In the present economic landscape, distributors play a crucial role in the efficient supply and distribution of goods. They provide valuable services beyond product sales to producers, wholesalers, and customers. What’s particularly encouraging is that distributors today have access to financial loans that facilitate their professional growth. They can secure the necessary funds with channel financing and optimize their finances.

According to MarketsAndMarkets, the global lending market is projected to reach USD 20Bn by 2026. This market encompasses various lending segments, including corporate loans, mortgages, and consumer loans. It also comprises traditional financial institutions like banks, credit unions, alternative lenders, and fintech companies that have emerged in recent years. Technological advancements, changing consumer behavior, and the increasing demand for credit are expected to contribute to the expansion of the lending market. However, it’s important to note that the growth projections are subject to market dynamics and economic conditions.

This blog will delve into channel financing and how dealers/distributors of businesses can leverage it to optimize their finances.

What is Channel Financing?

Channel financing is a financing solution that facilitates the digital flow of funds between buyers and the corporate’s (Anchor) lending partners in a supply chain. Simply put, it’s a working capital loan offered by financiers such as Banks/NBFCs to distributors/dealers, who purchase goods or services from a corporate.

Channel financing makes it simple and inexpensive to acquire capital. Financiers can provide funds to buyers using channel financing and maintain a smooth supply chain flow. Cash, credit, overdraft, bill discounting, vendor financing, invoice financing, PO financing and other products are some of the items covered under channel financing.

In traditional financing methods, anchors often have to wait weeks or months to receive payment for goods and services provided to their buyers. This delay in payment can affect the supplier’s cash flow and hinder their ability to finance their operations effectively.

To tackle this obstacle, anchors offer cash discounts, a financial incentive to encourage distributors to pay early for the goods they purchase. These discounts range from 0.5% to 3% based on the industry type. Cash discounts can significantly affect channel financing, benefiting both anchors and distributors. Dealers/Distributors can unlock many benefits for their business by taking advantage of these discounts.

How does Channel Financing work?

Channel financing provides dealers/distributors with access to financing against their outstanding invoices. Once an invoice financing request is processed and approved by the financier, it pays the corporate the value of the invoice upfront, allowing the distributors to avail cash discounts.

While this money is being transferred to the corporate’s account, if there is a Cash Discount given by the corporate and depending upon the channel financing terms finalized between the lender and corporate, the lender (bank/NBFC) can deduct the discount and transfer the rest to the corporate’s account. Distributors evaluate and post a thorough underwriting process, allocating credit terms to each distributor within the network. These credit terms may differ for each distributor. Once the credit period is over, the dealer/distributor is liable for repaying the loan amount and the accumulated interest on the principal amount back to the lending institution.

Benefits of Channel Financing

Channel financing provides several benefits for both distributors and anchors. For corporates, access to financing against outstanding invoices can help them improve their cash flow, reduce credit risk, and lower borrowing costs. For borrowers, it makes it easier to avail cash discounts and pay on time, provides favorable interest rates and credit periods, and, most importantly, gives instant and easy access to loan capital. Further, channel financing allows lenders to have payment control with auto-reconciliation features.

