Behind every thriving business lies a network of suppliers—each extending trust in the form of credit. In the B2B world, this trust is formalized through payment terms, yet the moment an invoice lands, the clock starts ticking. Delays, discrepancies, and manual inefficiencies in processing can quickly unravel supplier relationships and disrupt cash flow. That’s why modern, intelligent Accounts Payable (AP) management isn’t just a finance function—it’s a strategic imperative in 2025.

Account Payables teams often complain about the tedious nature of Accounts Payable management, and finance leaders are dissatisfied with the lack of visibility in the Accounts Payable functions. Smart AP management comes into play to fill these gaps, making the lives of AP teams and CFOs easier now.

In this blog, we will dive deep into smart AP management, discover the common challenges AP teams face, and explore how automation can solve them and elevate your AP department.

Accounts Payable Management: What It Is and Why It Matters

Accounts payable refer to the outstanding payments a company owes to its suppliers or vendors. Accounts payable management is the entire process of handling these financial obligations.

AP management includes the following steps:

- Recording invoices

- Verifying payment terms

- Approving invoices

- Processing payments

- Maintaining financial records

For CFOs, the main goal of efficient AP management is not about completing payments sooner but optimizing the payment cycle to maximize working capital.

Why It Matters?

Suppose your business doesn’t have proper AP management in place. There is a high chance your business faces missed or delayed payments—not due to lack of funds, but due to manual errors, lost invoices, or approval bottlenecks, leading to strained supplier relationships.

For example, if you are a manufacturing firm receiving hundreds of invoices monthly and if even a few go unrecorded or unapproved in time, it could delay raw material procurement, halt production, and damage supplier trust.

On the flip side, with smart AP management, you can experience increased supplier confidence and enhanced cash flow.

Common Challenges AP Departments Face in Managing Accounts Payable

The basic AP process goes like this: The AP analyst receives the invoice. They manually enter the data into the ERP or accounting system and check the invoice against the purchase order. The analyst then routes the invoice for approval. Once approved, they schedule payment against the invoice. The process may seem simple on the surface level, but there are multiple challenges associated with it:

1. Risk of Errors During Manual Invoice Processing

Even in 2025, about 68% of accounts payable teams manually enter invoice data into their ERP and accounting systems. It increases the chances of manual mistakes—like incorrect invoice details or even duplicate payments. In some instances, invoices are misrouted to the wrong approvers.

2. Poor Visibility into Invoice Status

Accounts payable analysts spend a lot of their time manually tracking invoices and payment status. There is minimal visibility within accounts payable data; thus, generating accurate cash flow projections becomes an actual challenge. It impacts the CFO’s decision-making because they cannot plan appropriately for future expenses and investments.

3. Complex Supplier Management

There is a constant need to maintain and update supplier details to facilitate faster payment processing. Addressing supplier queries and resolving issues consumes a lot of time when dealing with large volumes of transactions. Onboarding new suppliers and updating existing suppliers’ details remains a real challenge for the AP teams.

4. Risk of Fraud and Compliance Issues

Fraud and compliance breaches can have serious financial and reputational consequences to businesses. A common example is when a fraudster sends a fake invoice that closely mimics a real supplier’s format. If AP teams don’t verify details carefully, the company could unknowingly make payments to fraudulent accounts. Cyber risks, such as phishing, can also lead to the theft of sensitive financial information and cause fraudulent transactions.

Weak internal controls and a lack of audit trails often make such frauds easier to execute and harder to detect. On the compliance side, failure to track vendor data accurately can lead to breaches in tax reporting or data privacy regulations. To mitigate these risks, companies need robust approval workflows, automated fraud detection, and compliance monitoring systems.

5. Global Payment Complexities

In 2025, more companies are expanding to international markets. Cross-border payments come with a set of complexities – varying regulations, payment methods, and currencies. Volatile currency exchange rates can majorly impact payment amounts, making it hard to predict expenses. Compliance with foreign country tax laws is vital to prevent legal issues and penalties. These greatly add to operational overhead for Accounts Payable teams, requiring strong compliant systems and expert knowledge to avoid risks.

