Introduction

Enterprise Resource Planning (ERP) solutions have evolved into indispensable tools for finance leaders, catering to the needs of businesses of all sizes. Organizations seeking to optimize their operations and boost overall efficiency have increasingly adopted ERP to automate and manage their business processes, such as financial management, human resources, inventory tracking, etc.

However, implementing an ERP solution is not enough from a finance automation perspective; B2B organizations must take a strategic approach to derive maximum value from these powerful platforms.

Why do we say this, you ask?

Well, even post-ERP implementation, your organization may still encounter various finance process challenges and delays. Keep an eye out for the following indicators to discern between a standard ERP adoption and effective ERP utilization.

9 signs you aren’t using your ERP to its maximum potential

- Finance teams spend over 50% of their time in manually matching payments and data entry

- No automatic workflow is present that captures data (amounts and date) from invoices

- Frustrating challenges in accessing essential metrics and reports for decision-making

- Finance teams still send invoices manually for validation and approval

- Manually managing different types of deductions

- High rate of errors in invoicing consisting of duplicate and missed invoices

- Customers do not have proper visibility over invoice status

- Disconnect between inter-departmental teams due to absence of shared real-time data

- High payment processing costs

Remember, the more checks in this list mean more reasons for concern!

It is no secret that ERP systems aren’t fully automated and often require manual or programmatic intervention for multiple tasks. Despite investing in ERP software, finance leaders often feel there’s scope for more automation to improve business workflows.

When a business grows and data volume increases, ERPs often fail to handle the functional complexities and cannot scale with the business demands. But thanks to technological advancements, all the above tasks can now be automated to:

- Reduce DSO

- Improve productivity

- Enhance decision-making.

This can be achieved through ERP automation.

What is ERP Automation?

