Imagine running your business without any financial roadmap. Every expense catches you off guard, and managing cash flow feels like an endless struggle.

This is the challenge most businesses face without proper accounts payable forecasting.

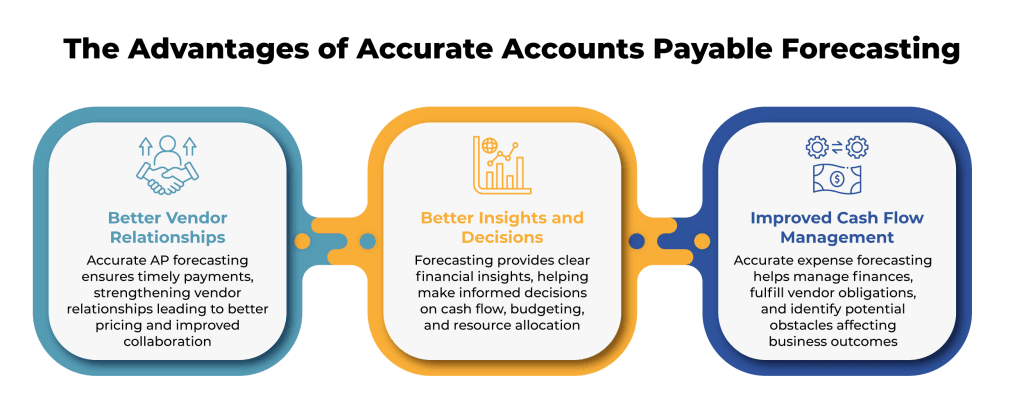

Knowing how to forecast accounts payable is essential for any business looking to stay financially stable. Maintaining your company’s finances and avoiding bankruptcy depends on accurate financial forecasts and planning. However, many businesses lack the resources and time to do this regularly.

As a result, they might run out of funds quickly or incur massive debt. Those who forecast their accounts payable and plan their expenses ahead of time see an increase in revenue and better manage their cash flow. A solid financial plan helps businesses consistently stay afloat.

In this blog, we’ll cover the basics of accounts payable (AP) forecasting, outline key steps and best practices, and discuss how advanced tools can make the process more accurate and efficient.

What does accounts payable forecasting involve?

The strategic practice of projecting future accounts payable expenses within a given timeframe—typically a fiscal year—is known as accounts payable forecasting. Keeping track of short-term commitments, or bills and expenses that must be paid off within a year, is essential to a business’s management. Organizations can maximize their cash flow by precisely projecting these expenses and ensuring ample funds for both strategic expenditures and operational demands.

The initial phase of AP forecasting entails projecting future expenses by examining past data and existing payments patterns. This strategy allows companies to plan for upcoming payments, coordinate their budgeting efforts, and maintain a strong foundation. Accurate forecasting is a vital part of strategic decision-making. It enables companies to manage financial instability and maintain a competitive advantage in the marketplace.

How to calculate expected accounts payable?

Forecasting future accounts payable for your business is critical for preserving liquidity and maintaining strong fiscal health. There are several methods to calculate it:

You can manually track your spendings. For example, if your business tends to purchase more inventory before the holiday season, you can expect your accounts payable balance to increase in the months leading up to it.

Historical data also plays a key role in forecasting accounts payable. Barring one-time expenses, past data from previous years can provide a reliable foundation for building accurate forecasts.

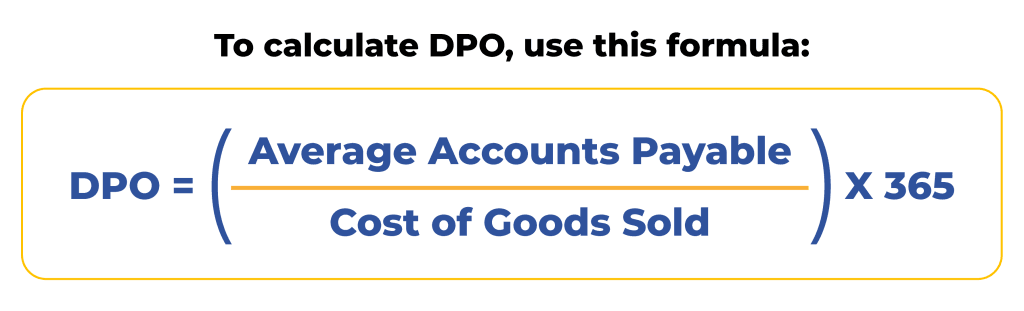

However, the most effective method to estimate expected accounts payable is by calculating Days Payable Outstanding (DPO).