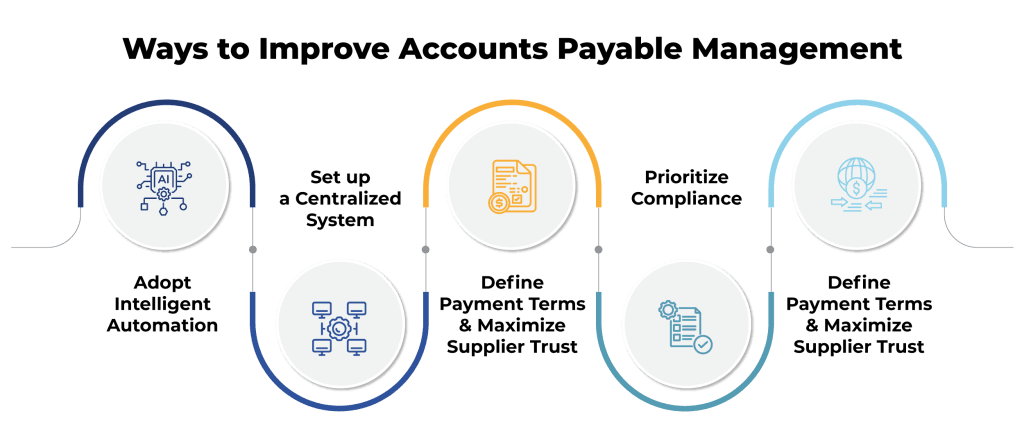

Ways to Improve Accounts Payable Management

88% of finance leaders believe that improving invoice management and supplier payments would free up their AP teams to focus on high-value activities. In this section, we have covered the top 5 ways that can transform your AP department:

1. Adopt Intelligent Automation

Leverage intelligent automation to enhance your AP processes end-to-end. Configure and automate workflows from invoice capture to processing, approvals and payments using AI and ML offered by automation tools.

It utilizes an advanced AI model to automate the capture and interpretation of invoice data. Unlike OCR, which scans and extracts text, AI enhances the entire process by reading data from various invoice formats and understanding the context and structure of the information. Set up approval workflows that direct invoices for approval automatically based on specified rules and levels, bypassing need for manual efforts.

2. Set up a Centralized System

Implement a cloud-based centralized platform that offers a single source of truth for all Accounts Payable data and processes. Integrate with your existing ERP and accounting systems to eliminate data silos. It will give all stakeholders, like the CFO, the AP team, approvers, and suppliers, secure and on-the-go access to the platform for faster and accurate decision making.

3. Define Payment Terms & Maximize Supplier Trust

Establish clear and consistent payment terms and communicate them effectively to the suppliers. Your Accounts Payable staff must be one step ahead of supplier queries and promptly resolve discrepancies to maintain those relationships. And don’t forget to take advantage of early payment discount programs—they can benefit your suppliers and your business.

4. Prioritize Compliance

Put in place stringent internal controls to prevent fraud. Be in compliance with relevant rules, such as data privacy regulations, tax legislation, and industry standards. Regularly review and audit the AP process to identify and eliminate probable compliance issues. Keep detailed records of all transactions.

5. Streamline Global Payments

Install a multi-currency-compliant platform that caters to cross-border regulatory considerations. Utilize currency hedging instruments capable of absorbing exchange rate fluctuations and meeting all payment regulatory needs abroad.

Top Benefits of Strong Accounts Payable Management Practices

When CFOs invest in strong AP management practices, the benefits extend beyond financial gains.

| Benefits | Description |

| Enhanced cash flow management | Enables companies to exercise tighter control over outgoing cash – timing payments strategically to make the most of early pay terms and avoiding late payment fees. It helps them maintain better cash flow planning to navigate market fluctuations and ensure effective growth. |

| Improved Supplier Relations | Clear communication and on-time payments build stronger supplier relationships. This leads to better payment terms and favorable payment terms. |

| Greater Operational Efficiency | Shortens invoice processing cycles and allows AP teams to concentrate on strategic initiatives. Centralized solutions facilitate easy interdepartmental communication and collaboration. |

| Compliance that runs in the background | Automated compliance checks and structured approvals in your AP process quietly keeps you aligned with tax rules and policy standards—no last-minute document hunts or audit-day chaos. |

| Scalable AP management | As your business grows, so does the paperwork. A smart AP system keeps up—managing higher invoice volumes without missing a beat or compromising on precision |

How Automation Solves Accounts Payable Management Challenges

AP automation can reduce the cost of processing a single invoice by more than 80%. In addition to significant cost savings, automation also solves key challenges in AP management:

- Eliminates Errors

Automation provides 100% accuracy in invoice processing by incorporating data validation procedures. It verifies discrepancies between invoices, purchase orders, and goods receipts in real-time. Intelligent systems even have the ability to mark duplicate invoices or suspicious transactions for further investigation.

- Boosts Productivity

By leveraging AP automation, CFOs can save up to 70% of the time of AP teams. It automates mundane activities like invoice processing, payment reconciliation, and invoice data entry and empowers AP departments to focus on high-value activities that require human touch, such as vendor relationship management.

- Shortens Approval Cycles

Automating the approval cycles of invoices ensures the approval processes are completed in minutes. It eliminates delays and facilitates timely payments. Shortening payment cycles enables companies to have improved cash flows and capitalize on early payment discounts.

- Lowers fraud risks

Fraud detection features of AP automation software utilize AI to identify suspicious payment trends or unauthorized vendor record changes. It offers a secure environment by requiring multi-step authentication for large payments and maintaining detailed records of all transactions.

