How would you feel if your business lost a $15,000 early payment discount just because a paper invoice sat unnoticed in someone’s inbox for three weeks? Or your AP team mistakenly paid the same $25,000 invoice twice.

These aren’t fictional horror stories; they are typical consequences of relying on manual invoice-to-payment systems.

The invoice-to-payment process cycle appears easy to do — review, approve, and pay. However, without automation, it can quickly become a nightmare as it involves numerous checkpoints, validations, and potential risks. In high-growth organizations, even a single error can cascade into delays and strained vendor trust.

In this blog, we’ll break down every step of the invoice-to-payment cycle, contrast manual versus automated workflows, and explore how automation can completely transform your financial operations.

What is Invoice-to-Payment?

The invoice-to-payment (I2P) process encompasses every task done by the AP team, from the moment an invoice is received from a supplier to the point where the payment is successfully executed. It involves receiving, verifying, approving, paying, and reconciling invoices.

The I2P process ensures that suppliers receive timely payments while providing businesses with clear visibility into their spending. A well-structured I2P process helps to maintain strong supplier relationships and ensures accurate financial recordkeeping.

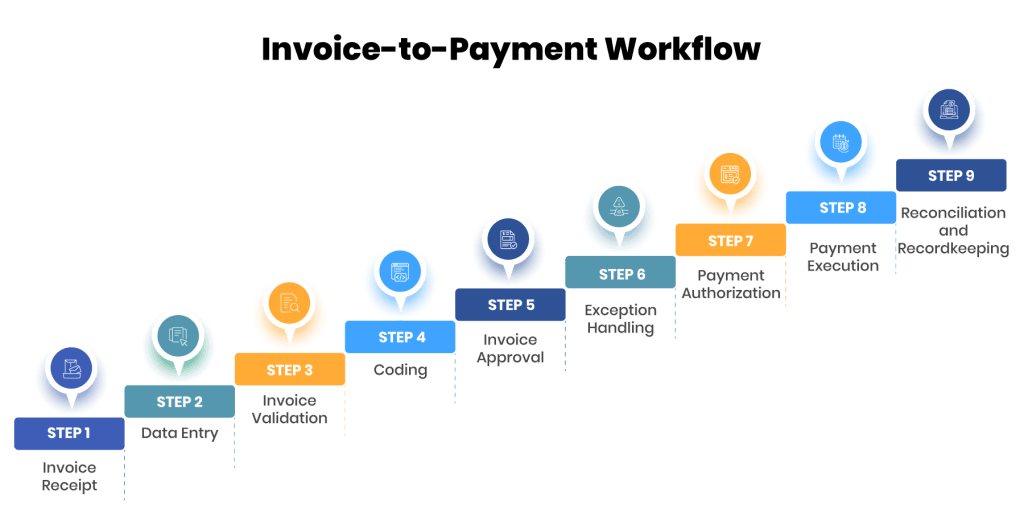

How Does the Invoice-to-Pay Process Work?

While the invoice-to-payment process may seem straightforward, it requires complex coordination across multiple teams and systems. The main steps involved in the I2P cycle are:

Step 1: Invoice Receipt

Receive invoices from suppliers through email, postal mail, portals, or EDI.

Step 2: Data Entry

Input invoice data into the accounting system or ERP, including scanning physical invoices.

Step 3: Invoice Validation

Perform three-way matching to verify invoices against purchase orders and delivery receipts.

Step 4: Coding

Assign General Ledger codes to ensure proper expense categorization.

Step 5: Invoice Approval

Route invoices to relevant stakeholders for approval before processing payments.

Step 6: Exception Handling

Identify and resolve discrepancies such as PO mismatches or missing signatures.

Step 7: Payment Authorization

Authorize payments based on terms, selecting the payment method and schedule.

Step 8: Payment Execution

Make payments on the due date, either internally or through third-party payment service providers.

Step 9: Reconciliation and Recordkeeping

Reconcile payments and file invoices for future reference and audit purposes.

How Are Invoices Received, Read, and Recorded?

The process of handling an invoice typically involves three distinct stages: receiving, reading, and recording—each with its own challenges.

| Steps | Process |

| Receiving | Invoices can be received in various formats, including scanned paper copies, PDFs, EDI feeds, or directly uploaded through supplier portals. The method of receipt depends on both the supplier’s setup and the organization’s digital maturity. |

| Reading | Traditionally, this meant that someone would manually review each invoice to interpret the details. Today, businesses frequently utilize AI-powered OCR models to automatically read and interpret invoices. These tools can also efficiently analyze semi-structured data. |

| Recording | The extracted information must be entered into the ERP to undergo further processing. In a manual process, the task is left for AP staff members to manually enter every field. With automation, data can be pushed directly into ERP systems, initiating further workflows like PO matching. |

