Introduction

Entering the financial landscape of 2024 brings new challenges to managing Accounts Receivable, making it more difficult than ever.

Globally, high interest rates continue to pose significant challenges for businesses, creating hurdles in the borrowing landscape due to elevated costs. As prognosticators within the industry anticipate continued economic growth slowdown as we enter 2024 accompanied by fluctuating interest rates, the revenue growth trajectory for corporations is likely to be impacted. Consequently, buyers are likely to defer their payments, amplifying the challenges faced by sellers grappling with the working capital repercussions of delayed payments. Effectively managing accounts receivable in this landscape will demand additional resources, particularly with already escalated labor costs, compounded by a scarcity of proficient finance professionals. These intertwined factors vividly illustrate the intricate landscape and formidable challenges awaiting businesses in the realm of accounts receivable management in 2024.

The B2B payments industry has undergone substantial transformations in the last five years and will continue to evolve in 2024. Industry leaders have started to actively implement cutting-edge technologies in their accounts receivable management processes to meet customer expectations and working capital demands in this digital age.

But the pivotal question is: Amidst the hundreds, which are the top 5 accounts receivables trends that you need to focus on in 2024?

- AI (Artificial Intelligence) Intergration in Accounts Receivables Management

- Informed Decision Making with Advanced Analytics

- Global Standards Adoption

- Real-Time Payments Implementation

- Prioritizing Customer Experience Enhancement

Let’s dive deep into these trends and see how they can transform your AR management.

