Do you still believe OCR (Optical Character Recognition) is enough for invoice processing?

It’s not—and here’s why.

OCR had its moment, helping businesses digitize invoices and reduce manual data entry. But in 2025, relying on OCR alone will not suffice. As invoicing processes grow more complex, companies are shifting to AI-powered Account Payables automation.

Why?

AI and ML surpass traditional OCR by handling complex invoice layouts, improving accuracy, and automating the entire accounts payable process. Let’s break down why OCR is falling short and which advanced technologies are stepping in to take over.

Why OCR Falls Short

OCR transformed invoice processing by digitizing printed and scanned invoices. However, as financial processes evolve, OCR’s limitations are becoming increasingly evident. Let’s break them down.

1. OCR in Invoice Processing is Susceptible to Errors

While Optical Character Recognition (OCR) can speed up invoice processing, it often struggles with accuracy. OCR can misread characters, leading to costly mistakes. For example, OCR might read the invoice number “O00123” as “000123”. This mistake can cause mismatches in your ERP – leading to expensive consequences.

Other common OCR challenges include:

- Confusing similar-looking letters and numbers (e.g., B vs. 8, O vs. 0)

- Struggling with handwriting and faded print

- Inability to read complex table structures in invoices and extract data

Even a 1% error rate with OCR can lead to significant losses, payment delays, compliance risks, and frustrated vendors.

2. High Maintenance and Manual Effort

To maintain accuracy, OCR requires continuous monitoring, frequent corrections, and ongoing updates. Since it only extracts text without understanding context or intent, accounts payable teams need to verify and correct errors manually. This manual intervention leads to:

- Slower invoice approvals

- Higher operational costs

- Increased workload for accounts payable teams

OCR also requires such upkeep because it struggles with:

- New supplier invoice formats: Different vendors use diverse invoice layouts, such as dynamic tables or multiple line items, which makes OCR error-prone. Any new layout often requires manual reconfiguration with OCR.

- Multiple languages: OCR often misinterprets characters or symbols in non-English invoices.

- Regulatory changes: Compliance requirements vary across regions, requiring teams to constantly update OCR models.

For instance, a global company working with suppliers from India, the U.S., and Germany would need to configure different OCR models to interpret varying invoice structures, tax formats, and currency notations.

Potential associated risk:

Without proper and regular updates, OCR may misread ‘Total Due: $1,000’ as $100.00 due to formatting inconsistencies. Even more critically, it might fail to distinguish between a discount and a penalty, misreading ‘5% early payment discount’ as ‘5% late payment fee,’ leading to costly financial miscalculations.

3. Limited Automation

OCR only extracts characters from the document —it cannot perform intelligent actions with the extracted data. It cannot validate an invoice or verify if it matches with purchase orders (POs), contracts, or approved payment terms. This lack of validation opens the door to errors, and fraud, making Account Payables workflows vulnerable to fake or altered invoices. Without smart validation, AP teams must manually cross-check invoices against the relevant documents, defeating the purpose of using automation.

OCR also falls short during the actual payment stage. When processing payments, payee details are required to be entered either manually into the payment portals or updated in CSV files that the finance team uploads to the banking platform. In short, OCR alone doesn’t eliminate manual data entry or streamline payment workflows—it merely digitizes the first step.

4. Compliance Issues

Businesses must comply with several financial regulations, tax laws, and data security standards. However, OCR-based invoice processing requires manual oversight and doesn’t inherently account for compliance requirements.

- IRS Standards: Invoices must meet the IRS standards for tax deductions, requiring accurate tax amounts, vendor details, and transaction dates. Errors in extracting these details by the OCR model can lead to incorrect tax filings and potential penalties.

- Record-keeping: Companies must maintain accurate financial records and audit trails. If OCR misclassifies or fails to capture key invoice details, it can jeopardize financial reporting integrity and lead to non-compliance.