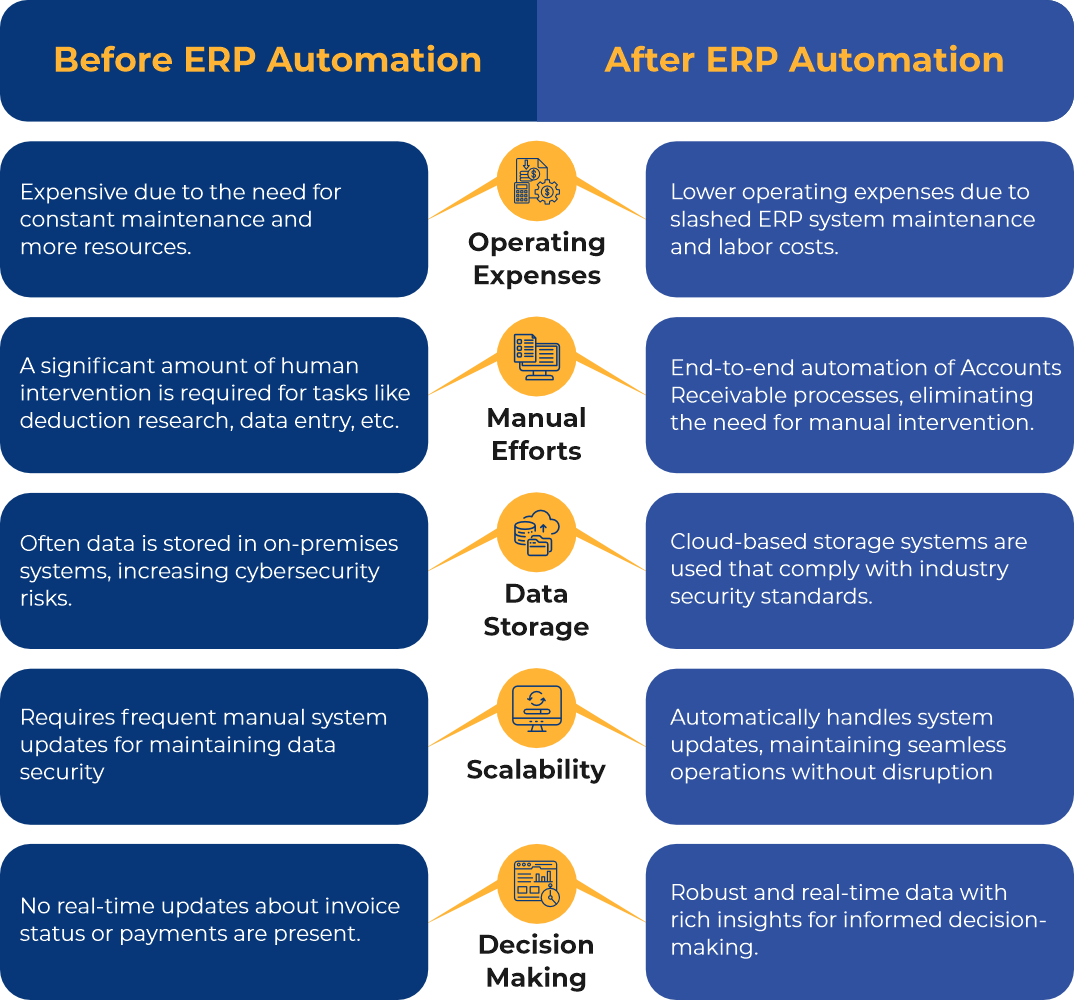

ERP Automation integrates advanced technologies such as Artificial Intelligence, IoT, RPA, and Machine Learning into existing ERP systems to automate finance workflows. ERP automation’s main purpose is to reduce human intervention in processes that still require substantial manual efforts and provides real-time data for improved decision-making.

Benefits of implementing ERP automation:

- Get more done with less workforce

ERP Automation streamlines repetitive and tedious tasks from finance processes to save the team’s time for high-value business activities that require human intelligence. In traditional ERP, even simple tasks such as creating reports require technical knowledge. With ERP Automation, the finance teams can do everything independently due to the easy-to-use nature of the platform.

- Get every detail at your fingertips in real-time

With ERP automation, finance leaders can stay updated with robust and timely data and gain a 360-degree view into finance operations to facilitate better resource planning and performance monitoring. This accurate data helps identify bottlenecks in the processes and fosters data-driven decision-making.

- Enhance operational efficiency with customizations that matter to you

ERP automation improves operational efficiency by implementing a more tailored solution that aligns precisely with the business needs. Customizing native ERP systems to add desirable features is complex. 33% of companies find it ‘very difficult’ or ‘difficult’ to make changes to their existing ERP system. ERP automation enables businesses to add features and configurations based on specific requirements.

Next, let’s explore a 3-step process that finance leaders can follow to get started with ERP automation.

Step 1: Evaluate your Business Processes to Identify Gaps that are Hurting your Working Capital Management

The core focus of an ERP implementation is to streamline business processes and serve as the system of record. Your first step is to evaluate your finance management processes to figure out the tasks your team is still doing manually, the number of resources allotted for each task, and the functions that clearly appear delayed and error prone and have the scope of further automation.

Once you have identified the areas your ERP cannot automate, half of your work is done. Using these insights, you can improve those areas by adopting additional solutions that can supplement/complement your ERP.

Step 2: Research and Select the Right ERP Automation Software

Once you’ve identified the gaps in your business processes that need ERP automation, the next step is to research and select an ERP automation software that aligns with your specific business requirements. Additionally, look for a solution that offers scalability and ease of integration with your existing ERP system.

Seamless integration is a critical factor for maximizing the benefits of your ERP solution. Most AR solutions that enhance your ERP capabilities come with easy integrations including APIs that facilitate efficient communication and data exchange between the systems. Carefully shortlist the one that suits your requirements.

Step 3: Unlock Maximum Value from your ERP with Accounts Receivable Automation Software

