DSO – Days Sales Outstanding is the most important metric on AR (#AccountsReceivable) health – contributing to #workingcapital health. As the world economy is getting stressed due to interest rates and recessionary pressures, the DSO days are worsening across industries.

As per a Dun & Bradstreet Industry report, Q3 2022 shows that 21 of the 211 industry segments report more than 10% of their ageing dollars are 90+ days past due. These results are higher than in Q2 2022 when 16 industry segments reported more than 10% of their ageing dollars were severely delinquent.

Further, in the 15 worst-performing industry segments, only 56% of payments are current and 44% of payments are delayed (12% by up to 30 days, 6% by up to 60 days, 4% by up to 90 days and 21% by > 90 days)

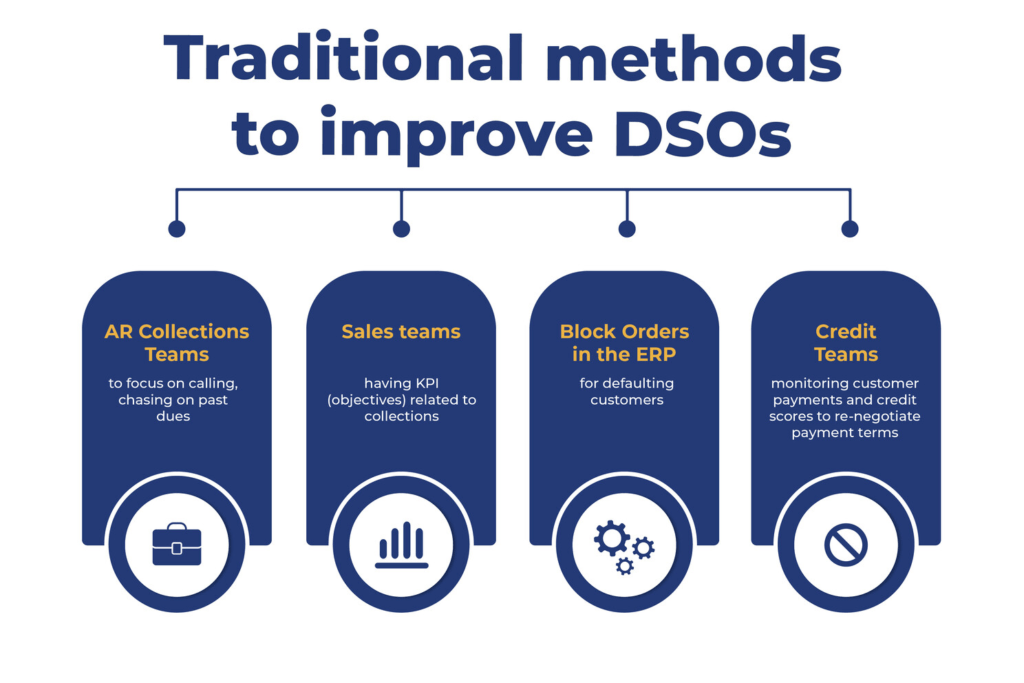

Traditional methods to improve DSOs include:

- AR Collections Teams – to focus on calling, chasing on past dues

- Sales teams – having KPI (objectives) related to collections

- Block Orders in the ERP for defaulting customers

- Credit Teams – monitoring customer payment behaviour and credit scores to re-negotiate payment terms

But, there is a huge opportunity to leverage the latest technology tools specifically #EIPP (Electronic invoice presentment and payment), which brings about a significant reduction in DSO days, while also reducing costs and enhancing revenues at the same time. More about the benefits of EIPP later in the article.

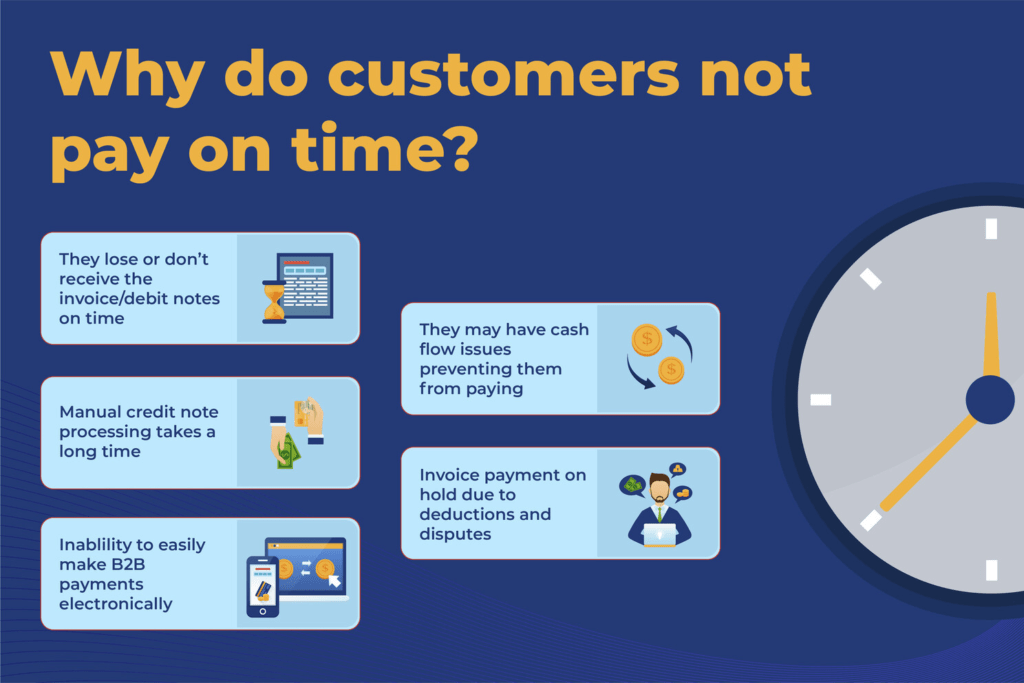

Why do customers not pay on time?