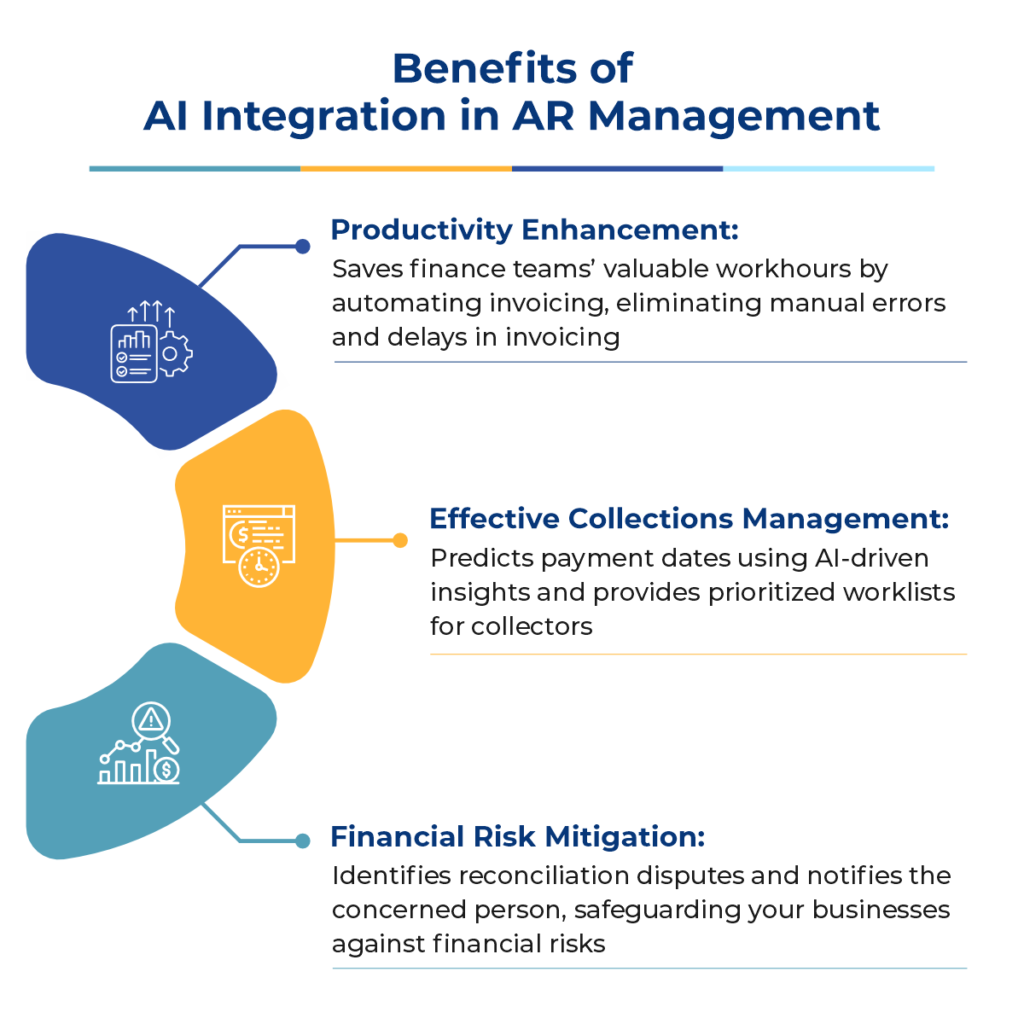

1) AI (Artificial Intelligence) Integration in AR Management

“59% of C-suite executives at large companies said their organization is currently using AI in their tax or finance department, and the other 41% are interested in doing so.” – KPMG

As AI is becoming mainstream, in 2024 it will outpace RPA (Robotic Process Automation) in influencing financial processes. While RPA is limited to automating pre-programmed business processes, the integration of AI into AR management signifies a paradigm shift. With AI, the system can make predictions and evolve rapidly, akin to human capabilities, leveraging data to enhance efficiency and bolster your business’s bottom line. Furthermore, it facilitates seamless integration of the AR system with the existing ERP to provide you with a single source of truth and a connected ecosystem.

AI in AR management transforms essential functions— invoicing, collections, and reconciliation— streamlining processes and fortifying financial operations to foster a more efficient and trustworthy business environment.

