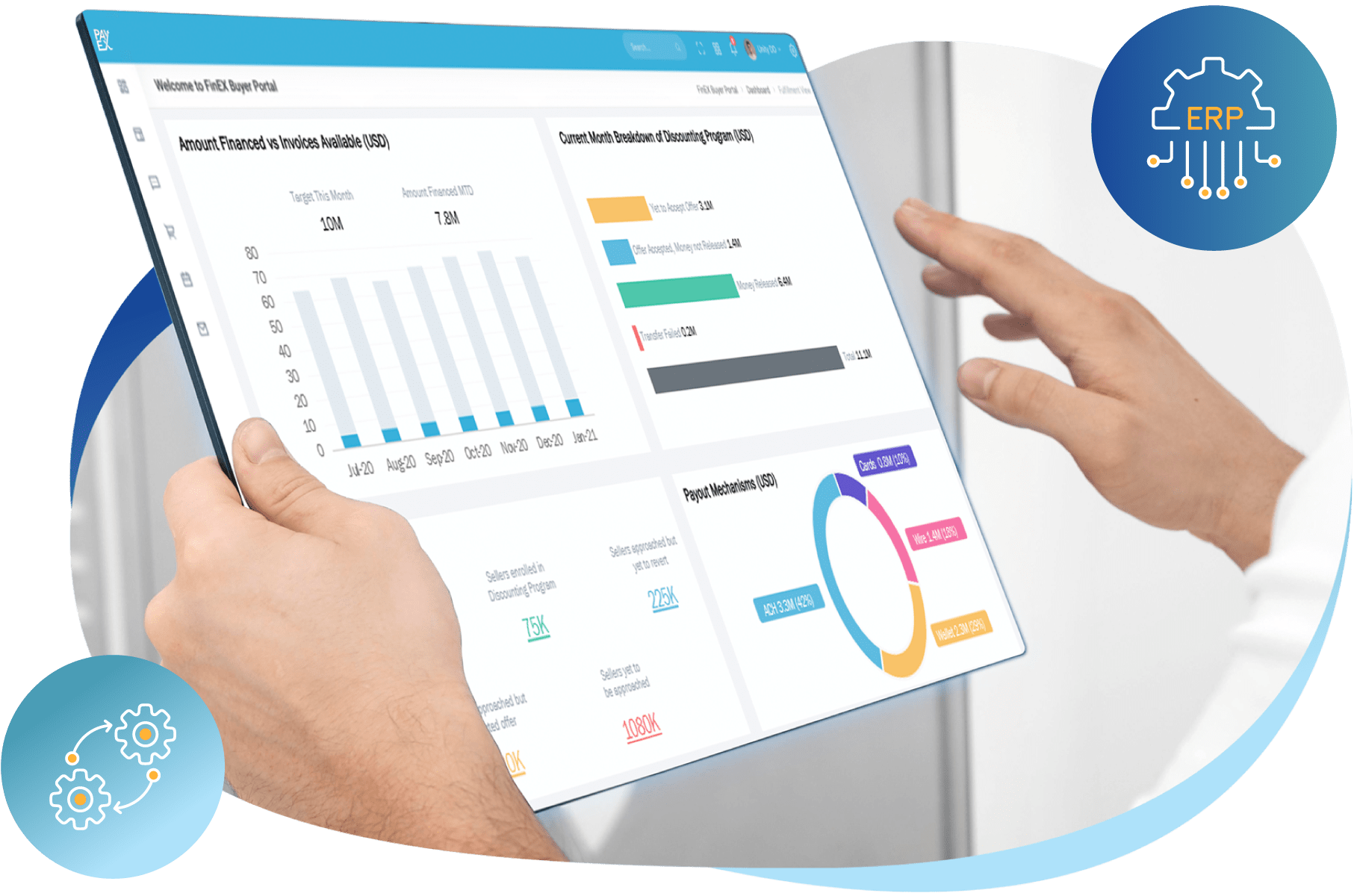

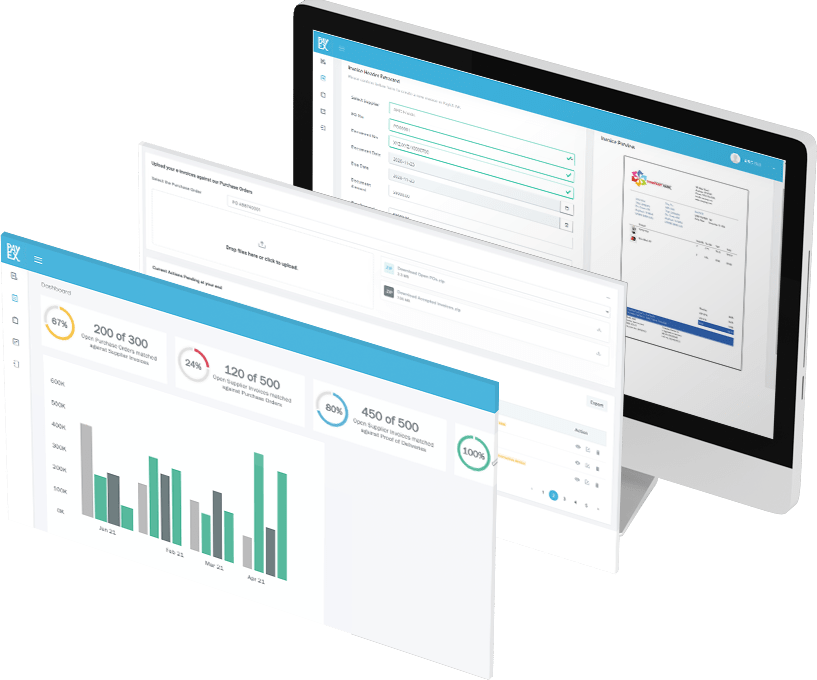

Discover the advanced finance automation possibilities that seamlessly enhance your ERP’s capabilities, making it 5X more powerful

Discover the advanced finance automation possibilities that seamlessly enhance your ERP’s capabilities, making it 5X more powerful

NACH FAQs

NACH (National Automated Clearing House) form is a document used by individuals or businesses to authorize automated transactions, providing consent for debits or credits from their bank accounts for recurring payments, such as loan EMIs or utility bills.

NACH (National Automated Clearing House) charges refer to the fees levied by banks or financial institutions for processing automated transactions through the NACH system.

If any NACH transaction gets bounced due to insufficient balance/KYC issues or above transaction limit, the bank may charge a penalty which will be incurred by the client.

After you complete the mandate registration process, you will receive a successful mandate registration intimation via email/SMS from your bank.

Note: NACH Activation generally takes 25-30 days from the date of submission of the form.

Step 1. Login to your PayEX application

Step 2. Go to Mandate Managment

Step 3. Select Mandate Cancellation

OR

Drop us an email at our support ID.

ERP

ERP

Who We Serve

Products

Resources