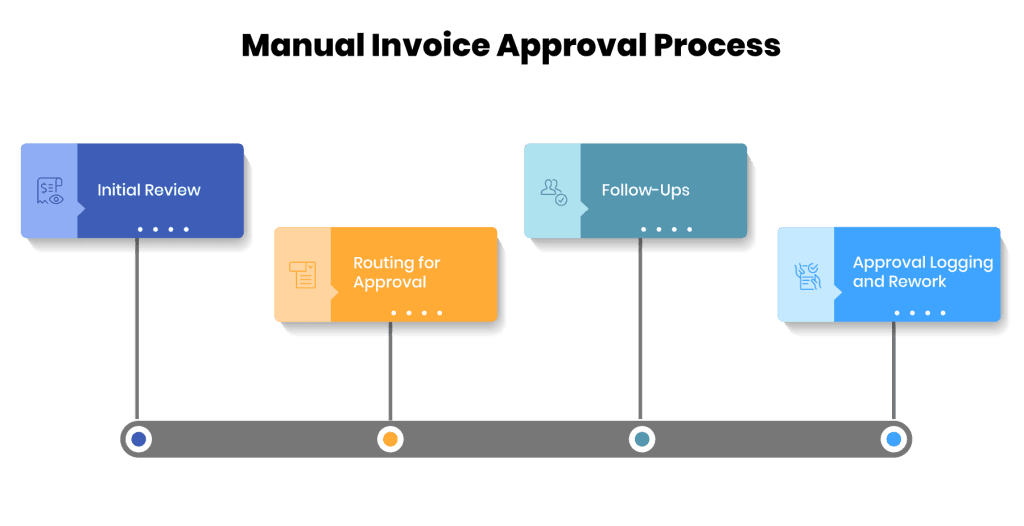

Typical Manual Invoice Approval Process

The manual invoice approval process is time-consuming, paper-heavy, and requires substantial follow-up with approvers. Here’s how it typically unfolds:

- Initial Review

The invoice is manually reviewed for basic completeness and accuracy. It includes checking vendor details, invoice numbers, and amounts. However, many critical errors go unnoticed due to limited visibility into matching documents.

- Routing for Approval

The invoice is routed to the relevant approver via email or printed form. If multiple approvals are required, it often results in delays and confusion. Paper trails are difficult to track, and there is no way to monitor the status in real time.

- Follow-Ups

AP staff must constantly chase approvers via email, phone calls, or physical visits for approval. Sometimes, invoices are approved weeks after the due date, resulting in late fees and strained vendor relationships.

- Approval Logging and Rework

Once approved, the AP team manually logs the approval into a spreadsheet or ERP. If disputes arise, the invoice may need to be reprocessed through the workflow, requiring additional clarification and creating rework loops.

Automated Invoice Approval Process

Around 29% of businesses require six or more approvals for processing an invoice, resulting in approval times that extend to three weeks or more. To overcome the inefficiencies of manual invoice approval, finance leaders are adopting automation.

- Automated Three-Way Matching

The system automatically compares invoice details with PO and goods receipt notes. If all three documents match in terms of quantity, price, and product description, the invoice is automatically approved for payment. If discrepancies arise, the system flags the issue and escalates it for human review.

- Rules-Based Approval Routing

Invoices are automatically routed to the correct approvers based on predefined rules, such as threshold amounts. Approvers are notified instantly, and they can approve invoices via email, app, or portal with a click, even while traveling.

- Automated Follow-Ups

Automated reminders are sent to approvers at the right time, allowing AP teams to shift their focus from chasing approvals to more strategic tasks. Live dashboards provide complete visibility into the status of each invoice.

- Automatic Approval Logging

Once an invoice is approved, the system automatically records the approval in the ERP or accounting software, eliminating the need for manual data entry. If discrepancies or disputes arise, the system routes the invoice to the appropriate stakeholder for resolution.

- Self-Service Supplier Portal

A supplier portal adds another layer of transparency to the approval process. Suppliers can:

- Upload invoices directly

- Track the real-time status of approvals

- View matched POs and receipts

- Receive alerts if an invoice is held up due to exceptions

In some advanced systems, such as PayEX AP, suppliers can even respond to validation errors or submit clarifications directly through the portal, thereby speeding up dispute resolution and invoice approvals.

Manual Payment Approval Process

Once an invoice is approved, it enters the payment approval phase. This step involves more than just releasing funds; it requires careful consideration of timing and payment methods. Here’s how the process works:

- Payment Batching

Invoices are manually grouped for payment based on vendor terms or cash flow priorities. This process requires constant spreadsheet management and carries the risk of duplicate payments.

- Authorization Request

Approval requests are sent via email or physical forms to authorized signatories. This method lacks security and can cause delays during the approvers’ absence.

- Verification and Sign-Off

Approvers often have limited context and are unable to view invoice history or supporting documents instantly. It slows approvals and leads to errors due to second-guessing.

- Payment Execution

After approval, payment details are manually entered into the banking system. This process is slow, prone to errors, and requires separate tracking to confirm payment completion.