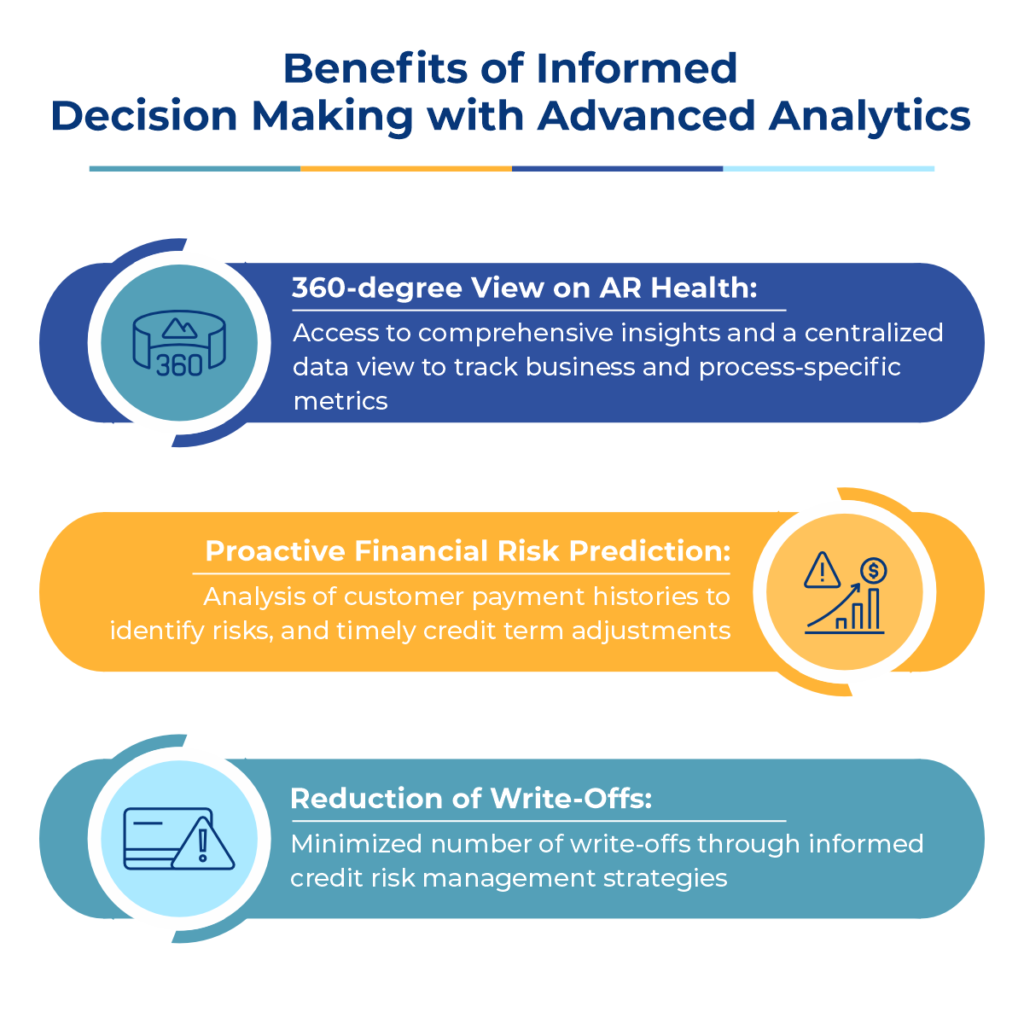

2) Informed Decision Making with Advanced Analytics

“60% of companies worldwide leverage advanced analytics to drive process and cost-efficiency.”

In 2024, finance leaders will increasingly depend on data-driven decision-making. The Adoption of advanced analytics steers businesses toward optimized cash flow and faster collections. It analyzes vast datasets to extract comprehensive, actionable insights. Armed with these insights, companies can forecast payment patterns, optimize credit terms, and enhance their collection strategies.

Previously, AR optimization had its limitations with reliance on limited datasets, primarily sourced from ERP. However, with advanced AR analytics, a comprehensive overview of your AR functions becomes available. Finance teams gain the ability to monitor essential KPIs such as DSO (days sales outstanding), DDO (days deductions or disputes outstanding), suspense accounts trends, and customer-specific patterns and drill down into underlying data sets to improve these KPIs. As businesses leverage advanced AR analytics, finance leaders gain access to a dynamic toolkit for decision-making, ensuring financial stability and agility in the data-driven landscape in 2024.

3) Adoption of Global Standards

The global momentum towards e-invoicing is gaining substantial traction, with over 80 countries mandating its adoption and others swiftly following suit. E-invoices reduce the chances of errors in invoice generation and delivery. Furthermore, it ensures that the government promptly receives the information about the sale of goods.

In India, e-invoicing has become mandatory for all B2B transactions since April 2021. France, Spain, Belgium, Portugal, Poland, Greece, Turkey, and Italy have also enforced B2B e-invoicing mandates. Even in the United States, the Federal Reserve has been actively researching e-invoicing since 2016. It has emphasized the crucial role of e-invoicing in achieving seamless processing in order-to-cash and procure-to-pay. The establishment of the Digital Business Networks Alliance (DBNAlliance), overseeing an electronic exchange network for e-invoices and e-remittances, marks a significant shift in B2B payments modernization in the United States.

ISO 20022 has emerged as the new financial messaging standard for cross-border and high-value payments. It is a common platform that Swift has created for sending payment messages and exchanging payment data in the financial industry. SWIFT has set a three-year transition period from November 2022 to transition from SWIFT MT to ISO 20022 compliant messages. By November 2025, Swift will discontinue MT, and the B2B payments industry will leverage only ISO 20022.