1. Invoices and Debit notes – Not received on time OR lost in transit.

Today a big portion of invoices/debit notes are delivered via paper and emails. Some of the challenges:

- Paper Mail – could take several days to reach the customer, customer AP teams have to then spend significant time processing the invoices (scanning, indexing, validating, matching, approvals and posting into ERP)

- Emails – could get into junk box OR due to personnel changes in the customer could bounce back

Hence, when chased for collections, the customer could say “I have not received the invoice – can you please resend” and this means several days lost.

2. Credit notes – The ability to pay invoices using one or more credit notes.

Today these credit notes also are shared via email and paper mail – causing similar issues to the point above.

3. Payment modes

Since it is not possible to digitally pay B2B invoices (v/s B2C invoices – e.g. utility invoices that can be paid via your bank with a standing instruction or in two clicks), often customers have to pay using cheques, wires etc which are both expensive and takes 1+ days for the payment to reach the seller.

4. Deductions and disputes

Customers often do not pay an invoice if there is a dispute or deduction/s on that particular invoice. Often, the customer wants these to be resolved before paying an invoice.

5. Cash flows

The customer does not have money available to pay on the due date – hence delaying payment.

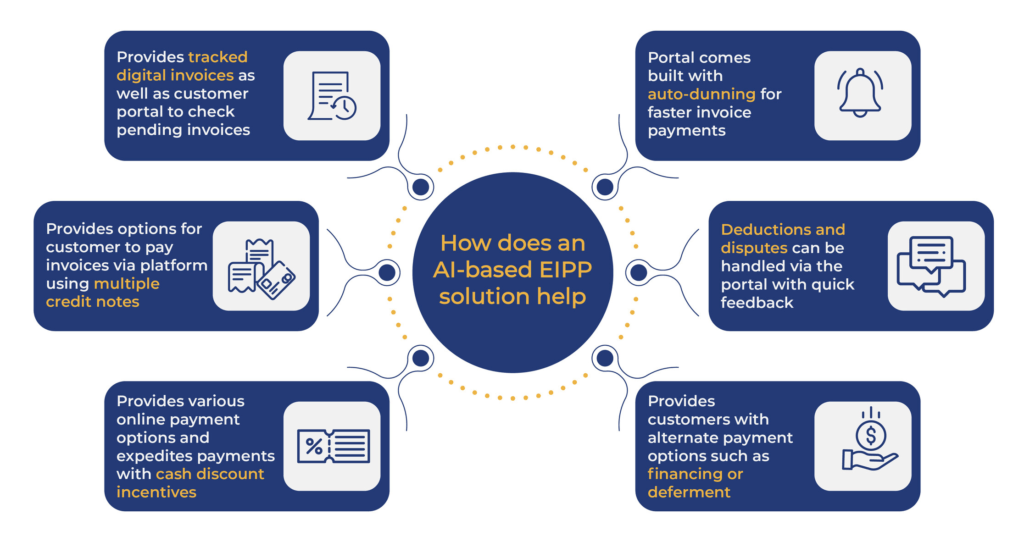

How can implementing a robust EIPP (Electronic invoice presentment and payment platform) help?

1. Invoice Presentment

- Send invoices via email (links) and track status – opened, bounced etc.

- EIPP Customer Portal – a single destination for customers to view all outstanding – invoices, credit and debit notes, and payment history

2. Credit Notes

- In the EIPP customer portal – enable payment of invoices via one or more credit notes. Display all outstanding credit notes and used credit notes.

- Embed accounting rules – e.g. Credit note of LOB1 (line of business) cannot be applied to an invoice of LOB2.

3. Payment Modes (#B2Bpayments)

- Enable customers to pay via all digital payment models – ACH, real-time payments, Cards, and off-line (if required) like wires and cheques in a simple payment interface (similar to consumer bill payments)

- Other payment functionalities: Enable storage of payment methods – e.g. cards, ACH, and support recurring and scheduling payments.

4. Deductions and disputes

- Enable customers to make deductions at the time of Invoice payment with your (Seller) #deduction reasons like “with-holding tax”, “short material supplied” etc.

- Customers can track deduction status – e.g. approved or rejected

5. Cash flows (#CashFlow)

If a customer does not have money to pay on the due date:

- Provide financing options – via banks and other lenders

- Provide deferment with real-time computation of interest penalties to be paid

6. Cash Discounts

Enable early pay cash discounts to customers for faster collections (win-win for both parties)

7. Dunning and chases

Enable email, text and EIPP automated dunning/messaging for overdue payments, early pay cash discounts etc.

Based on Global PayEX experience, our customers have realized ~20% reduction in DSO days within 3-6 months of EIPP implementation, while at the same time significantly enhancing their customer satisfaction.

Reach out to us to learn more by sending an email to [email protected]