of all the deductions and categorizing them by customer, invoice, and payment

- Managing approvals via emails from multiple departments

- Managing the Maker/Checker system for approval, if it’s part of the existing organizational flow

- Monitoring the open deductions and the DDO (days deductions outstanding)

- Raising Disputes:

The deduction can be approved if it is within pre-defined thresholds or established rulesets and contracts. Disputes arise when deductions do not align with the pre-defined criteria or established rulesets.

Disputing is a challenging process due to the:

-Tedious process of collecting supporting documents, such as Contracts, Proof of Delivery, etc., that are required to raise a dispute.

– Customers and sellers could have their own mechanisms for raising disputes. Example: Disputes to be raised via customer portals.

– Manually addressing different disputes requires documents/proofs that vary by dispute type.

– In manual processes, there is no mechanism for customers and sellers to track the disputes.

– In dispute resolution, either the customer agrees to pay or rejects; if rejected, this might have to go through internal approvals before acceptance and accounting. This manual approval process is tedious and time-consuming.

- Accounting:

At a broad level, each deduction type has a specific deduction accounting entry in the ERP. For example, if there is a goods-related deduction accounting entry to be made in the ERP, here the A/R team will follow these steps:

– If there is a credit note (acceptance), the A/R team will apply the rule

‘Invoice – Credit note = Payment’

– If there is no credit note (acceptance), the A/R team will either create a debit note and close the invoice or create a credit note (open) and apply the partial payment to the invoice.

Manually handling these deduction-specific accounting entries in ERP is a time-consuming process.

Streamline Deductions Management with AI-Powered Automation

With the swift advancement in EIPP (Electronic Invoice Presentment and Payment) and cash application technologies powered by AI, the automation of deductions management is also gaining rapid momentum.

This section will unveil how EIPP and cash application help streamline the deductions management process.

- Electronic Invoice Presentment and Payment:

EIPP automates the invoicing and payment processing and creates a customer portal on behalf of the seller. The seller then encourages their customers to transact through the platform. This portal allows customers to view invoices, pay invoices, make deductions, and raise disputes.

Specific features for deductions management:

– Feature for customers to make multiple deductions across one or more invoices. Customers can also attach relevant proof of deduction.

– Upfront deduction validations.

– Customers can raise disputes against invoices and track their status in real-time.

– Custom workflows/maker checker system for approvals based on deduction types.

– Disputed deductions are automatically highlighted to customers with specific reasons.

– Deduction accounting is automatically completed straight-through into the ERP; no manual entries are required.

– Detailed dashboards on deduction management for sellers help monitor deduction trends, DDO, open deduction status, etc.

- Cash Application Automation:

AI-based cash application software, such as Global PayEX’s AlgoriQ, can automatically read incoming remittances, interpret and identify deductions, and trigger dispute resolution workflows.

Specific features for deductions management:

– Ability to auto-read any remittance advice format such as PDF, emails, excel, EDIs, etc.

– Ability to extract deduction information from the remittance advice and auto-identify deductions at invoice and payment levels, such as trade promotion deductions.

– Ability to extract deduction information from the invoices and auto-identify deductions at invoice and payment levels, even in cases where multiple deductions are tagged to a single invoice.

– Auto-tagging of deductions to seller’s deduction definitions such as goods short supplied, PO to invoice price mismatch, etc.

– Custom workflows/maker-checker system for approvals based on deduction types.

– Real-time tracking of disputes, whether open, paid, or accepted.

– Deduction accounting is done straight through into the ERP; no manual entries are required.

In a Nutshell

Managing deductions has become increasingly vital for sustained growth in today’s business landscape. As businesses expand, the complexity and volume of deductions keep rising, making it difficult for the AR team to manage it efficiently through manual processes. The growing need to address this challenge is evident, making automated deductions management a cornerstone for financial health.

CFOs and finance professionals must recognize the urgency of adopting advanced automation technologies such as EIPP and Cash Application software to streamline deductions management. Failing to do so might jeopardize financial health, hindering the business from succeeding in the race for sustained profitability.

At Global PayEX, we help businesses automate the deductions management process to achieve streamlined workflows, enhanced accuracy, and proactive resolution of disputes. Talk to our experts to learn more about our solutions.