What is Days Payable Outstanding (DPO)?

Days Payable Outstanding (DPO) is a financial indicator that measures the average number of days a business takes to pay its bills and invoices to suppliers. It is an essential metric in AP management as it provides insight into how a company manages its cash flow and vendor relationships.

A higher DPO can indicate that a company is taking longer to pay its suppliers, which might be a strategy to maximize cash on hand for a longer period. However, it’s crucial to balance this with maintaining good relationships with suppliers, as excessively delaying payments could strain these relationships and potentially lead to less favorable terms in the future.

On the other hand, a lower DPO suggests that a company is paying its bills more quickly. This can be beneficial in strengthening supplier relationships and possibly securing discounts for early payments.

Understanding and managing DPO is a key component of overall working capital management, as it directly impacts a company’s liquidity and financial health.

DPO Calculation and Formula

Breakdown of the formula

Step 1: Determine the average accounts payable (beginning + ending AP) / 2.

Step 2: Determine the total number of purchases made over the given period.

Step 3: Utilize the DPO formula, which is as follows:

For instance:

Imagine a B2B scenario where Company ABC Ltd. has $70,000 in accounts payable and $700,000 in the cost of goods sold for the current quarter, which spans 90 days.

To determine the Days Payable Outstanding (DPO), follow these steps:

Step 1: Divide the accounts payable by the cost of goods sold.

Step 2: Multiply the result by the number of days in the quarter.

Using the figures:

DPO = ($70,000 / $700,000) x 90

DPO = 0.1 x 90

DPO = 9

Therefore, Company ABC Ltd. takes an average of 9 days to settle its accounts payable.

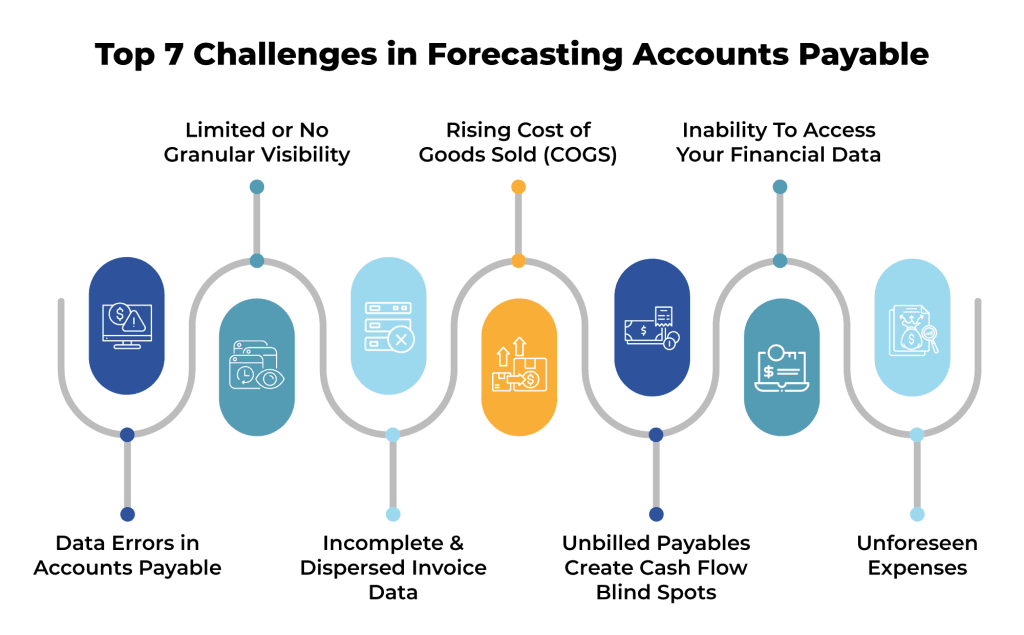

Why can forecasting accounts payable be challenging?

