In spite of the fact that credit cards are one of the most convenient payment methods, many US businesses still do not accept them due to the high credit card processing fees. These fees can substantially impact profits, making it difficult for merchants with thin profit margins to sustain.

Have you ever wondered if you could charge your customers for using a credit card?

Now, your business can easily do that. There is one financial strategy that has been rapidly gaining ground in the United States, reshaping how organizations navigate the complex terrain of B2B payments: ‘Surcharging.’ Simply put, surcharging refers to adding an extra charge to the initial cost of a good or service when your customers use a credit card for payment.

Against the backdrop of technological advancements and dynamic shifts in the US economy, there has been a surge in the adoption of surcharging by businesses. This blog will explore the ins and outs of surcharging in B2B payments. By understanding and leveraging credit card surcharging, organizations can position themselves for success in 2024.

What is Credit Card Surcharging in B2B Payments?

Credit Card Surcharging in B2B payments adds a fee to a transaction whenever your customer uses a credit card for payment, typically to cover the cost of card processing.

Card payment networks charge the sellers around 3.5% per transaction. These fees cover handling costs, fraud and the risk of accepting the credit card payment. Businesses add a surcharge fee to their transactions to offset these charges.

Surcharge Fee vs Convenience Fee

It can often be easy to confuse convenience fees with surcharge fees, but there are a lot of differences.

A convenience fee is a fixed amount charged for the convenience of using non-standard payment methods.

For example, a grocery shop typically sells in cash. However, if the grocery shop provides customers with an alternative option to pay using a credit or debit card, they could charge a convenience fee. The convenience fee is charged for the privilege of using the payment method, which is not the standardized option.

However, a surcharge fee is an extra charge applied to cover the merchant’s processing fees and is a percentage of the total transaction amount. It applies only to credit card transactions. However, it is important to note that certain restrictions are imposed by card companies, federal and state, on surcharging.

Surcharge Fee vs Cash Discount

Cash Discount is a price reduction applied to the total amount when a customer pays within a specific time. It varies with payment dates and, in some cases, differs based on product lines.

For instance: Let’s consider March 1st as the invoice date.

| Payment Date | Cash Discount Available |

| First 5 days after purchase – [March 1st-5th] | 10% |

| Between 6-15 days after purchase – [March 6th-15th] | 7.5% |

| Between 15-30 days after purchase – [March 16th-31st] | 5% |

| After 30 days of purchase (April 1st onwards) | No cash discount |

In the above example, the customer can only get the cash discount if they pay within 30 days after purchase. It helps the merchants collect receivables faster and benefits the customers by providing discounts.

On the other hand, a credit card surcharge is an additional percentage added to the listed price when a customer chooses to pay using a credit card.

