"Our accounts teams are delighted with the time & effort saved, and there are much fewer instances of accounting errors. AlgoriQ has automated every step of the reconciliation process, including identification of commission & deductions, accounting them into respective ledgers, and transferring entries to payables."

Saranyan R

Chief Finance Officer

TTK Prestige

Jyotsna Sharma

Chief Financial Officer

Bridgestone India

Jessica Chan

Director of Treasury APAC

Stanley Black & Decker

"We have been using FreePay since 2017 and the improvement and efficiency it has brought in our collections and account receivables management has been remarkable. It has helped deliver electronic invoices to our Channel Partners in real-time, and process payments with all our business terms plugged in."

Joseph Selvakumar

Vice President - Commercial

V-Guard Industries Ltd.

Ranjan Choudhury

Treasury Global Delivery Center Leader

3M

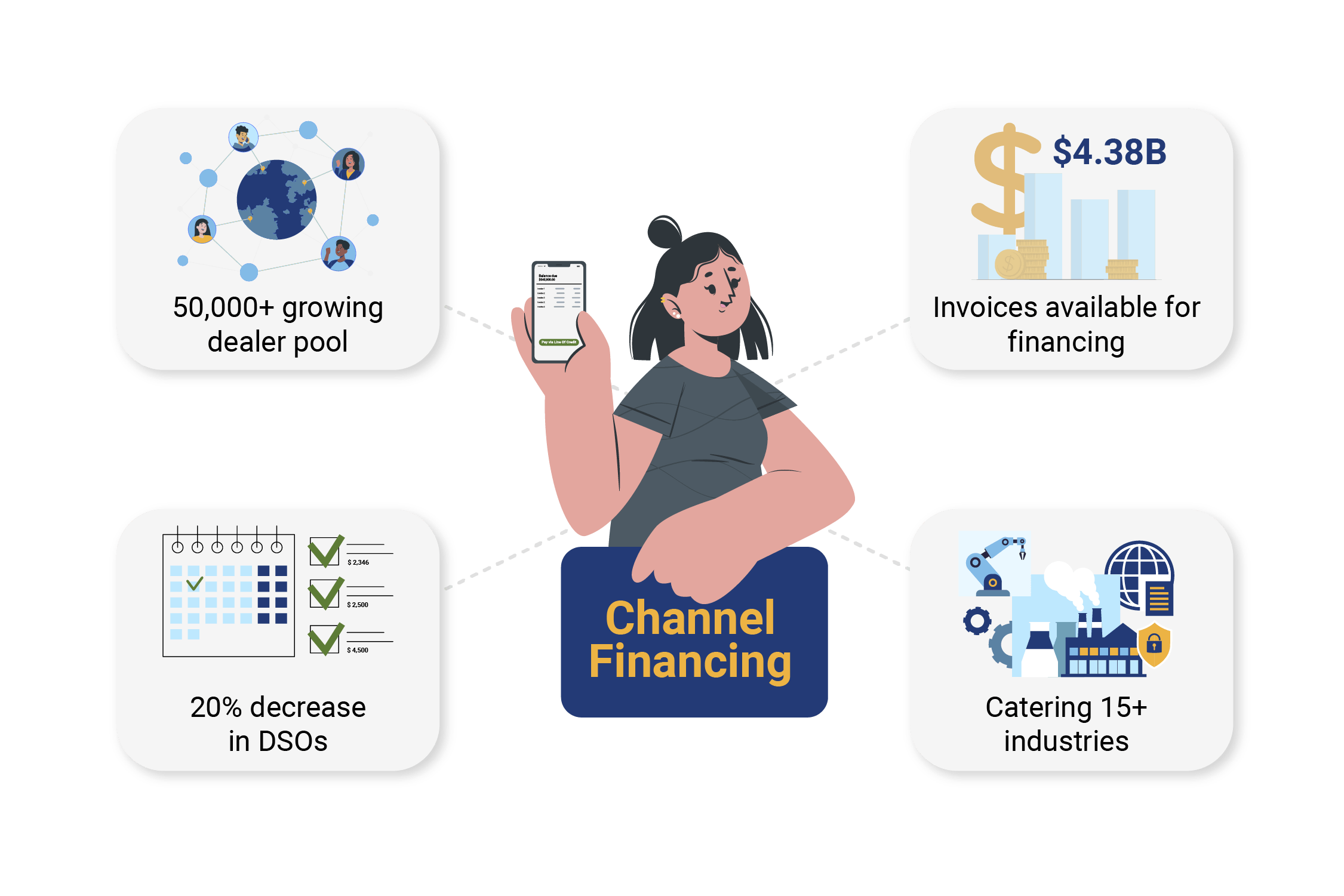

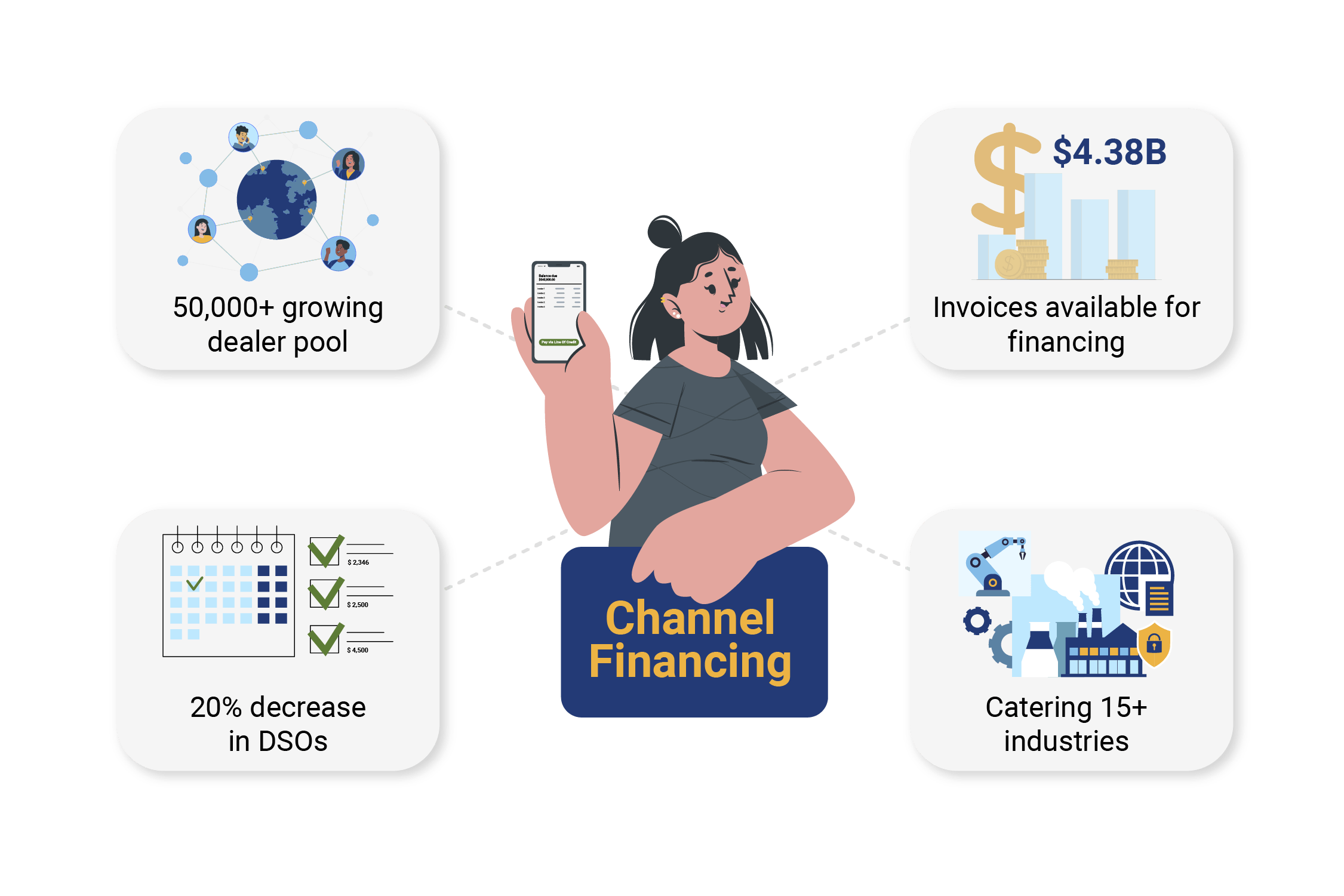

50,000+ growing dealer pool with access to channel financing

$4.38 Bn invoices value available for dealer financing

20% decrease in DSOs – Get paid early to improve cash flow in your business today

15+ Industries – Cater to industry-specific use cases across 15+ industries with active adoption by several dealers

Who We Serve

Products

Resources