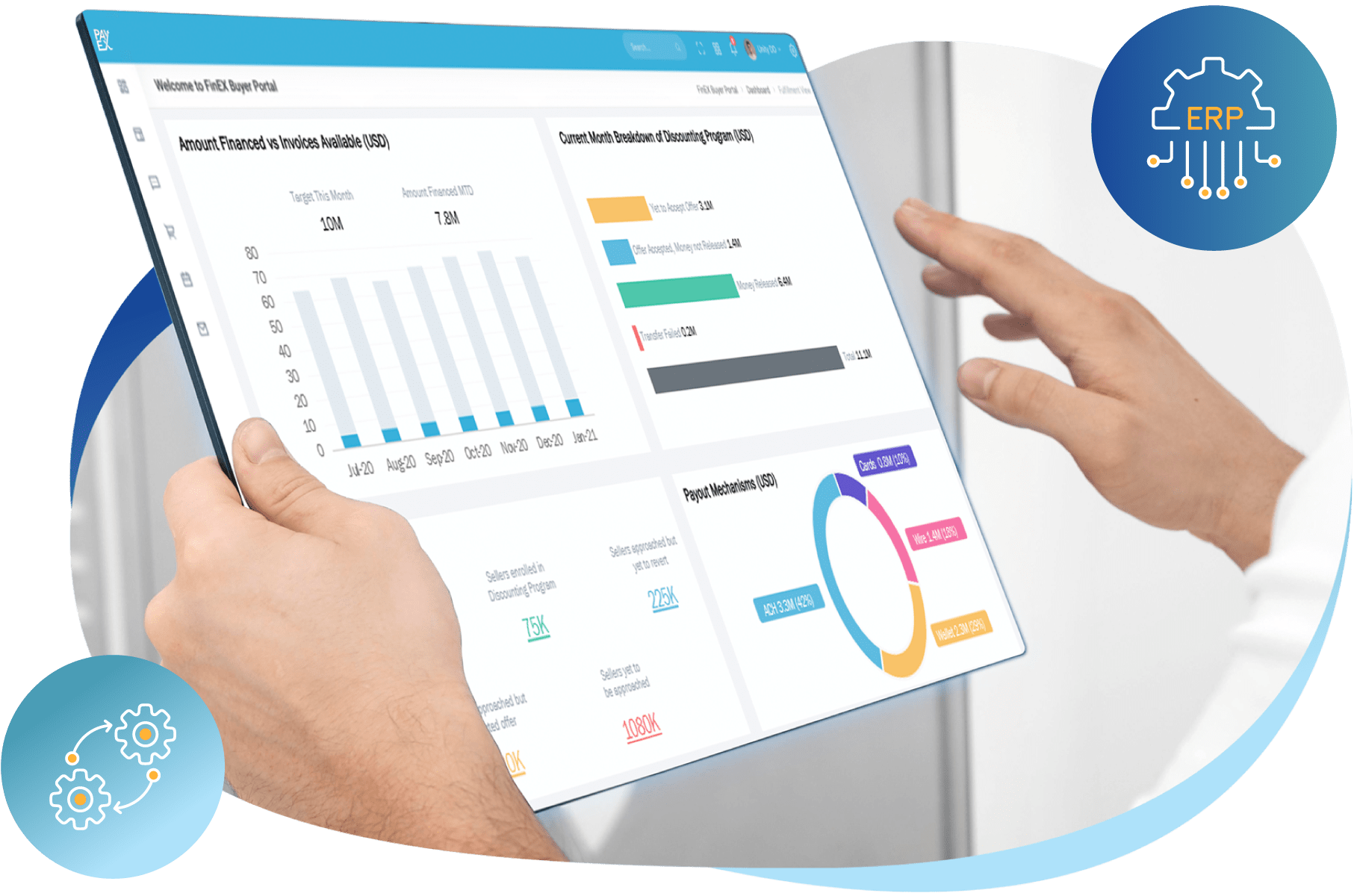

Discover the advanced finance automation possibilities that seamlessly enhance your ERP’s capabilities, making it 5X more powerful

Discover the advanced finance automation possibilities that seamlessly enhance your ERP’s capabilities, making it 5X more powerful

Irrespective of your chosen ERP system, we can seamlessly establish integration with your ERP to

automate both AR and AP process end to end. We closely liaise with your IT department to configure

data flows using plug and play utility that can automate the last mile with minimal effort or resources.