- Tax Estimation: The US has no uniform sales tax system; rates and exemptions vary by state. OCR may struggle to extract tax breakdowns correctly, leading to incorrect tax reporting and possible audits.

If OCR Invoice Processing Isn’t the Future, What Is?

The answer is AI-powered accounts payable automation and e-invoicing.

Today, AI and machine learning are driving the next evolution, automating the end-to-end AP process, reducing manual intervention, improving accuracy, and cutting costs. Combined with e-invoicing – a key innovation, these technologies are transforming AP management from reactive processing to proactive cash flow management.

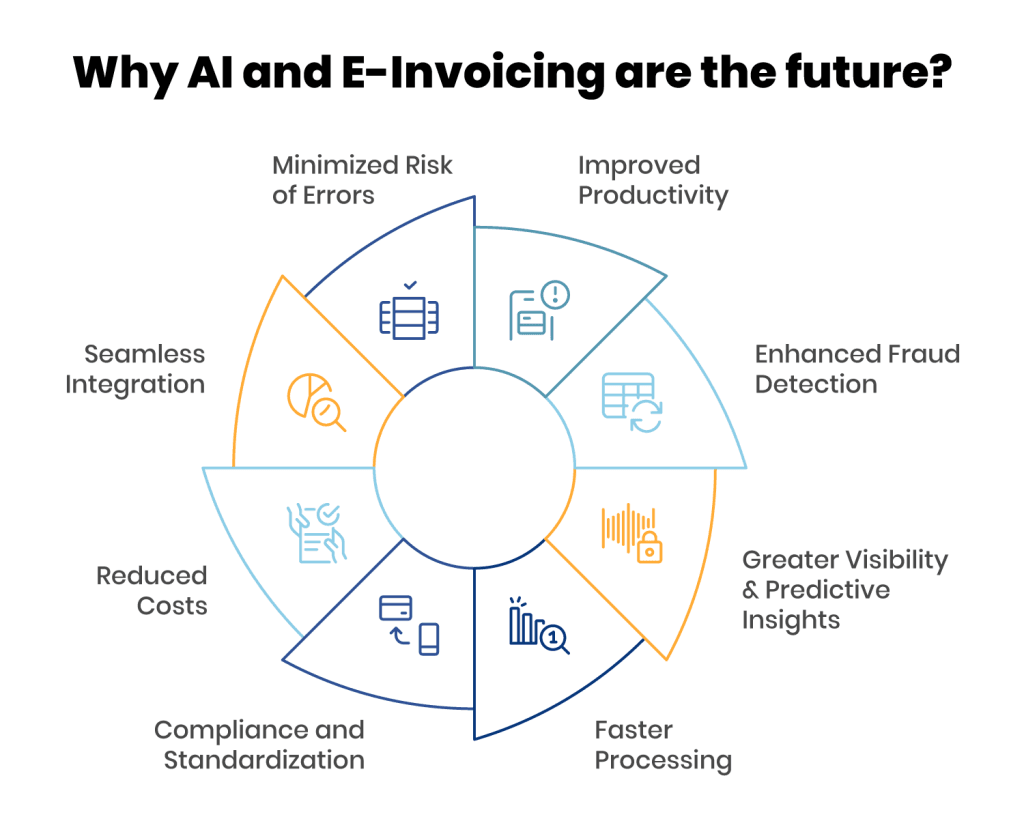

Why AI and E-Invoicing Are the Future?

AI and e-invoicing are not separate trends. They complement each other to create an autonomous AP function. While e-invoicing digitizes invoice creation and exchange and ensures compliance with global invoicing regulations, AI brings the intelligence to validate data and eliminate errors. Modern AP automation solutions combine e-invoicing with AI to accurately extract data from even the most complex invoice formats. Here are the top benefits of integrating AI and e-invoicing into your AP management:

- Minimized Risk of Errors: The AI-powered OCR model extracts and validates invoice data, reducing the need for manual data entry and ensuring accuracy. It can read invoices in any format.