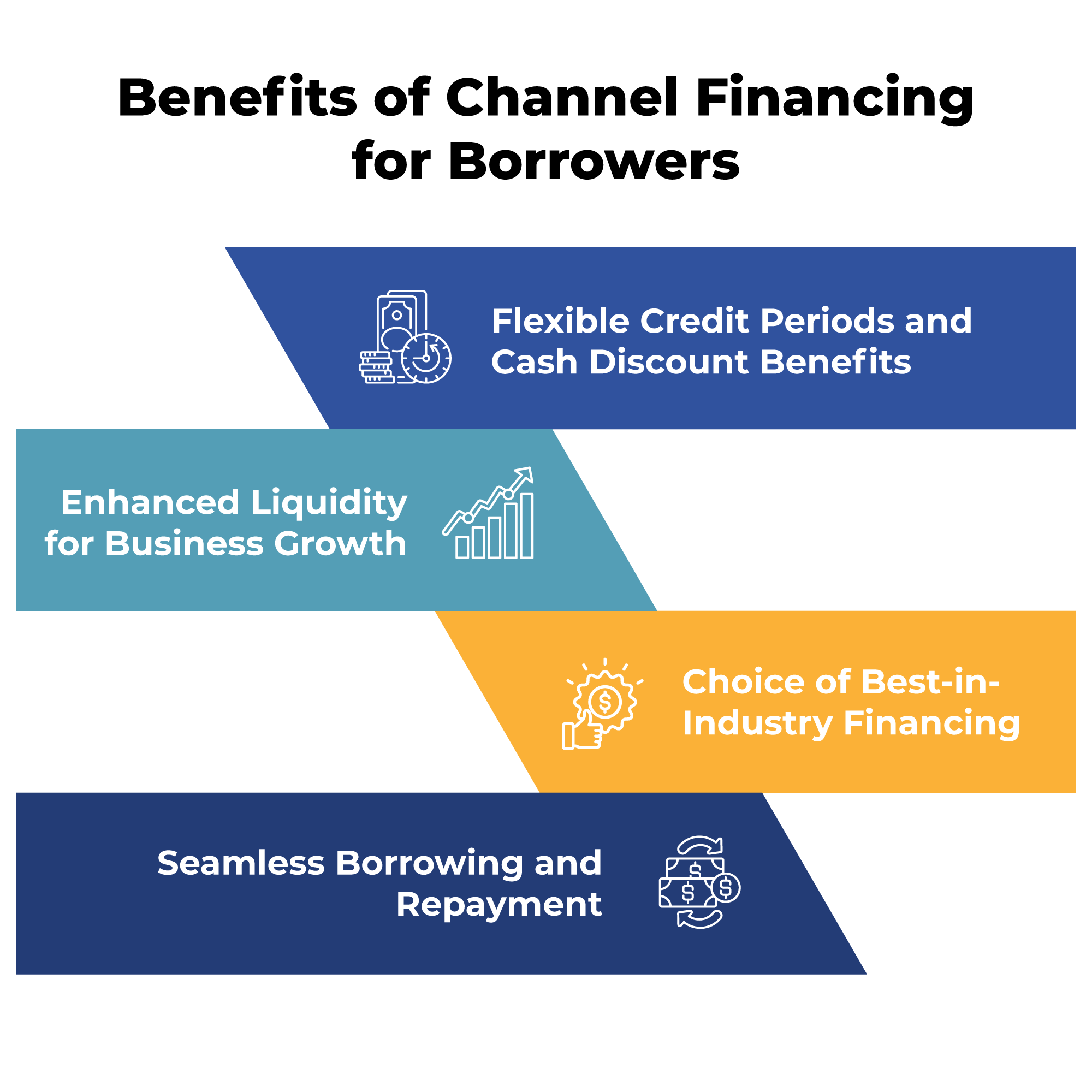

Benefits for Borrowers:

- Flexible Credit Periods and Cash Discount Benefits: Borrowers can maintain or extend credit periods while enjoying cash discount benefits. It provides the flexibility to take advantage of early payment discounts.

- Enhanced Liquidity for Business Growth: Channel financing boosts borrowers’ liquidity, empowering them to fuel business growth. With access to tailored financing options, borrowers can effectively manage cash flow, invest in expansion, and increase sales volumes.

- Choice of Best-in-Industry Financing: Borrowers can select financing options from leading banks and NBFCs. It ensures competitive credit terms, attractive interest rates, and flexible repayment structures for specific business needs.

- Seamless Borrowing and Repayment: An integrated platform streamlines the borrowing and repayment process, enabling borrowers to easily apply for financing, track application status, and manage repayments. It enhances convenience and efficiency for borrowers.

Benefits for Corporates:

- Enhanced Liquidity for Increased Sales: Channel financing provides corporates with enhanced liquidity, enabling them to invest in their sales efforts and drive higher sales volumes.

- Accelerated Cash Flows and Reduced Working Capital Costs: Channel financing speeds up cash flows by facilitating faster distributor payment cycles. It massively reduces the Days Sales Outstanding (DSOs) and lowers working capital costs.