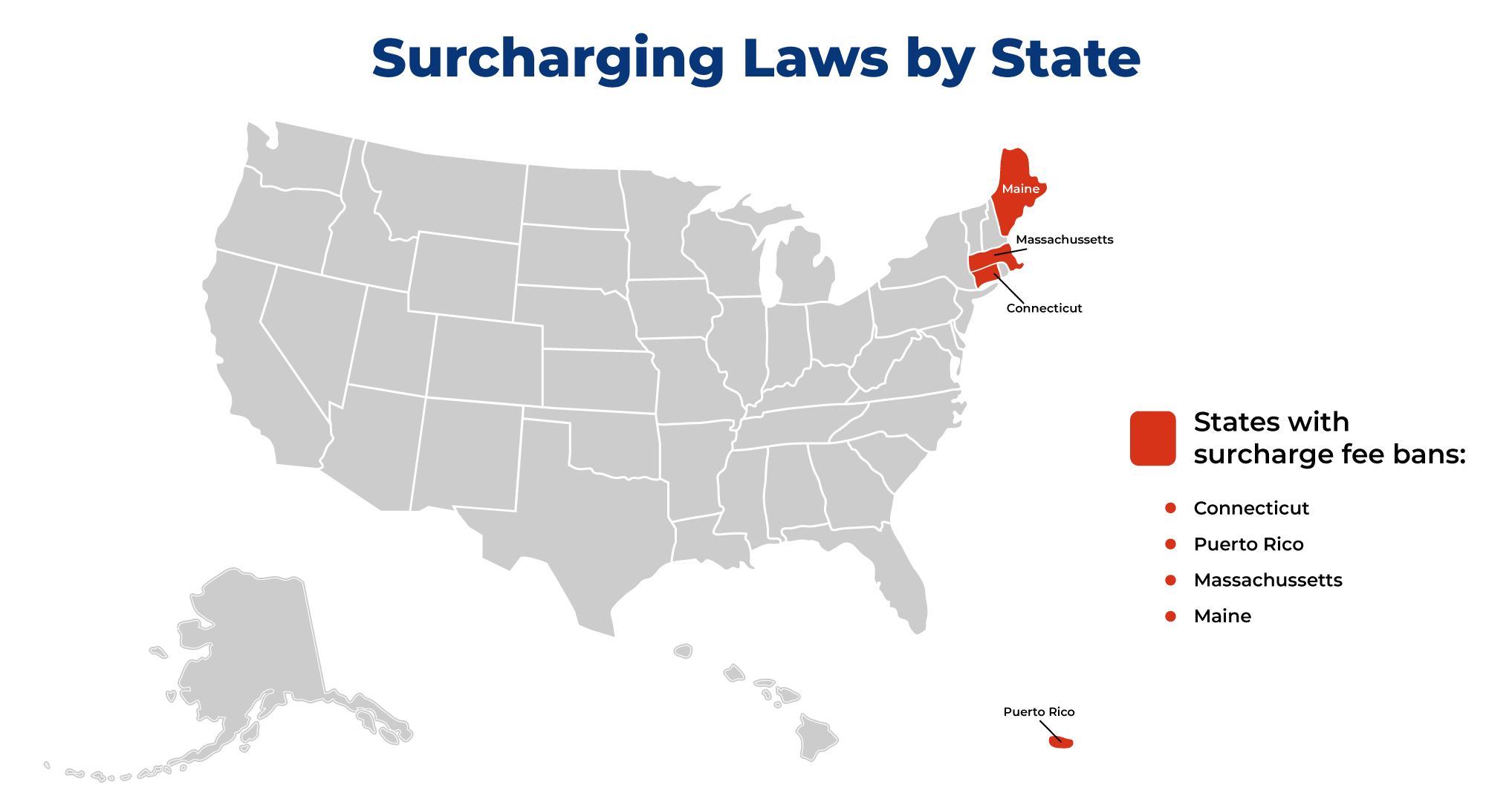

Surcharging Laws by State

Surcharging laws vary from state to state. While surcharge fees are legal under federal law in the US, the National Merchants Association reports that some states explicitly prohibit such fees:

- In 47 states of the United States, surcharging is legalized.

- The laws in Connecticut and Puerto Rico do not allow merchants to impose surcharges on B2B Payments.

- The states of Maine and Massachusetts restrict surcharging of B2C transactions.

- Colorado merchants can charge up to 2% or the total amount of the processing fee.

- Illinois state laws allow surcharging up to 1%, or the cost of the processing fee, whichever is less.

- Maine and New York have enacted regulations mandating that merchants provide customers with information about their surcharging policies.

- Hawaii, Illinois, New Jersey, and Rhode Island have pending laws to make surcharging illegal.

Credit Card Surcharging Rules and How to Compute the Surcharge Fee?

There are several operating rules merchants must follow to execute surcharging. Here are the key ones:

- Merchants must give 30 days written notice before initiating credit card surcharges to the card network and payment processor.

- Surcharging should be imposed at the brand level or product level.

- The surcharge fee cannot be more than the cost of payment processing and is capped at 4% of the purchase price for Mastercard and 3% for Visa credit cards.

- Notice of the surcharging must be displayed at the entrance of the business and the point of sale. It must appear on the business’s website for online transactions.