- Improved Productivity: AI automatically matches invoices with purchase orders and receipts, flagging discrepancies in real time. This reduces teams’ workload, allowing them to focus on higher-value tasks.

- Enhanced Fraud Detection: AI and Machine learning algorithms analyze historical invoice data and payment patterns to detect duplicate payments, suspicious transactions, and policy violations; helping reduce fraud risk.

- Greater Visibility & Predictive Insights: AI enhances visibility into the entire accounts payable process through centralized dashboards, offering real-time insights into invoice status, approvals, and cash flow. It also enables predictive analysis by identifying spending patterns and forecasting future cash requirements—helping finance teams optimize payment cycles and improve financial planning.

- Faster Processing: E-invoicing significantly reduces invoice processing times by eliminating manual data entry and paper handling. This ensures vendors are paid on time, strengthens supplier relationships, and improves cash flow management.

- Compliance and Standardization: Many governments mandate e-invoicing to combat tax fraud and enhance transparency, making compliance easier. AI complements this by enabling robust record-keeping, maintaining a clear audit trail of all financial transactions, and ensuring adherence to regulatory requirements.

- Reduced Costs: It eliminates paper-based invoices, lowering printing, mailing, and physical storage expenses, resulting in significant cost savings for AP departments.

- Seamless Integration: E-invoicing integrates with ERP and AP systems, ensuring smooth data flow across platforms and reducing manual intervention.

By switching to AP automation solutions, businesses can eliminate inefficiencies associated with OCR and future-proof their accounts payable management.

The Best AP Automation Software (And NOT the Best OCR Software for Invoice Processing)

Manual invoice processing is slow, error-prone, and expensive. Traditional OCR tools can only scan documents but they cannot validate, handle exceptions, automate approvals, or support decision-making.

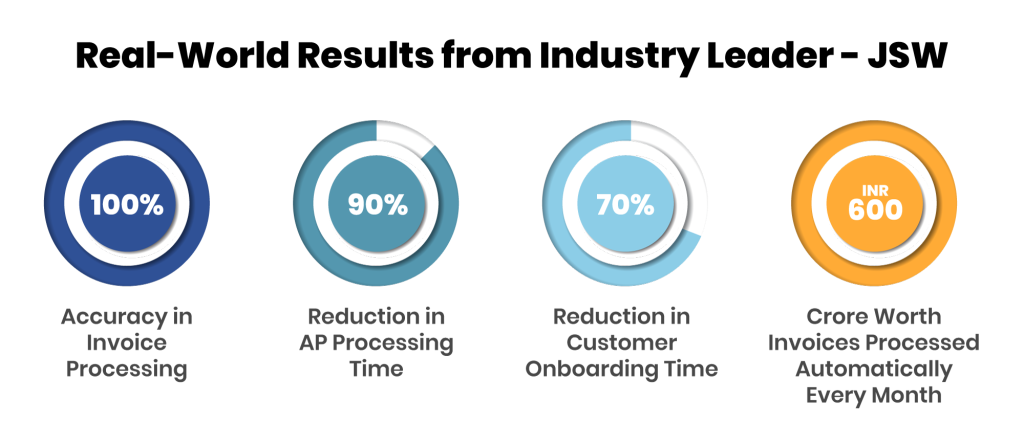

That’s where PayEX AP by Global PayEX comes in—an AI-powered end-to-end Accounts Payable automation solution that reduces invoice processing costs by 40% and speeds up approvals by 50%.

What is PayEX AP?

PayEX AP is an advanced, AI-powered accounts payable automation solution that goes far beyond OCR. With its deep learning AI models and a cloud-native approach, PayEX AP enhances payables operations by automating invoice data extraction, document classification, and reconciliation workflows. It integrates seamlessly with existing ERP using pre-built connectors to mitigate fraud and compliance risks, reduce manual paperwork and delays, and provide complete data visibility.