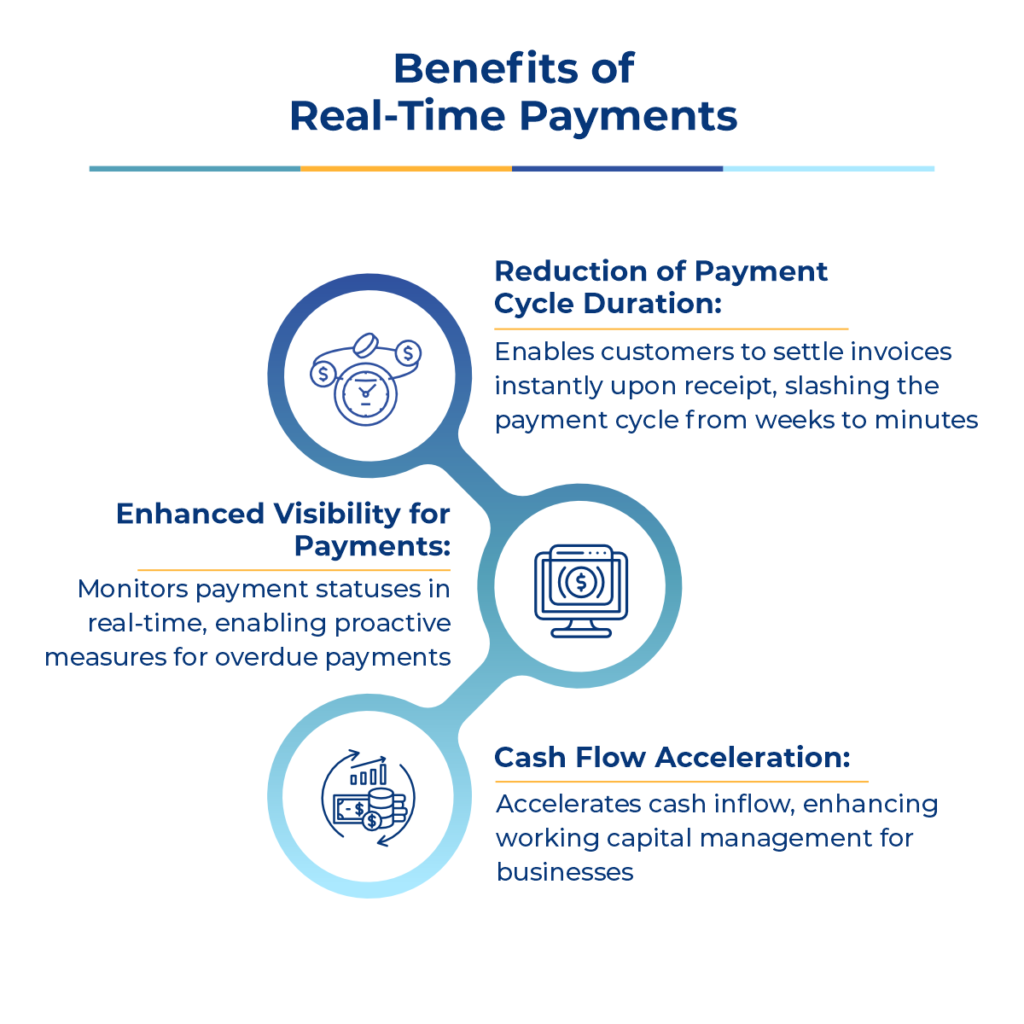

4) Real-Time Payments Implementation

“Real-time payments are expected to account for 27.8% of all electronic payments globally by 2027.” – ACI Worldwide

In 2024, Real-Time Payments (RTP) is set to completely change how businesses handle their accounts receivable. RTP facilitates instant payments for customers, ensuring swift transactions and heightened client satisfaction. With the rise of mobile wallets, that securely store payment details on devices, real-time payments have become more convenient than ever. Businesses get their money faster, significantly easing cash flow management.

One significant advantage is that RTP instantly updates businesses on their receivables. This empowers finance teams to make well-informed decisions, akin to having a live feed of incoming funds. Additionally, RTP enhances transaction security, that eliminates the reliance on outdated payment rails that businesses had to contend with in the past.