- The surcharge dollar amount must appear on the transaction receipt and be included in the Network Authorization Request and settlement.

If your business fails to abide by these rules and still imposes surcharging, there can be high penalties levied and strict legal actions taken against it by the regulatory authorities.

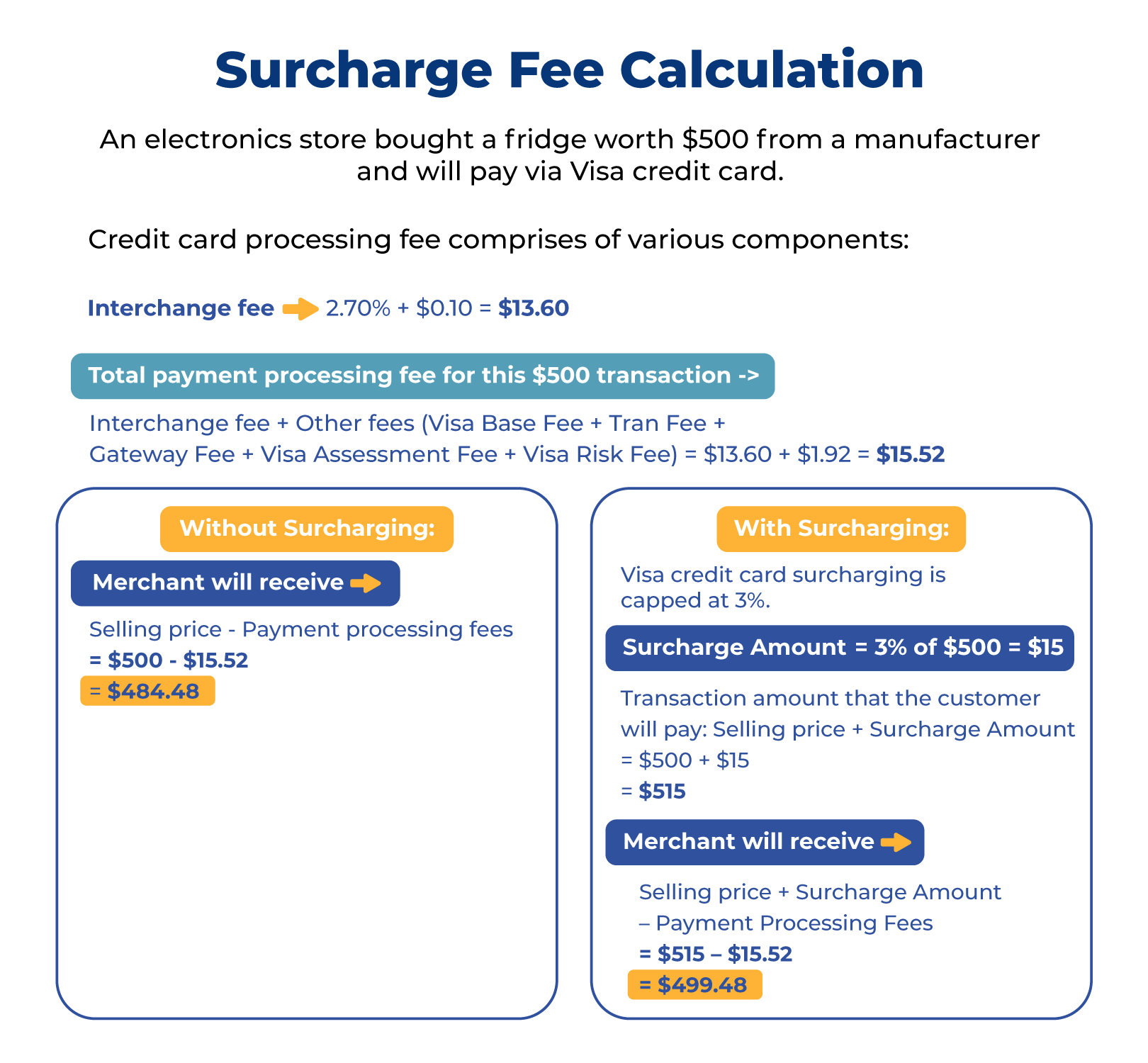

How to Calculate Surcharge Fee?