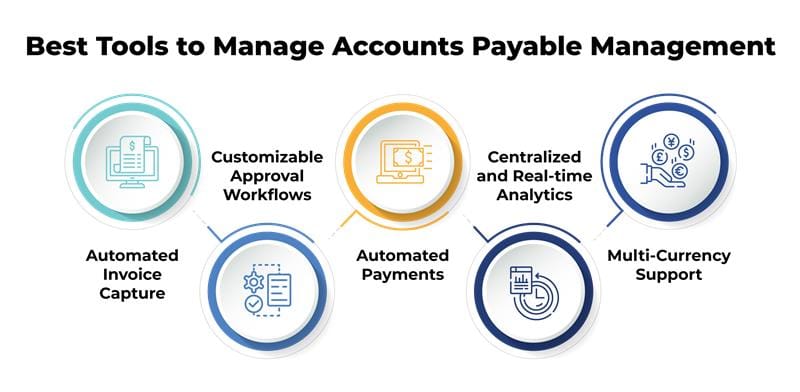

Best Tools to Manage Accounts Payable Effectively

Selecting the right AP tools that suit your business needs is definitely difficult with so many tools out there. It’s easy to get lost in the noise. But for CFOs looking to truly modernize their payables with Accounts Payable automation, a few capabilities are non-negotiable:

1. Automated Invoice Capture

Automated Invoice Capture employs OCR to extract information from invoices in any format. It eliminates the need for manual data entry, greatly accelerating invoice processing and reducing errors. The key information is populated automatically into your AP system.

2. Customizable Approval Workflows

Automated invoice approval workflows are essential to providing financial control. The ability to customize the approval routes depending on invoice amounts, departments, or other factors guarantees that the right staff members validate and approve each invoice. This automation entails timely reminders to approvers, ensuring invoices are reviewed before their due dates.

3. Automated Payments

Automated payments track the due dates of invoices and enable payment scheduling, ensuring that vendors are paid on time. It simplifies the payment process by allowing you to predefine payment dates according to invoice terms, discounts, or your cash flow plan. Automated payout facilities eliminate late payment penalties, and you can benefit from early payment discounts.

4. Centralized and Real-time Analytics

Real-time AP analytics delivers actionable insights into your AP health on a centralized platform. It provides detailed dashboards for tracking performance indicators such as DPO and lets you view payment statuses and spot process bottlenecks. With predictive analytics, it also creates accurate cash flow forecasts.

5. Multi-Currency Support

Multi-currency support automates currency conversions based on real-time exchange rates and provides support for international payment compliance. It is vital for creating strong relationships with international suppliers and managing global financial operations efficiently.

How Global PayEX Enhances AP Management Efficiency

Global PayEX offers a comprehensive AI-powered AP automation solution, PayEX AP, designed to streamline every aspect of the accounts payable process. It provides:

1. Automated PO delivery to Eradicate Errors and Speed Up Order Processing

- Automatically delivers the Purchase Order to the right vendors

- Accepts multi-format documents such as PO, non-PO, and service-based invoices

- Auto-validates invoices against POs

2. Vendor Portal to Simplify Invoice Tracking and Improve Communication

- Enables your vendors to upload invoices and digitally signed documents in a self-service vendor portal

- Provides seamless query resolution with audit trails & ticketing support

- Provides access to real-time payment status tracking & remittance advice downloads

3. Automated Invoice Approvals to Shorten Approval Cycles and Prevent Payment Delays

- Multi-level & multi-department custom approval workflows

- End-to-end audit trails for better control

- Upfront invoice verification to reduce manual checks

4. Automated Pay-Outs to Ensure Timely Payments and Improve Cash Flow Management

- Auto-process payments as per due dates

- Real-time visibility into DPO (Days Payable Outstanding)

- Offers vendor financing through multiple banks & NBFCs

5. Statement Reconciliation to Identify Discrepancies and Improve Financial Analysis

- Enables vendors to upload statements & access reconciliation reports

- Auto-matches vendor & corporate statements

- Takes prompt action to resolve discrepancies

FAQs – Accounts Payable Management

1) What is smart accounts payable management?

Smart Accounts Payable Management is a strategic and technology-driven approach to handling a company’s accounts payables. It encompasses automating the entire AP process with the help of sophisticated technologies like AI and ML.

2) What is the goal of smart AP management?

The goal is to make payment processing effective, optimize cash flow, and maintain good supplier relationships.

3) What are the most important Account Payables metrics I should regularly monitor?

You should track DPO, invoice processing time, and error rates. Periodic checking provides valuable information about the performance of your system so that you can identify the bottlenecks.

4) Is Account Payables automation secure enough to handle sensitive financial data?

Secure AP automation software such as PayEX AP by Global PayEX uses strong security measures to safeguard sensitive financial information, such as encryption, access controls, and regular security audits. It complies with industry standards and regulations to prevent the risk of cyber-attacks and data privacy.

5) How does AP automation help to improve financial visibility and control within the company?

AP automation consolidates all invoice and payment data in one location, providing real-time visibility into AP health. Dashboards and reports provide 360-degree visibility into key performance indicators, enabling better cash flow forecasting and decision-making.