- Mitigated Credit Risks and Improved Cash Flow Predictability: By utilizing channel financing, corporates can transfer credit risks associated with distributor payments to financial institutions. It helps to reduce the impact of potential payment delays or defaults, improving cash flow predictability and providing more financial stability.

- Streamlined Business Processes and Operational Efficiency: Channel financing often incorporates an integrated platform for lending that streamlines business processes and workflows. It improves operational efficiency, simplifies documentation and administrative tasks, and enables corporates to focus on core sales activities.

- Stronger Partner Relationships and Competitive Advantage: By offering channel financing options, corporates strengthen their relationships with distributors. Providing access to financing solutions positions corporates as valuable partners, supporting distributors’ working capital needs and fostering long-term collaboration.

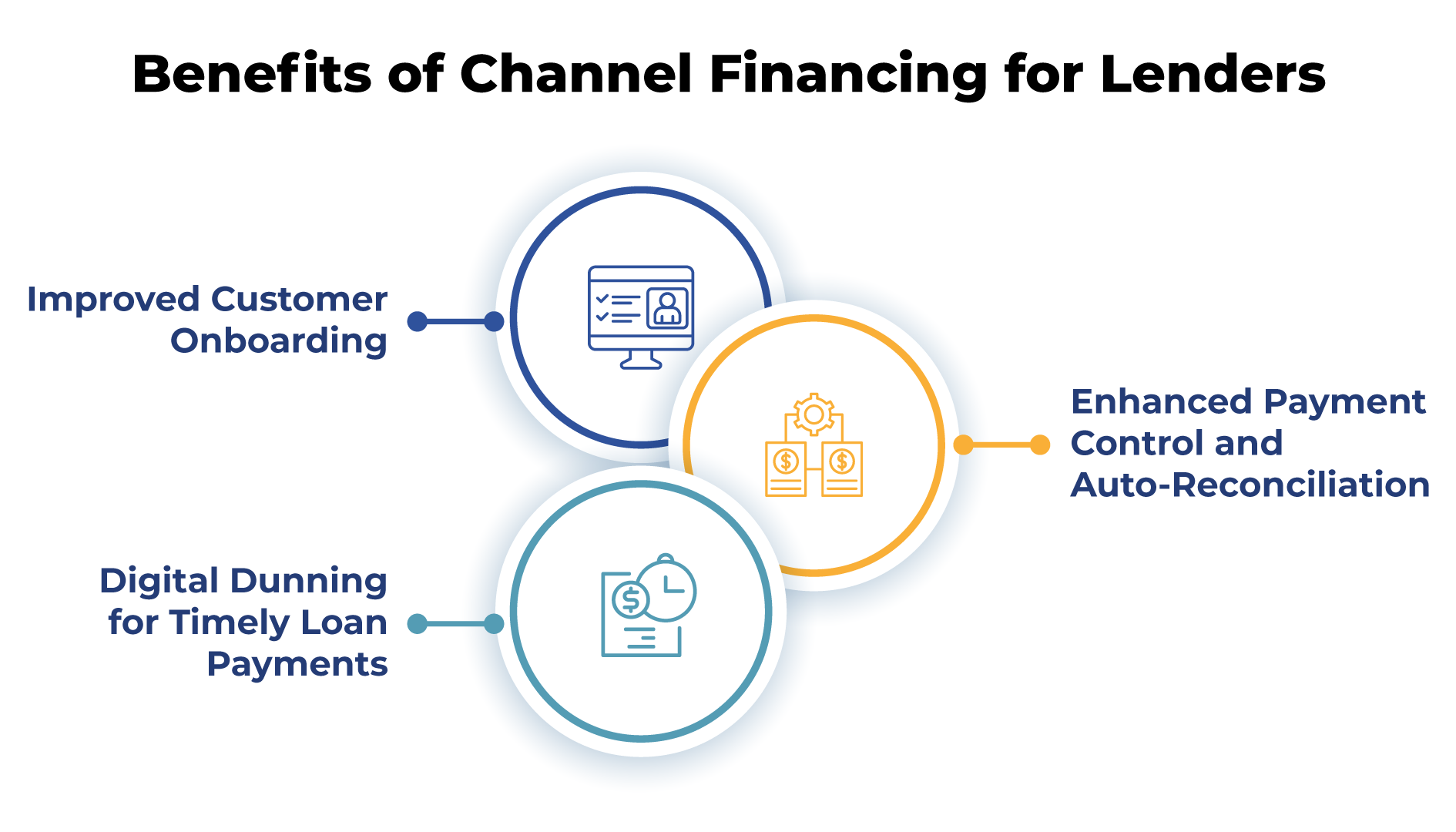

Benefits for Lenders:

- Improved Customer Onboarding: By utilizing business volumes, past payment trends, and credit scoring indicators, lenders can streamline and expedite the customer onboarding process. It enables lenders to assess the creditworthiness of potential borrowers more accurately.

- Enhanced Payment Control and Auto-Reconciliation: Channel financing technological solutions provide lenders with payment control mechanisms and automated reconciliation processes. Lenders can monitor and manage loan repayments effectively, ensuring timely payments and minimizing the risk of delinquencies.

- Digital Dunning for Timely Loan Payments: Embedded digital dunning features in channel financing platforms serve as automated reminders and notifications for borrowers to make their loan payments on time. This proactive approach improves payment compliance and reduces the likelihood of payment delays or defaults.

How Does FinEX Help Corporates Apply for Channel Financing?

Global PayEX’s FinEX is a powerful SaaS-based platform that enables corporates to facilitate invoice financing, and helps bridge the gap between the borrowers (dealers/distributors) and lending institutions (banks/NBFCs) using technology. In particular, FinEX streamlines the process of applying for channel financing, which helps dealers/distributors obtain working capital by financing their invoices to make timely payments to the corporate.

- Integration with the Corporate’s ERP System:

FinEX’s first step is integrating with the corporate’s Enterprise Resource Planning (ERP) system. This integration allows FinEX to access and extract the buyers’ data related to open invoices, debit notes, credit notes, etc., streamlining the subsequent financing process.

- Invoice Payment:

One of the key benefits of using FinEX for channel financing is that it provides a simple and intuitive interface for dealers/distributors to connect with lenders, view their invoices and pay them as well on the same platform with a simple click-to-finance button, assured with favorable credit terms from our partner lenders of PayEX. FinEX can facilitate a channel financing program that works on either auto-pull or dealer consent-based mechanisms.

- Payment Reconciliation:

Upon receiving payment for the financed invoices, the corporate’s ERP system is updated to reflect the reconciliation of the invoice payments. It ensures accurate financial record-keeping and visibility into the corporate’s financial position.

- Dunning Process for Loan Repayment:

A dunning process is triggered within FinEX to ensure timely loan repayment to the lender. The dealer receives notifications and reminders regarding the loan repayment obligations, ensuring compliance with the agreed-upon terms.

- Digital Onboarding:

The platform offers one-time digital onboarding, enabling dealers/distributors to quickly sign up and start the application process online without needing paper-based documentation. It can save both time and money for dealers/distributors and lenders alike, eliminating the need for manual processes and reducing the risk of errors. Once onboarded onto the channel financing program, dealers/distributors can finance multiple invoices with a click of a button, dependent upon their credit limit, rather than going through the tedious document submission and underwriting process every time.

Conclusion

In today’s economic landscape, channel financing has emerged as a vital tool for distributors to optimize their finances and enhance working capital. With the support of loans, dealers/distributors can effectively manage cash flow, access working capital, and foster professional growth. FinEX, a powerful SaaS-based platform, streamlines the channel financing process. It facilitates invoice financing via multiple lending partners, revolutionizing how dealers/distributors obtain working capital.

The platform facilitates invoice payment reconciliation, ensuring accurate financial record-keeping and visibility into the corporate’s financial position. By integrating with the corporate’s ERP system, FinEX simplifies the retrieval of open invoices, providing a transparent overview of outstanding payments. Additionally, FinEX triggers a dunning process to ensure timely loan repayment, fostering responsible financial management.

Are you looking to provide channel financing to your distributor network to optimize your finances and enhance working capital for your business? Talk to our experts to learn more and start leveraging the benefits of FinEX for streamlined and efficient channel financing.