The surcharge fees vary but are always a small percentage of the total transaction amount. The payment processor and the merchant determine the amount of the surcharge fee.

Today, we will understand how surcharge fees work with this example:

Surcharging will help the merchant to offset the credit card payment processing fees.

Benefits and Drawbacks of Surcharging

Surcharging is a controversial topic today. It can be seen as a way for businesses to save the fees credit card companies charge. But from another angle, adding these extra fees might affect the customer experience.

Benefits

- Lower Operating Costs:

Especially for mid-sized and small businesses operating on narrow profit margins, payment processing expenses can quickly accumulate. By implementing surcharges for credit card transactions, organizations can recoup a significant portion of these processing costs.

- Compliance with Regulations:

Credit card surcharging in B2B is subject to various rules and regulations. By complying with these, businesses demonstrate their commitment to following the law, which can enhance their reputation and credibility in the market.

- Flexibility and Control:

Automating the surcharging process using technological solutions gives businesses complete control over their pricing strategies. They can choose when and how to implement surcharge fees, tailoring their approach to suit their business needs and circumstances. It also encourages them to provide customers with transparency regarding their pricing structures.

- Improved Working Capital Management:

As processing fees become nullified, businesses experience reduced operating costs, consequently boosting profit margins. This extra revenue can be reinvested in the company or used to expand operations, hire employees, or improve customer service. Ultimately, it enhances cash flow for businesses

Drawbacks

- Negative Customer Experience:

Surcharging can be a sensitive issue if the fee is not disclosed to the buyer until the point of sale. For many customers, this creates a feeling of being cheated by the business and can damage the whole customer experience and result in customer attrition. Even one such case can affect your business reputation.

