"Our accounts teams are delighted with the time & effort saved, and there are much fewer instances of accounting errors. AlgoriQ has automated every step of the reconciliation process, including identification of commission & deductions, accounting them into respective ledgers, and transferring entries to payables."

Saranyan R

Chief Finance Officer

TTK Prestige

Jyotsna Sharma

Chief Financial Officer

Bridgestone India

Jessica Chan

Director of Treasury APAC

Stanley Black & Decker

"We have been using FreePay since 2017 and the improvement and efficiency it has brought in our collections and account receivables management has been remarkable. It has helped deliver electronic invoices to our Channel Partners in real-time, and process payments with all our business terms plugged in."

Joseph Selvakumar

Vice President - Commercial

V-Guard Industries Ltd.

Ranjan Choudhury

Treasury Global Delivery Center Leader

3M

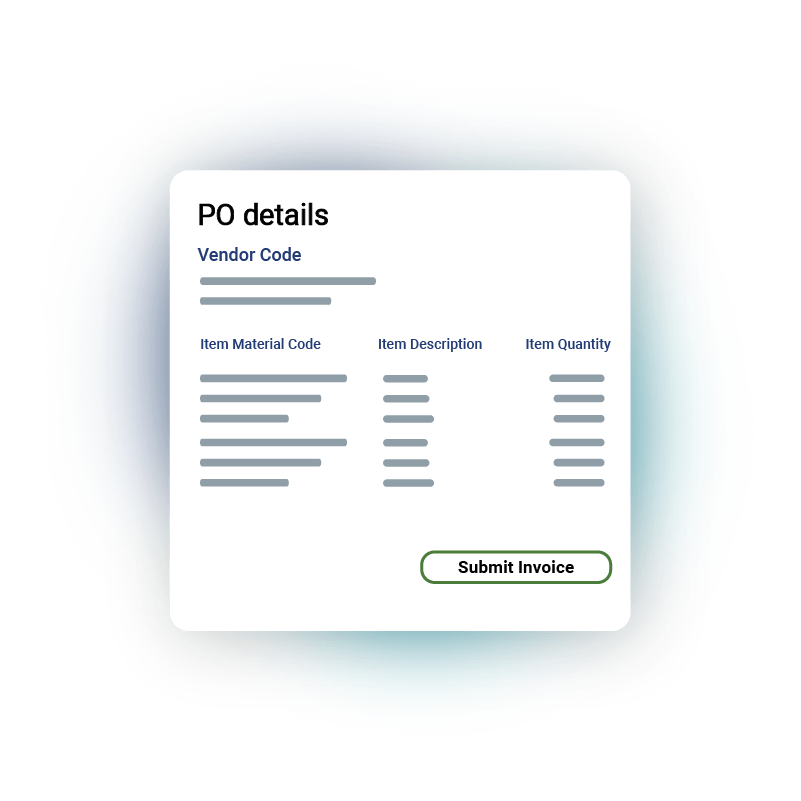

Automate invoice data extraction, and validation for a touchless experience straight through to ERP, reducing costs from manual intervention and error reduction

Validate upfront, prompt timely action, and facilitate workflows across levels and departments to accelerate invoice processing

Auto-extract invoice data and perform sanity checks upon submission to avoid ingesting incorrect invoicing data minimizing costly mistakes and fraud

We support multiple validations like matching invoice amount against the PO amount, statutory details mentioned in the invoice, matching the invoice amount against GRN and many other configurable validations.

Yes. You can define different invoicing parties for the PO, allowing other vendors to submit invoices from different vendor codes.

Our solution has a data extraction accuracy of 96%+ for structured invoices (system-generated PDF, digitally signed documents, etc.).

Who We Serve

Products

Resources