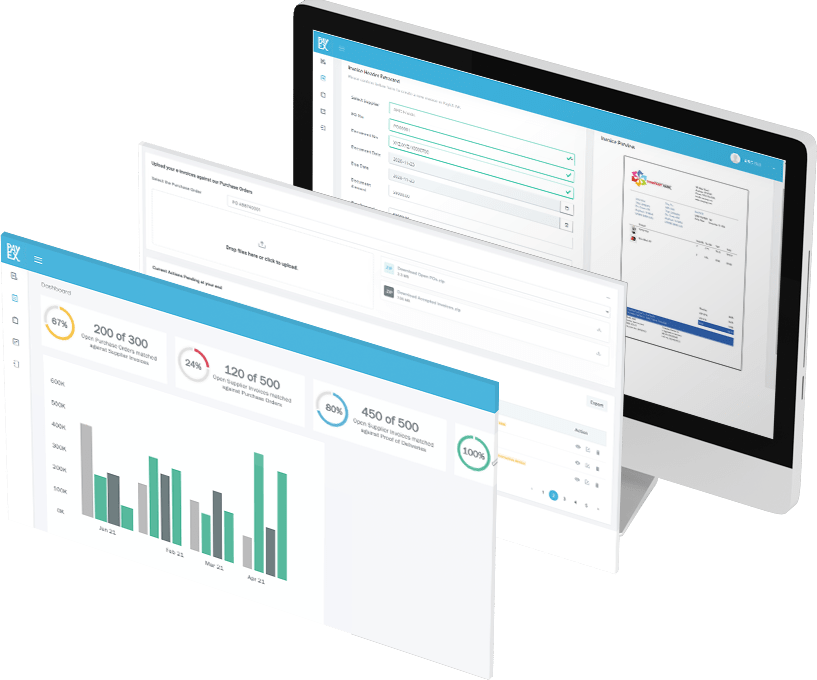

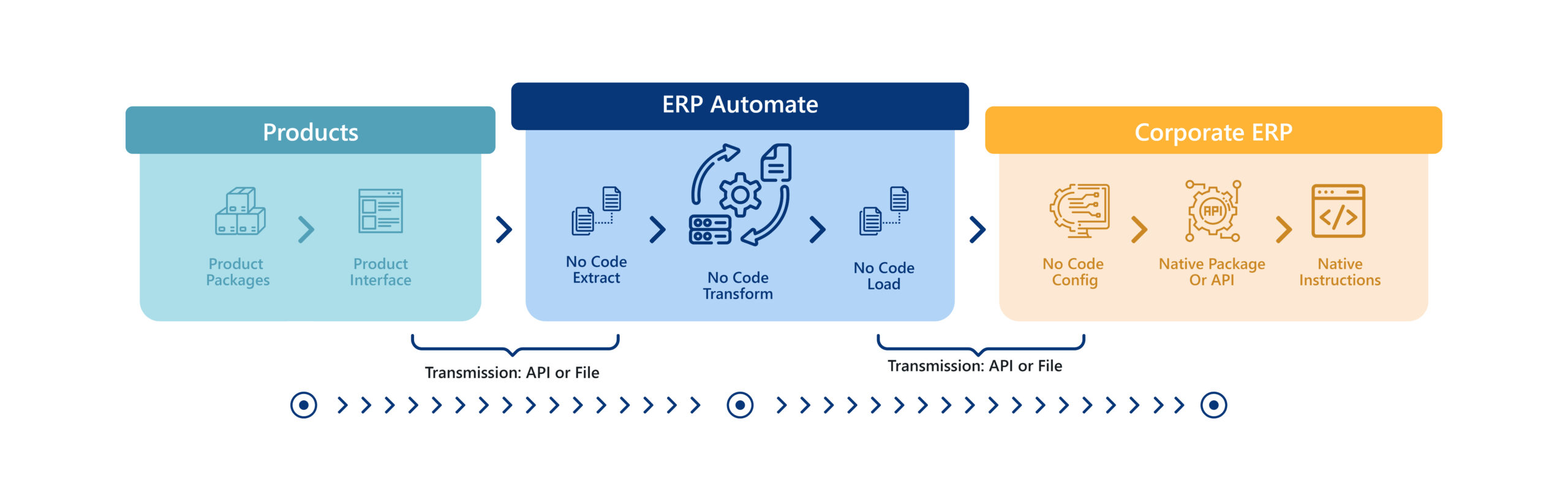

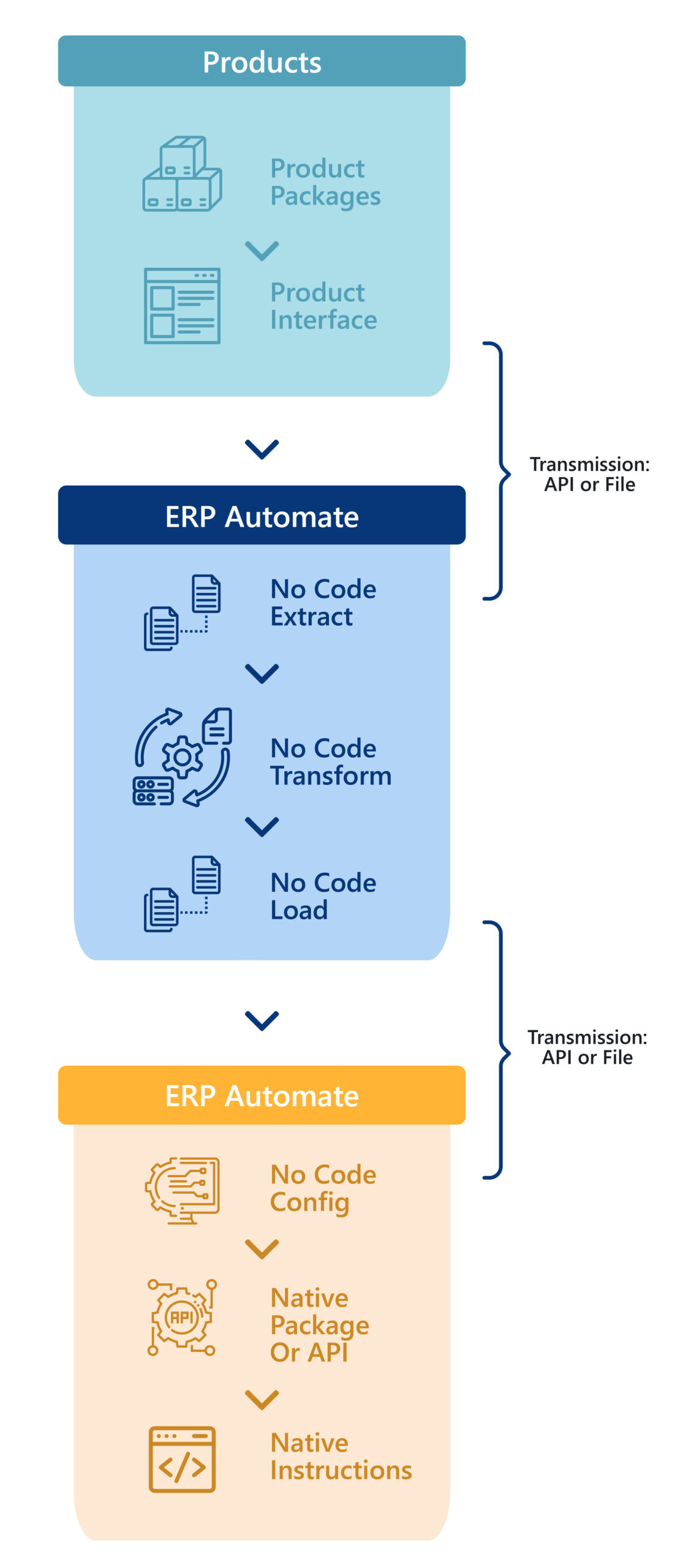

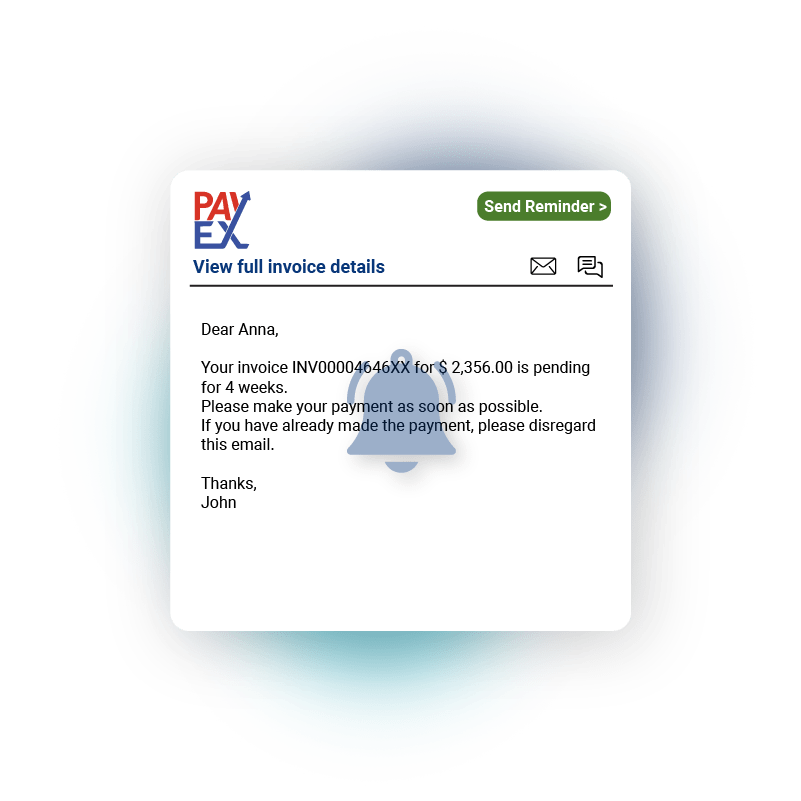

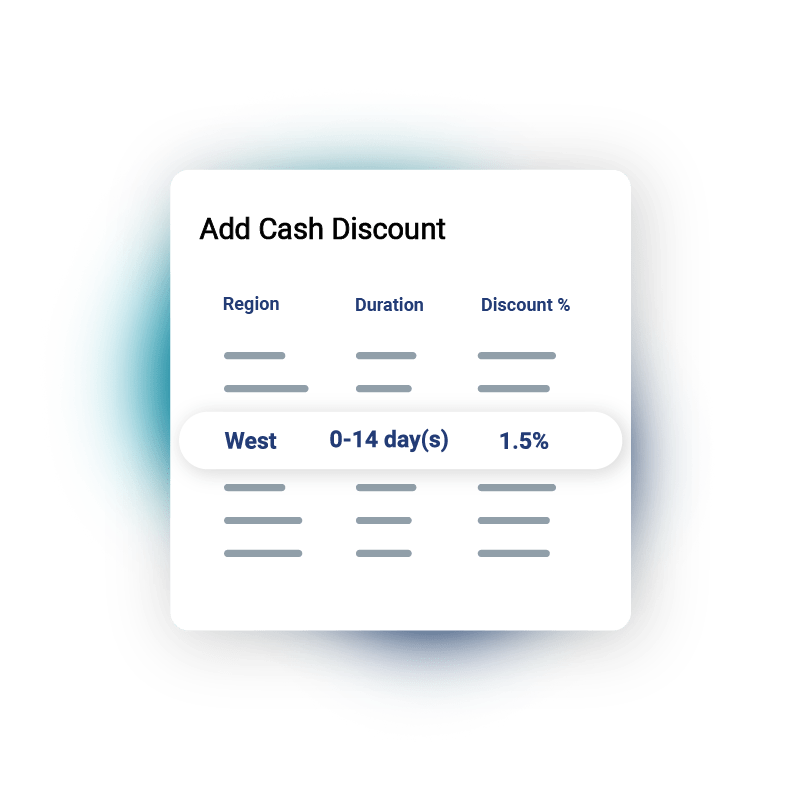

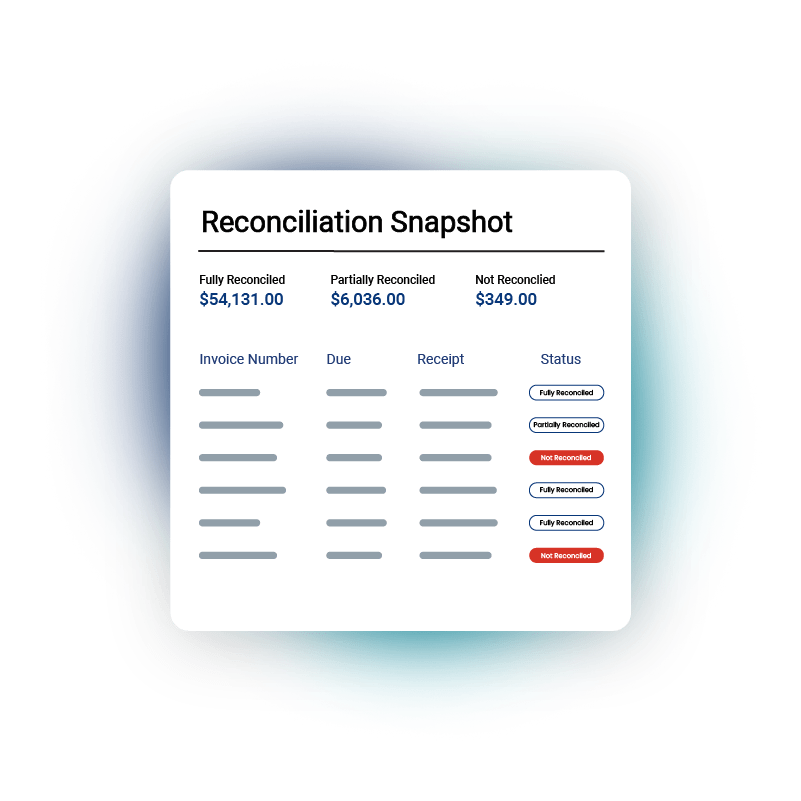

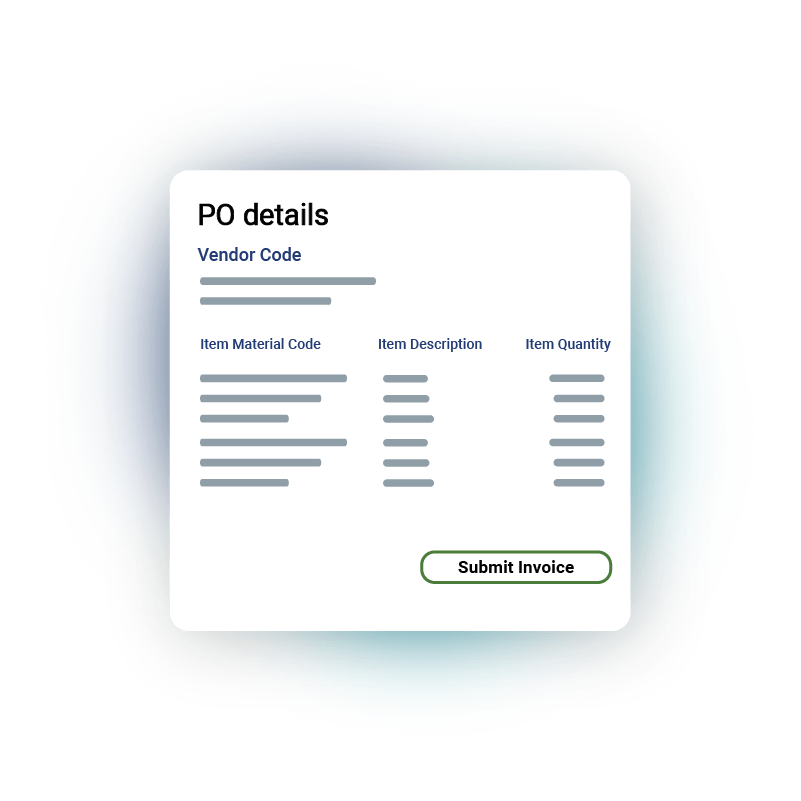

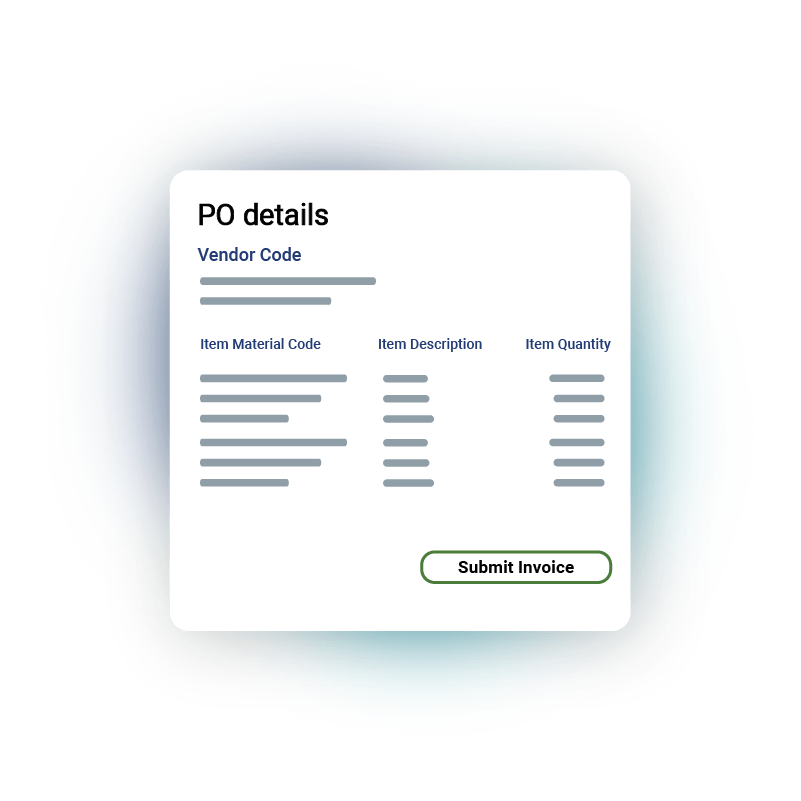

Irrespective of your chosen ERP system, we can seamlessly establish integration with your ERP to automate both AR and AP process end to end. We closely liaise with your IT department to configure data flows using plug and play utility that can automate the last mile with minimal effort or resources.

Why Choose Global PayEX

with your ERP

Global PayEX can integrate with your ERP within 4-6 weeks with minimal involvement from your technical teams. We have in-house ERP experts to enable comprehensive testing across use cases to ensure bi directional ERP data flow occurs as expected.

We have pre-built adaptors to integrate seamlessly across all leading ERPs, including SAP ECC, SAP S/4HANA, Oracle NetSuite, and Acumatica. However, as our solutions are ERP agnostic, we can integrate across ERPs to extract and post data to your ERP based on your accounting workflows.

While most AR/ AP automation players depend on deep ERP integration, our microservice architecture is decoupled. Global PayEX has a flexible technology architecture independent of your ERP strategy.

With an API integration, the information is updated in real-time into your ERP. We also support file-based integrations where information is posted to the ERP based on pre-decided batch timings.

ERP

ERP

Who We Serve

Products

Resources