Automated Payment Approval Process

By automating the payment approval process, organizations can enhance efficiency and ensure timely and accurate payments. Here’s how automation transforms payment approvals:

- Intelligent Batching

The system automatically groups payments by due date, priority, or vendor discount terms. It reduces missed opportunities and eliminates the risk of human errors.

- Transparent Authorization Requests

Payment approval chains are built into the platform based on amount thresholds or vendor type. Approval requests are sent automatically via mobile apps or email. It prevents delays by notifying approvers instantly, even when they are remote or unavailable, while keeping a clear record of all actions.

- Instant Verification

Approvers can instantly access all relevant documents, invoice details, purchase orders, and payment history via centralized dashboards. This comprehensive visibility allows faster, well-informed approval decisions.

Once payment requests are approved, AP teams can schedule the payments based on cash availability.

- Automated Payouts

The system pushes payments directly through secure integrations with banks or payment gateways. It eliminates the need to:

- Manually log in to banking portals

- Upload payment files

- Perform redundant checks before final execution

The system also generates automatic confirmations, simplifying reconciliation and recordkeeping.

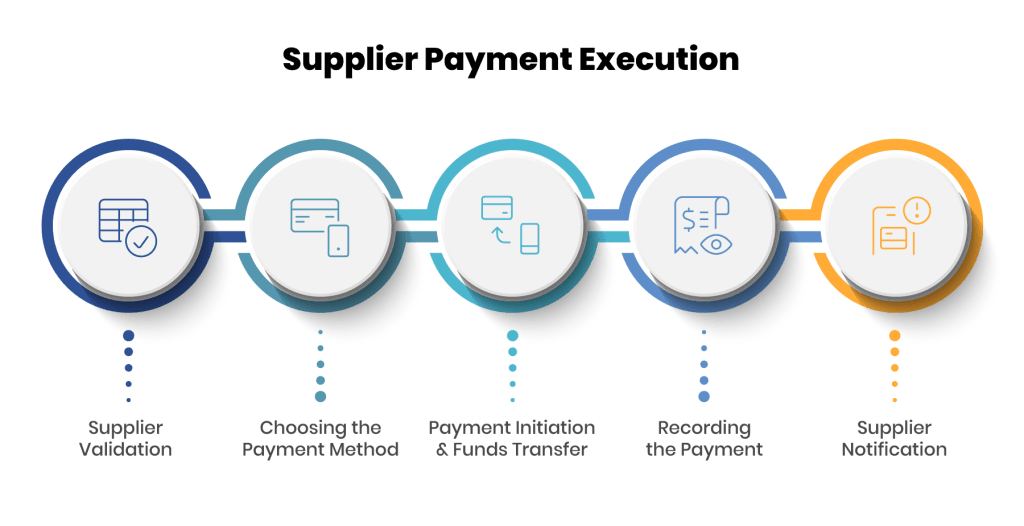

How is Supplier Payment Executed?

Once an invoice is approved for payment, the final step in the invoice-to-payment cycle is executing the supplier payment. Let’s take a closer look at how payment execution occurs:

- Supplier Validation

Before releasing payment, key supplier details are verified, such as bank account information, tax IDs, and blacklist screenings. These checks are done during onboarding and revalidated at the time of payment to ensure compliance and prevent fraud.

- Choosing the Payment Method

Once the final verification is done, the appropriate payment method is selected. It can include options like EFT, checks, ACH, or UPI. The choice depends on supplier preferences. In automated workflows, international supplier payments are handled with considerations for foreign exchange rates and cross-border payment restrictions.

- Payment Initiation & Funds Transfer

Payments are initiated based on the scheduled dates. For electronic transfers, funds are transferred to the supplier’s bank account via integrated banking channels. In the case of check payments, physical checks are generated and sent to the supplier’s address.

- Recording the Payment

Once the transfer is complete, the transaction is recorded in the ERP. Simultaneously, payment confirmations with reference numbers and timestamps are generated and stored.

- Supplier Notification

Suppliers are notified of the payment confirmation in real-time via email or supplier portals. This proactive communication strengthens supplier trust.

Transforming the Invoice-to-Payment Process with Automation

The invoice-to-payment cycle is no longer confined to spreadsheets, fragmented approvals, and endless follow-ups. AI-driven solutions have transformed this process by replacing error-prone manual processes with frictionless automation.

Every stage of the invoice-to-payment cycle—from invoice capture to final payment—is automated for efficiency without compromising compliance. Invoices are received via email or supplier portals, where AI-driven OCR models accurately extract critical data. This data seamlessly flows into validation engines that perform n-way matching, identify discrepancies, and route invoices through intelligent, rule-based approval workflows. Approvers can review and act instantly, anytime and anywhere, significantly reducing approval times. Whether payments are domestic or cross-border, the solutions securely trigger transactions, with each step timestamped and fully compliant with internal controls and regulations.

Automating the invoice-to-payment process provides a strategic advantage for businesses of all sizes, enabling faster payments, tighter controls, and smarter decision-making. Talk to our experts to explore how PayEX AP can transform your invoice-to-payment function.