Introduction

Let’s go back to 2003.

You are driving on an unknown terrain and hoping to reach your destination. Google maps do not exist, so you have to rely only on road signs and ask people for directions.

This mirrors the B2B payments landscape before ISO 20022, filled with complexities and dependencies. Businesses used to struggle to find the right path for efficient data exchange, encountering delays, errors, and inefficiencies.

In our interconnected global economy, accurate financial transactions are vital. The financial industry continually evolves to meet the demands of modern businesses. One such evolution is ISO 20022. In this blog, we’ll explore ISO 20022, its origin, significance, and benefits for businesses. Let’s start with understanding ISO 20022.

What is ISO 20022?

ISO 20022 is a global standard for exchanging electronic messages which uses XML syntax and offers structured, rich data that can be used for every kind of financial business transaction. It was created to give the financial industry a common platform for sending payments messages and exchanging payments data.

Origin and Global Adoption

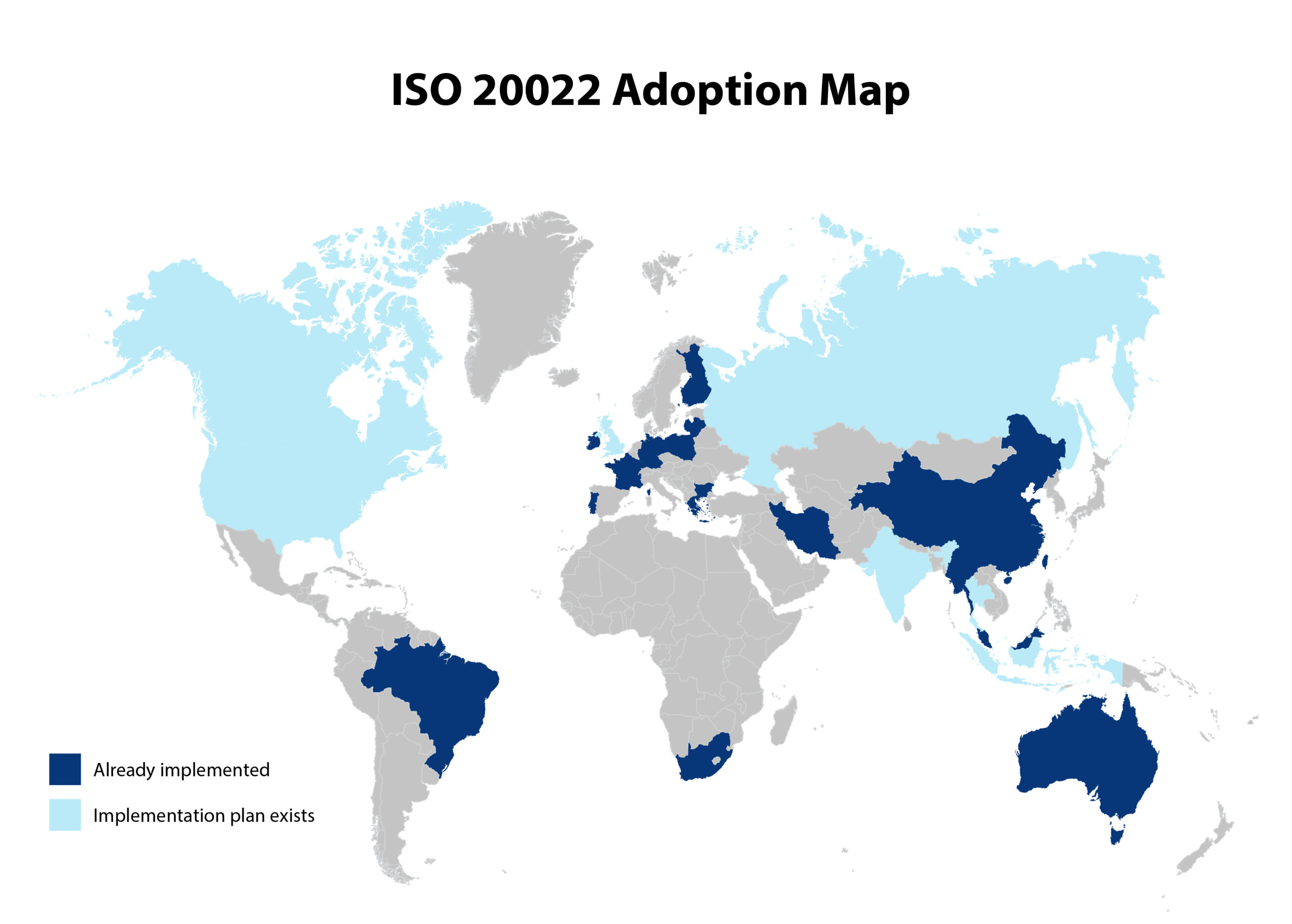

ISO 20022 traces its roots back to 2004 replacing ISO 15022. Since then, it has gained widespread acceptance on a global scale. As the earliest adopter of ISO 20022, SEPA (Single Euro Payment Area) distinguished itself as the most advanced example of the standard’s implementation.

Currently, there are about 200 initiatives around the world that have either implemented, or are planning to implement, ISO 20022. It has already been adopted in 70+ countries to replace domestic or legacy formats, but worldwide ISO 20022 adoption will take place in the next few years.

Significance of ISO 20022 for the US Businesses

B2B payments involve complex and large-scale transactions. Over the years, US businesses have long grappled with challenges in the B2B payment landscape which led to inefficiencies and increased operational costs. The main factors were:

- Legacy systems

- Manual processes

- Varying data formats

The adoption of ISO 20022 is particularly significant as it streamlines data exchange between businesses, banks, and financial entities. This ensures that critical payment information is accurately conveyed.

ISO 20022: Addressing the Challenges of B2B Payments Landscape