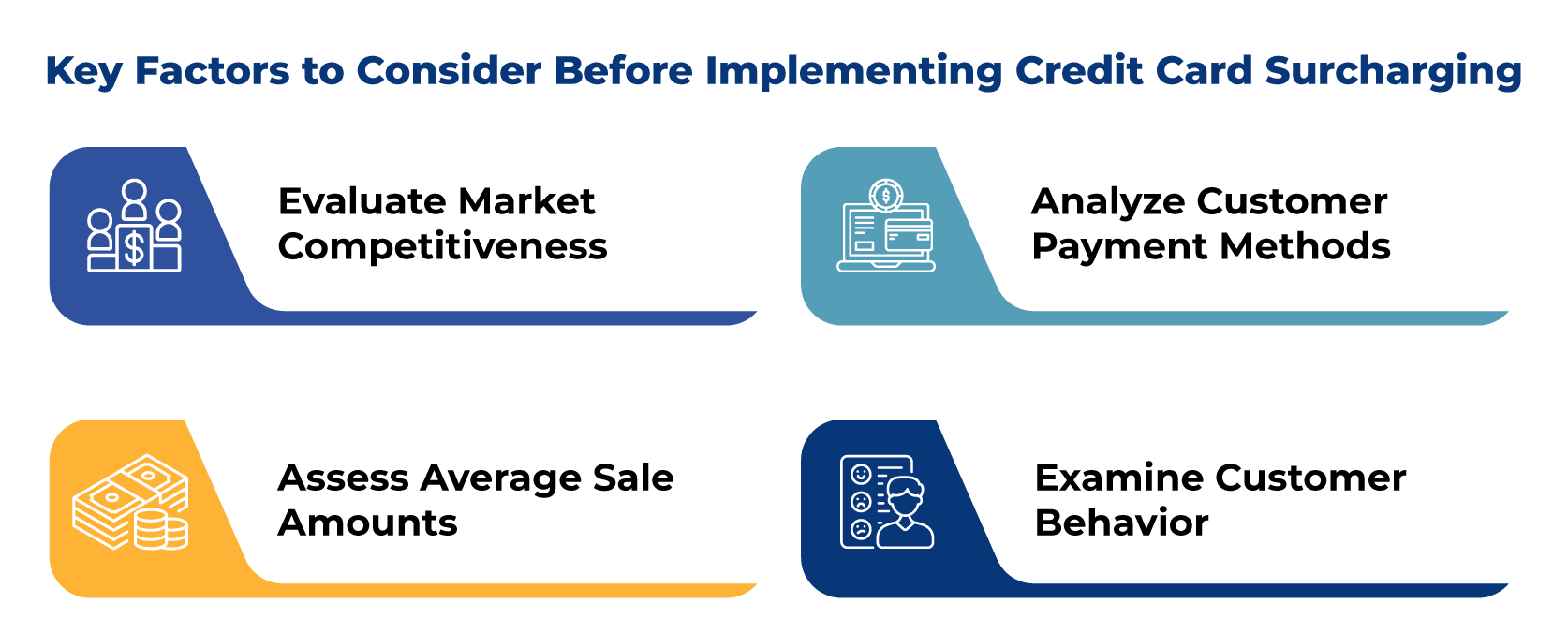

Key Factors to Consider Before Implementing Credit Card Surcharging

Surcharging is a solid financial strategy for many businesses, but there are certain factors that you need to evaluate before deciding whether surcharging is right for your business or not.

- Evaluate Market Competitiveness:

In a highly competitive target market with numerous alternative options, where customers have the potential to substitute your products/services, implementing surcharge fees could result in losses. Proper research of the market and competitors is necessary. Only if the other players too have imposed surcharging fees should you go ahead with it.

- Analyze Customer Payment Methods:

Businesses need to gauge the total number of customers using credit cards for payments compared to the total number of customers. If the credit card users represent a small portion, then it is unwise to implement surcharging as the potential savings from a surcharge fee are not worth the resulting impact on customer experience.

- Assess Average Sale Amounts:

Surcharging is not a fit for businesses with small average sales. For example, if a company has a $4.00 sale, the surcharge amount will be around $0.16, which can’t even cover the cost of interchange fees. Also, if the average sale amounts are higher, the surcharge amount will be increased, which can affect CX. Surcharging is ideal for businesses with medium average transaction value as customers won’t mind paying a small surcharge fee.

- Examine Customer Behavior:

Merchants must analyze the customers’ potential receptiveness to surcharging before imposing it. Specific customers find that the advantages of paying with a credit card outweigh the drawbacks of an additional fee. But, for some businesses, corporate cards act as their operating line of credit. And now, if the working capital benefits these businesses gain from using these credit cards could open them to a potential surcharge, they will have to look for other options.

Streamlining B2B Surcharging with Automation Advancements

Businesses are revolutionizing their surcharge management by embracing the power of automation, aiming for precision, compliance, and transparency. Let’s explore the key automation advancements that are simplifying B2B surcharging for finance leaders:

- Automated validation of surcharges, ensuring adherence to state laws

- Auto-calculation of surcharge percentages based on interchange rates and other factors

- Transparent display of surcharge amounts during invoice payments

- Auto-application of surcharge fees for eligible transactions. Detailed breakdown of payment details for sellers at the invoice level

- Automated posting in ERP considering the payment breakup

- Assured compliance with card network regulations and surcharge rules

How can US Businesses make Surcharging Work for them?

In these dynamic economic shifts, merchants are more likely to use credit for their purchases to manage their finances, but sellers suffer because of the high processing costs. Surcharging is the need of the hour for US B2B payments, but implementing it comes with its challenges.

Fortunately, payment solution providers who already comply with all the rules and regulations exist. Businesses must choose the right solution providers for a smooth implementation of surcharging.

At Global PayEX, we help businesses cut down the payment processing fees by integrating directly with your ERP and supporting Level 2 and Level 3 credit card processing capabilities. Our EIPP solution, FreePay, provides highly advanced automation capabilities for B2B surcharge management and ensures an error-free application of the surcharge fee for payments. Talk to our experts to see our solutions live in action.