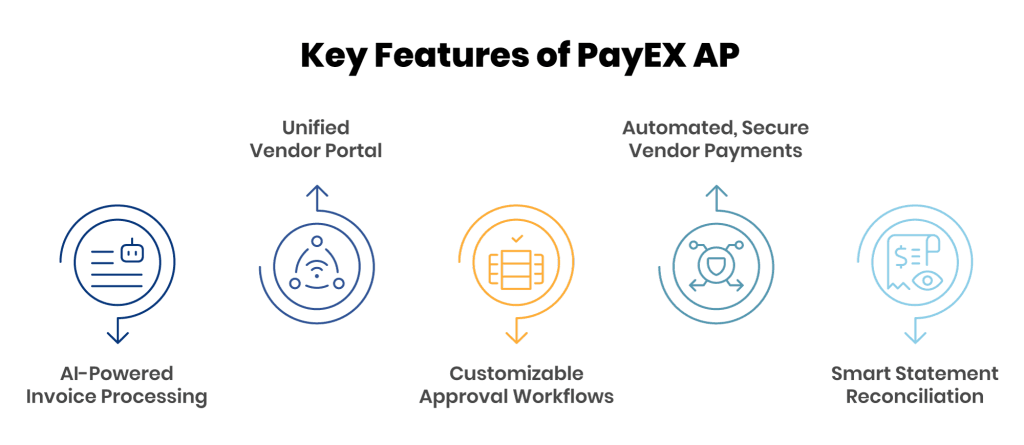

Key Features:

1. AI-Powered Invoice Processing

Your inbox shouldn’t double as an invoice storage system. The invoices should enter your system the moment vendors submit them. PayEX AP automates invoice capture, validation, and processing to reduce manual effort and errors.

Here’s how it happens:

- Step 1: Vendors submit invoices in any format, including PO, non-PO, logistics, or service-based invoices.

- Step 2: AI model scans and validates invoices instantly, identifying duplicates and errors.

- Step 3: Approved invoices flow directly into the ERP system without manual intervention.

The Business Impact:

✅ 50% faster invoice processing: Invoices get validated instantly, reducing back-and-forth with vendors

✅ 85% fewer invoice errors: AI-based contextual validation catches inconsistencies before they escalate

✅ Stronger compliance: Automated tax checks ensure every invoice meets regulatory standards

2. Unified Vendor Portal

“Has my invoice been approved?”; “When will I get paid?”; “Why was my invoice rejected?”

Finance teams get questions like these every day from vendors. PayEX AP gives vendors real-time visibility into invoice and payment status, reducing manual inquiries. Vendors get:

- A self-service portal that allows them to track purchase orders, invoice status, and payment timelines.

- Payment options such as early payment discounts and channel financing improve vendor cash flow.

The Business Impact:

✅ Fewer vendor inquiries: Real-time invoice and payment tracking eliminates the need for follow-up emails

✅ Stronger vendor relationships: Provides transparency to the vendors, which fosters trust and long-term partnerships.

✅ Improved efficiency: Automated workflows reduce manual intervention in vendor management

3. Customizable Approval Workflows

Finance teams often rely on email follow-ups and manager availability, which slows down invoice processing. PayEX AP automates invoice approvals to eliminate delays and manual follow-ups.

- Smart, rule-based workflows: It routes invoices to the correct approver based on amount, department, or urgency

- One-click approvals from desktop or mobile: The solution enables multi-level and multi-department approvals with role-based access

- Full audit trails: It provides complete audit trails for enhanced visibility and fraud prevention

The Business Impact:

✅ Faster invoice processing: No more bottlenecks; approvals happen automatically

✅ Stronger internal controls: Audit trails ensure compliance and reduce fraud risks

✅ More time for strategic finance tasks: Less time spent chasing approvals means more focus on growth

4. Automated, Secure Vendor Payments

Late or inconsistent vendor payments disrupt cash flow, strain supplier relationships, and increase financial risk. With PayEX AP, vendor payouts happen automatically:

- It schedules and executes vendor payments automatically based on due dates

- Dynamic discounting and external financing options optimize working capital requirements

- A centralized vendor database tracks payment trends and vendor performance

- Ensures full and real-time visibility into Days Payable Outstanding (DPO) to optimize cash flow

The Business Impact:

✅ 40% reduction in invoice processing costs: Lower admin costs by eliminating manual payments

✅ Optimized working capital: Strategic payment scheduling ensures businesses never overpay or delay payments unnecessarily

✅ Better cash flow management: Automated processing means improved predictability in payables

5. Smart Statement Reconciliation

Finance teams spend countless hours matching invoices, payments, and purchase orders. Without automation, mismatches go unnoticed. PayEX AP makes reconciliation effortless and error-free:

- Vendors upload statements, and AI auto-matches invoices, payments, and purchase orders

- Real-time reconciliation reports give full visibility into pending payments

- Vendors can upload statements and view real-time reconciliation reports

- Auto-matches vendor and corporate statements, flagging discrepancies instantly

- Provides actionable insights to resolve mismatches before they become major issues

The Business Impact:

✅ Finance teams no longer waste weeks on reconciliation

✅ Automated matching reduces errors that lead to conflicts

✅ A fully reconciled AP process improves reporting and forecasting

With a G2 rating of 4.9 out of 5, Global PayEX is one of the few solution providers worldwide known for delivering consistently high levels of customer satisfaction. With Global PayEX, businesses can achieve a fully automated AP and AR function, streamlining both outgoing and incoming payments while ensuring compliance and efficiency at scale.

The Bottom Line: OCR Alone Won’t Help

In 2025, invoice processing isn’t just about digitizing documents; it’s about fully automating workflows. Traditional OCR tools can extract text, but they lack the intelligence to interpret context, flag anomalies, or streamline invoice processing at scale. AI-powered OCR models go a step further by recognizing patterns, identifying mismatches, and assisting in real-time validations. PayEX AP doesn’t just read invoices; it understands, validates, and processes them intelligently. To stay competitive, CFOs must move beyond OCR and adopt holistic AP automation solutions with built-in AI-powered OCR models.

For businesses looking to move beyond OCR, Global PayEX helps navigate the next stage of the AP automation journey. Talk to our experts to assess your current workflows and find your business’s most suitable automation strategy.

Frequently Asked Questions (FAQs)

1) What is OCR in invoice processing?

In invoice processing, OCR (Optical Character Recognition) = extracts text from scanned or digital invoices, converting it into machine-readable data. It automates data entry, reducing manual effort, but often requires AI enhancements for accuracy, validation, and handling of diverse invoice formats.

2) How accurate is OCR scanning in invoice processing?

The accuracy of OCR in invoice processing varies depending on invoice image quality, font complexity, and invoice layout. It often struggles with handwritten text, poor image quality, and complex invoice layouts. The accuracy can be measured by metrics such as character error rate (CER), word error rate (WER), or line error rate (LER).

3) How does OCR work in invoice processing?

Invoice OCR converts scanned invoices or PDFs into structured, searchable data. Here’s how it works:

- Image Scanning: The system captures an invoice from a scanned document, PDF, or image.

- Text Recognition: OCR technology identifies characters, numbers, and symbols from the document.

- Data Extraction: Key fields like invoice number, date, vendor details, and total amount are extracted.

- Data Structuring: The extracted text is formatted into a structured, machine-readable format.

- Validation & Error Checking: Some systems apply rules to detect errors, duplicates, or missing fields.

4) What is the AI-powered OCR automation in Accounts Payable Management?

An AI-powered OCR model in Accounts Payable refers to the use of OCR enhanced with AI to automate and improve invoice data extraction.

Unlike traditional OCR, which simply scans and recognizes text, the AI-powered OCR model utilizes contextual understanding to extract key data points more accurately. It works seamlessly with invoices of any format, making it highly reliable.