In this digital age, most businesses operate globally but traditionally, financial institutions have had tendencies to develop, approve and implement region specific standards which resulted in inconsistency, defeating the purpose of doing global business. ISO 20022 – the ‘de facto’ new standard, was designed to solve this.

It offers a solution to these challenges by providing a common language for financial messaging. By adopting this standard, businesses can streamline their payment processes, reduce errors, and enhance their competitiveness in the global market. ISO 20022’s rich data model allows for detailed transaction information, which is particularly valuable for cash reconciliations.

Benefits of ISO 20022

The advantages of this standardization approach are numerous. Here is a list of the key ones:

- Enhanced Data Quality: ISO 20022’s structured messages allow for more comprehensive and accurate transaction data, reducing the risk of errors and accurate reconciliations

- Improved Automation: The standardized format enables greater automation in payment processing, reducing manual intervention and costs

- Global Interoperability: It promotes seamless communication between domestic and international entities, enhancing cross-border transactions

- Rich Analytics: Standardized data content enables better analytics and reporting, aiding decision-making processes

- Elevated Customer Satisfaction: It has a direct impact on customer satisfaction as it provides improved visibility and transparency as well as a high level of reliability while processing transactions

Best Practices for Implementation of ISO 20022

Implementing ISO 20022 effectively requires careful planning and execution. Here are some best practices for US businesses looking to make the transition:

Conclusion

ISO 20022 is not just a technical upgrade; it’s a strategic imperative for all businesses. However, there are multiple barriers such as unsuitable legacy systems, inadequate resources that hinder widespread adoption. With strategic planning and collaboration with the right technology partners these hurdles can be overcome.

Embracing ISO 20022 promises streamlined processes, enhanced efficiency, and ultimately, a brighter future for B2B payments on a global scale. Global PayEX helps businesses in their journey of ISO 20022 adoption. It utilizes AI-driven cloud-native software, to automate and enhance the Accounts Receivables and Accounts Payable workflows, ensuring efficiency, speed, and precision in managing critical financial transactions. Talk to our experts to learn more.