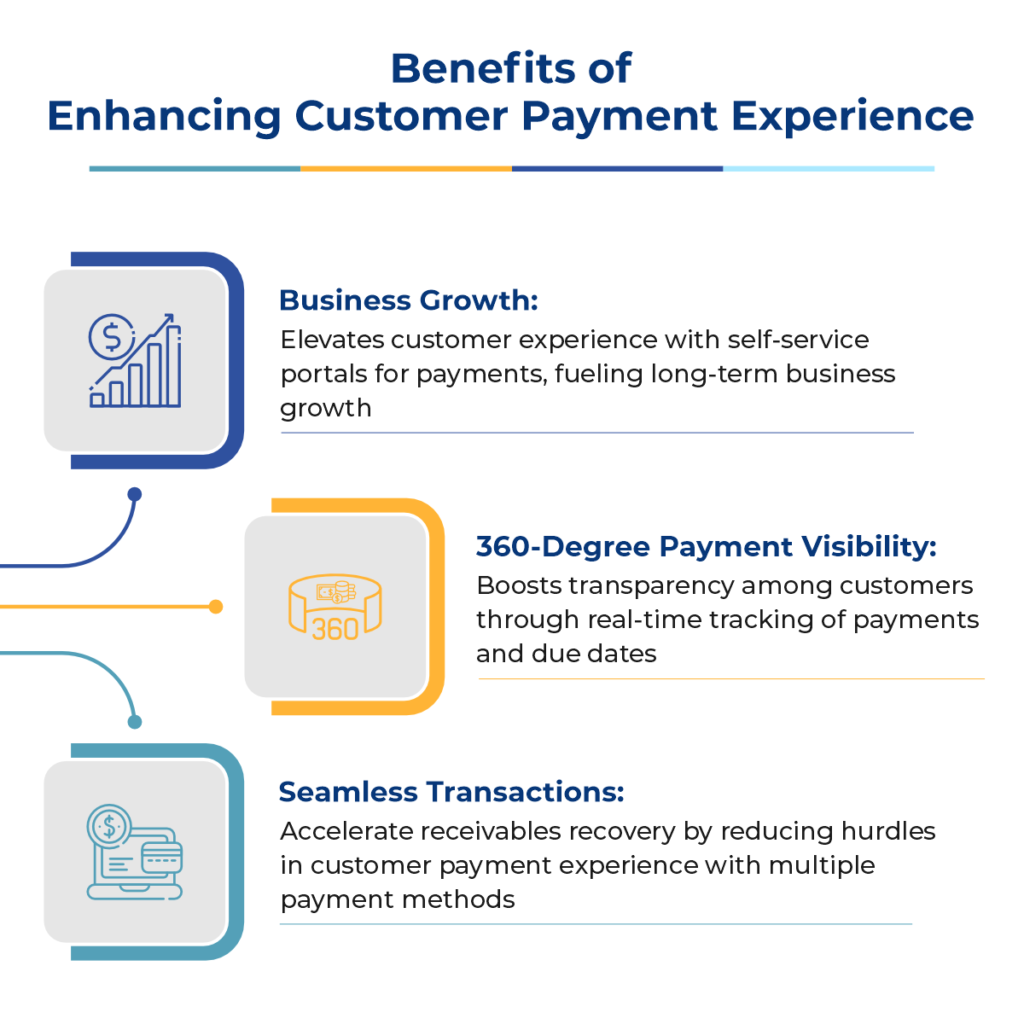

5) Enhancement of Customer Experience

“85% of B2B buyers value a positive experience with their partners as much as their products and services.” – PYMNTS

As businesses evolve, customers increasingly anticipate efficient and personalized interactions throughout the invoicing and payment process. This includes providing an easy-to-use interface and intuitive self-service portals with invoice tracking, multiple payment methods, and secure payment processing. Businesses that will prioritize customer-centric approaches by proactively addressing needs, delivering timely payment reminders, and leveraging automation to eliminate process delays will not only satisfy customers but also establish themselves as trustworthy business partners. Investing in uplifting customer payment experience in 2024 will no longer be seen as one of the business strategies; but a fundamental aspect of sustaining business success.

In a Nutshell

The top five trends that redefine AR practices in 2024 emphasize efficiency and customer-centricity. There are multiple threats to AR management in the coming years, including cybersecurity threats, dynamic economic conditions and changes in customer payment patterns. However, adopting these trends will ensure resilience and sustained success in the evolving world of accounts receivable. In this journey, the right technology partner is also essential: the one who will offer solutions that can scale with the market and be tailored to your business requirements.

At Global PayEX, we lead the charge in transforming AR management with our AI-powered end-to-end AR automation solutions to elevate your business growth. Talk to our experts to see our solutions live in action.