Anticipating accounts payable isn’t always simple. Financial teams and business owners deal with several significant obstacles, such as:

- Data Errors in Accounts Payable

Small mistakes in your income statement or other documents can cause inaccurate projections. Inaccuracies in invoice processing, could lead to multiple payments or payments of the incorrect sum in accounts payable forecasts, which could increase expenses through late fees.

- Limited or No Granular Visibility

The main cause of the potential for negative variance is spreadsheets’ inability to provide minute and detailed information about cash inflows and outflows. This lack of detailed and real-time visibility makes it difficult to identify payment trends and forecast accurately.

- Incomplete & Dispersed Invoice Data

Scattered AP data across multiple systems makes manual consolidation slow and error-prone. Moreover, missing data on the quantity of products or the terms of payment for the vendor can lead to payments made incorrectly, inaccurate financial projections and uncertain cash flow expectations.

- Rising Cost of Goods Sold (COGS)

Fluctuating labor, manufacturing, and raw material costs—along with seasonal price shifts—can be difficult to track and predict. Unexpected vendor price hikes further disrupt forecasting and make it harder to predict cash flow accurately.

- Unbilled Payables Create Cash Flow Blind Spots

When supplier invoices are delayed or are yet to be received, predicting outgoing payments becomes challenging. These gaps can throw off cash flow calculations, complicate working capital decisions, and create unexpected liquidity pressures.

- Inability To Access Your Financial Data

While you can evaluate historical data with legacy accounts payable systems, these systems do not always guarantee real-time visibility and accurate accounts payable information. Thus, you might not be able to observe your financial performance or adjust as things change directly.

- Unforeseen Expenses

Sudden expenses like emergency operational costs, legal fees, regulatory penalties, or last-minute vendor surcharges can distort AP forecasts. It requires finance teams to maintain higher cash reserves and adjust liquidity strategies.

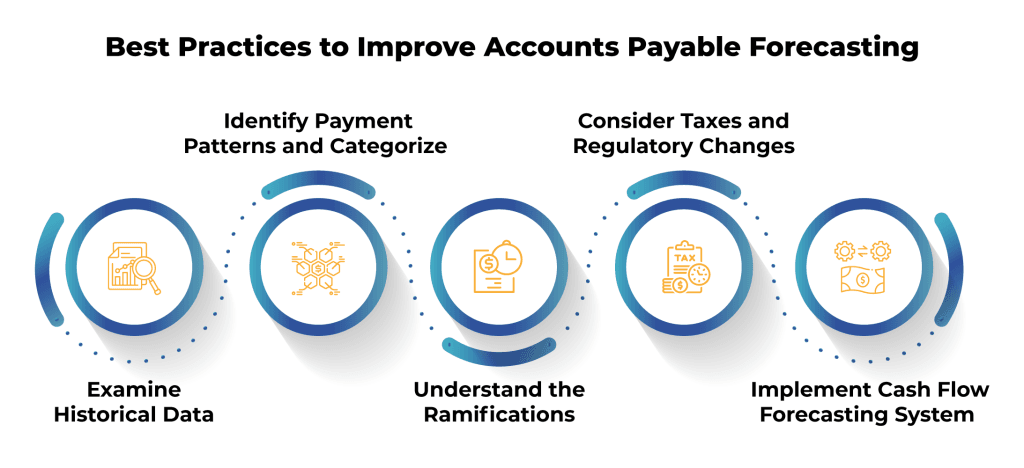

Best practices to improve accounts payable forecasting

Forecasting accounts payable is a tricky and unpredictable process. However, managing your resources and comprehending your cash flow will be much simpler if you adhere to a few key practices to improve forecasting.

