Business Payments Coalition (BPC) is a consortium of organizations reshaping the US B2B payment ecosystem to promote the adoption of electronic payments, e-invoicing, and e-remittance. BPC’s primary objective is to achieve straight-through processing across both the P2P and O2C cycles for all US businesses.

In collaboration with the Federal Reserve, the BPC launched an e-remittance Exchange Pilot Program in September 2023. This groundbreaking initiative brings together the industry leaders, qualified service providers and business participants to test an exchange framework ecosystem that enables businesses to exchange electronic remittance data. This pilot phase, extending through mid-2024 represents the final step before the market adoption of an exchange framework for e-remittance in the United States.

Global PayEX is honored to be selected as a participant of the Business Payments Coalition, alongside notable industry leaders such as SAP, Nacha, Jack Henry, and US Bank, to modernize B2B Payments in the US.

Global PayEX’s Role in the E-Remittance Exchange Pilot Program

- Piloting a fully operational e-remittance exchange framework:

Global PayEX, in collaboration with other industry leaders, is pioneering an operational electronic delivery network, utilizing its efficacy in enabling seamless exchange of remittance information across diverse industries in the United States.

- Finalizing recommendations for the ISO 20022 remittance data model:

Actively contributing to the standardization of financial transactions, we are shaping recommendations for the ISO 20022 remittance data model. This will ensure efficiency in processing electronic remittances, promoting industry-wide best practices.

- Preparing for a production exchange framework for payments:

Global PayEX is gearing up to establish a production exchange framework that inclusively supports all payment methods. Our goal is to ensure the accessibility and effectiveness of B2B payments modernization across diverse payment methods, contributing to a comprehensive transformation of the US B2B payment landscape.

What Problems are we Trying to Solve?

The current state of invoice and remittance information exchange in the United States is characterized by a high degree of manual intervention, labor-intensive processes, unstandardized remittance advice formats, and substantial costs. These inefficiencies pose significant obstacles to the overall effectiveness of the B2B payment process. Despite the introduction of electronic payments over 30 years ago in the US, the accurate delivery and processing of remittance information have remained formidable challenges.

Recognizing the intricacies involved in remittance processing, BPC and the Federal Reserve have taken the initiative to establish an electronic delivery network for e-remittance. This e-remittance Exchange framework is designed to address these challenges and enhance the efficiency of remittance processing in the United States.

How does the E-Remittance Exchange Network function?

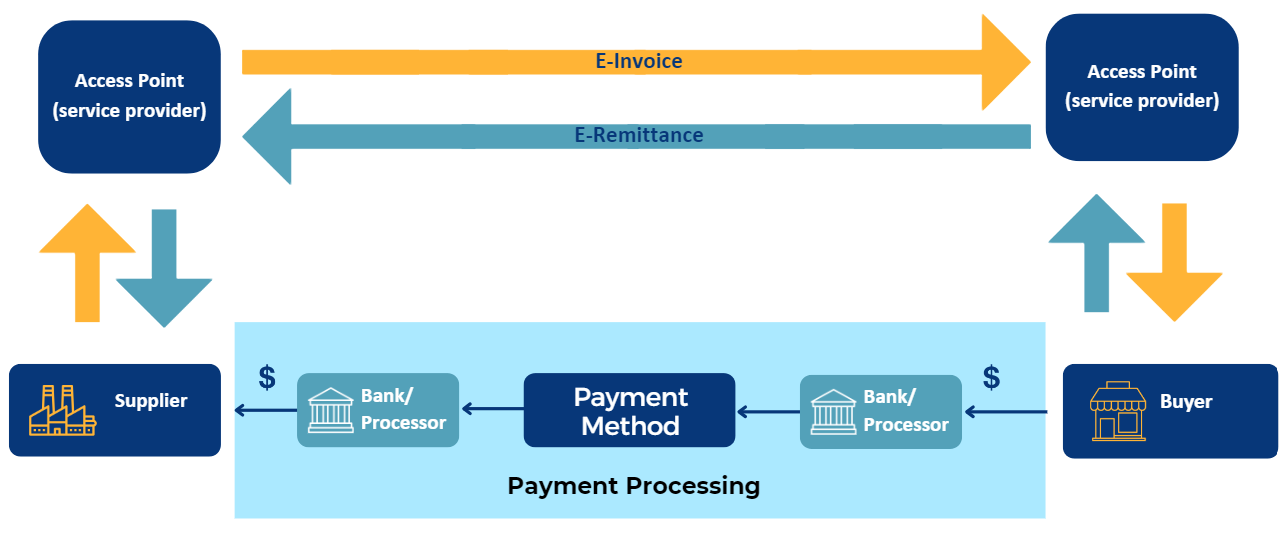

The e-remittance exchange framework is an electronic delivery network based on a four-corner ecosystem, where service providers act as access points that send and receive electronic documents (e-invoice & e-remittance). This framework supports all payment methods and requires no change to the existing systems.

E-Remittance Exchange Framework

Step 1: The buyer generates the remittance advice and sends it to their e-remittance service provider, also known as an access point.

Step 2: The buyer’s access point delivers the e-remittance to the supplier’s access point.

Step 3: The supplier’s access point converts the remittance advice into the required format for their AR system and sends it to them.

Step 4: The supplier’s AR system reconciles the payment, extracts the remittance data, and posts it directly to their ERP system.

Transformational Benefits for Corporates

This e-remittance exchange framework is set to deliver substantial transformative impacts for corporates. Here is a list of five key benefits:

- Lower Costs: Enables costs reduction by facilitating straight-through processing of remittance information and reducing manual efforts for finance teams

- Enhanced Security: Establishes a secure financial transactions network with standardized policies, guidelines, and stringent security measures

- Increased Transparency: Provides corporates with clear and comprehensive visibility into payment statuses and remittance details

- Better Cash Management: Enhances cash flow management with automation and improved accuracy in financial management

- Reduction in Errors: Eliminates manual errors in remittance processing, ensuring a reliable financial transaction environment for corporates

This e-remittance exchange framework is poised to revolutionize the B2B payments landscape in the US. As companies embark on the modernization journey of B2B payments, the strategic involvement of a technology partner becomes pivotal.

At Global PayEX, we help businesses of all sizes with AR & AP process automation using our AI-powered ERP-agnostic product suite. Want to ensure a future-ready approach to finance management for your business? Talk to our experts to see our solutions live in action.