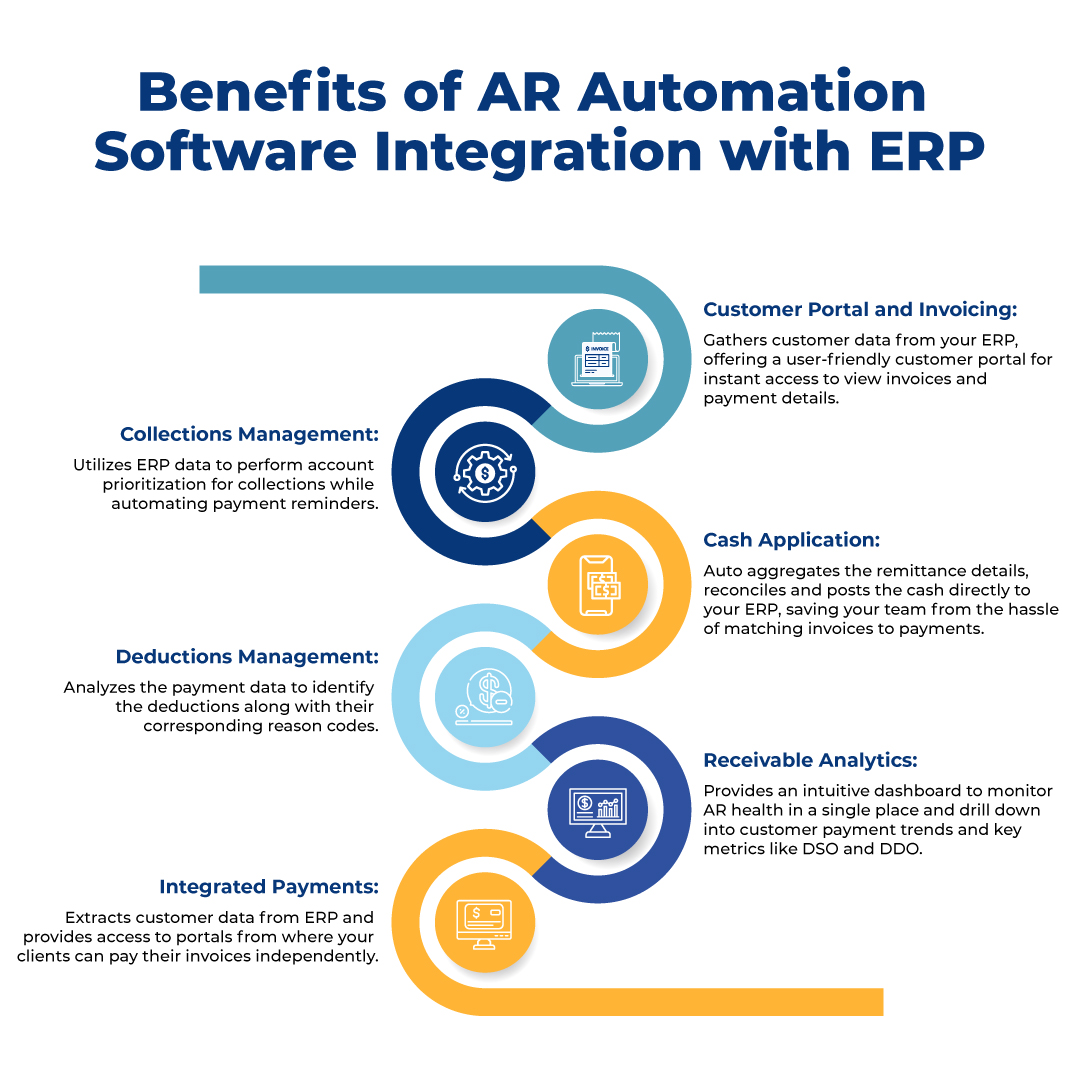

After successfully integrating your ERP with an AR automation software, you can speed up all those time-consuming tasks of invoicing, cash reconciliation, deductions management, and recovery of the receivables which are often lacking with ERP’s built-in AR capabilities alone. It also helps in decision-making on matters such as delinquent account prioritization and setting customers’ credit limits.

Businesses prefer AR automation tools that perfectly integrate with their ERP system and have a faster deployment cycle. Let’s look at how this integration can optimize your Accounts Receivable management:

In a Nutshell

Implementing AR automation with your existing ERP means you are future-proofing your finance processes for any scale of operations. By embracing ERP automation with a comprehensive strategy that goes beyond the conventional understanding of ERP implementation, businesses can truly maximize the value of their ERP solution.

At Global PayEX, we provide AI-powered AR automation solutions that seamlessly integrate with your existing ERP to take your business’s financial management to the next level. Our solutions are ERP agnostic and easily integrate with all major ERPs, including Acumatica, NetSuite, SAP, MS Dynamics, and other ERPs, to meet the needs of growing businesses, making them flexible and adaptable solutions.

Read the full story of how Global PayEX’s EIPP solution, FreePay directly integrated with Bridgestone’s ERP, SAP, to ensure 98%+ straight through reconciliation. Talk to our experts to learn more.