- Examine Historical Data

Your historical data should be a treasure trove for forecasting, particularly if you have information on both your projected and actual outcomes for that time frame. Most business expenses follow a pattern. Even if they aren’t due every month, they aren’t rarely random.

Examine past data:

When did unexpected costs occur?

To what extent did you predict them?

Did your process successfully account for these increases, or did the actual expenses surpass your projections?

Understand the reasons behind any major shifts you observe; this often indicates what needs to be adjusted in your forecasting model for the future.

- Identify Payment Patterns and Categorize

Identify recurring expenses and payment patterns. Categorize current expenses to identify trends. For instance, grouping supplier payments that increase at the start of each quarter can help you analyze trends and manage cash flow more effectively.

- Understand the Ramifications

Not all late payment penalties carry the same weight—some impact finances, while others can strain business relationships. Assess the:

– Instances of late payments and associated penalties.

– On-time payments and their corresponding goods/services.

– Repayment patterns for outstanding debts.

By identifying which expenses can be strategically deferred with minimal financial or reputational risk, businesses can optimize cash flow while maintaining strong supplier relationships.

- Consider Taxes and Regulatory Changes

Accurate tax calculations are essential for forecasting accounts payable and ensuring sufficient cash flow to meet tax obligations. Staying updated on changes in tax laws and business regulations will enable your business to update the forecasts and maintain compliance.

- Implement Cash Flow Forecasting System

An automated cash flow forecasting system predicts future cash inflows and outflows by consolidating data from invoices, payment schedules, and contracts to generate real-time forecasts. Finance leaders are adopting these systems to improve accuracy and control over accounts payable and anticipate cash flow needs. It enables scenario planning for factors like supplier price changes and payment delays, ensuring forecasts stay accurate even as conditions shift.

Key advantages of implementing a cash flow forecasting system

A good cash flow forecasting system helps businesses avoid last-minute financial surprises and stay on top of their expenses by planning. AI-powered AP automation solutions, PayEX AP by Global PayEX, has a built-in cash flow forecasting system. Here’s how it can power your business financial operations:

- Powerful AI and ML Models

PayEX AP uses Artificial Intelligence to create custom models that fit your business needs. These models analyze your data to give you accurate forecasts, helping you keep track of what you owe in real-time and manage your Days Payable Outstanding (DPO).

- Accurate Predictions

PayEX AP uses past and present data to make accurate predictions. It combines multiple patterns and runs different scenarios to predict the best possible outcomes, helping you anticipate expenses and handle any cost requirements that might come up.

- Easy Integration for Centralized Processes

PayEX AP smoothly integrates with all your existing systems, like ERP and accounting software. This means you won’t lose any important invoice data, and your forecasts will always be based on the latest information. All of it accessible to you on one single centralized dashboard.

- Smart Scenario Planning

With PayEX AP, you can easily plan for different financial situations. If unexpected expenses come up, you can adjust your forecasts quickly using a simple interface, making risk management easier.

- Detailed Insights

The tool gives you detailed views of your cash flow, breaking down the data by location, currency, customer and more. This helps you make more precise plans and better financial decisions.

Accounts Payable forecasting FAQs

- What is accounts payable forecasting?

Accounts payable forecasting means predicting future bills and expenses your business needs to pay. This helps you manage cash flow better by knowing when and how much money you’ll need to cover your obligations.

- How to forecast accounts payable payments?

To forecast accounts payable payments, start by collecting past expense data. Look for patterns in spending and consider factors like market conditions. Regularly update your forecasts to keep them accurate. Using automation tools can help simplify the process and reduce mistakes, ensuring you have funds ready for future expenses.

- What formula is commonly used to forecast accounts payable?

The Days Payable Outstanding (DPO) formula is a simple way to forecast accounts payable. Calculate DPO by dividing the average accounts payable by the cost of goods sold and then multiplying by 365. This helps you see how long it typically takes to pay your bills.

- How can advanced tools help in AP forecasting?

Advanced tools, especially AI-based systems, enhance forecasting accuracy by analyzing large amounts of data in real-time. They can run different scenarios, identify trends, and provide detailed insights, making the forecasting process more efficient and precise.