Processing dealer invoices across Europe may seem like a routine task, but the reality is far more layered. The European business landscape is a patchwork of tax regimes, invoicing standards, language requirements, and regulatory frameworks.

As someone who works closely with teams processing over 300 invoices daily from dealers across Europe, I’ve seen firsthand the challenges that come with managing such high volumes at scale. With businesses expanding globally and engaging with partners across the European Union (EU), dealing with invoices from multiple countries is far from straightforward. Ensuring compliance with EU regulations, handling cross-border transactions, and managing local practices can become increasingly complex.

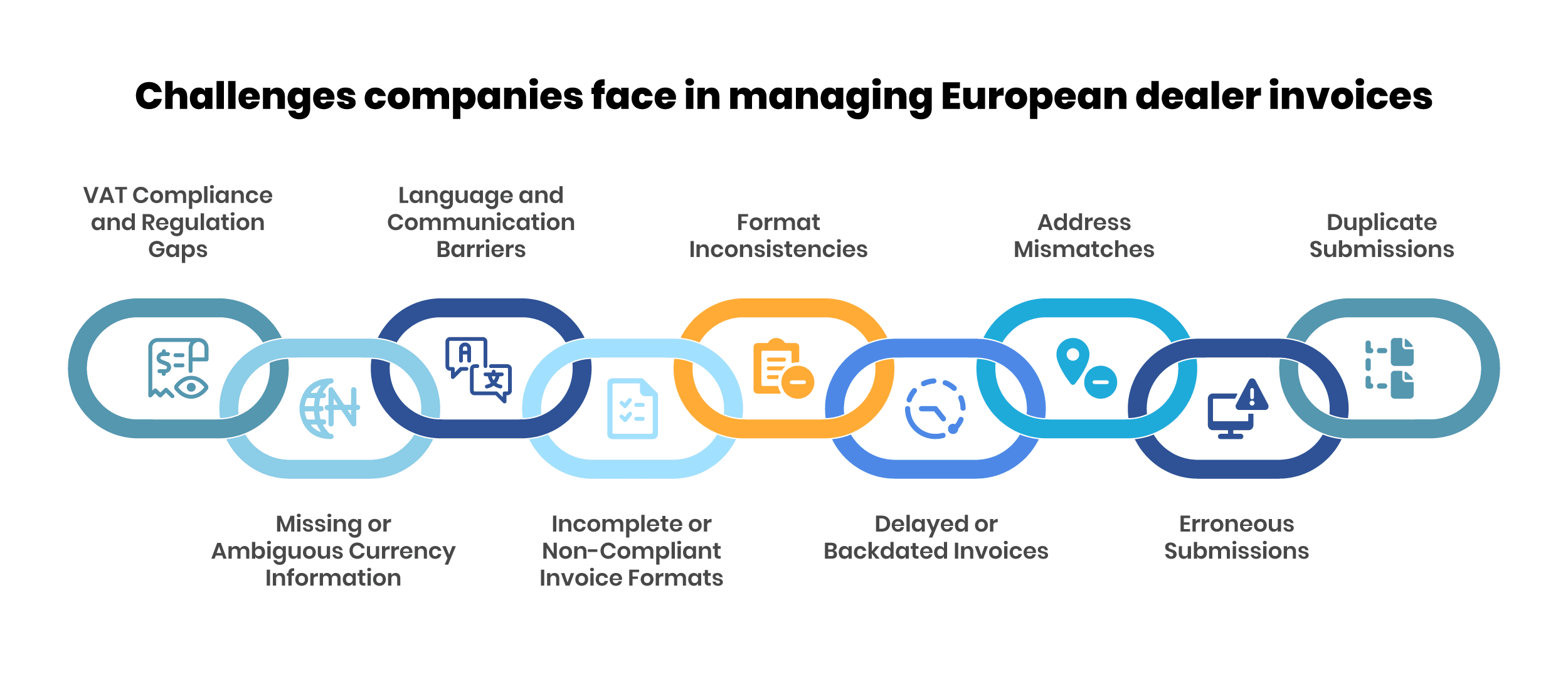

Here’s a closer look at the real-world challenges companies face in managing European dealer invoices at scale:

1. VAT Compliance and Regulation Gaps

Value-Added Tax (VAT) is a critical component of invoicing within Europe. However, compliance issues frequently arise due to:

- Incorrect VAT Numbers: Dealers sometimes fail to validate the correct VAT percentage or amount, leading to errors in tax treatment.

- Missing VAT Details: Required fields such as the applicable VAT rate or reverse charge notes are occasionally left out.

- Improper Reverse Charge Application: For intra-EU business-to-business transactions, the reverse charge mechanism must be applied, but it’s often misunderstood or misused.

2. Missing or Ambiguous Currency Information

Dealers sometimes issue invoices without clearly specifying the currency in which the payment is expected or was made. When invoices lack clarity on whether the transaction was conducted in EUR, GBP, or USD, it becomes difficult for the finance team to:

- Identify the correct ledger for reconciliation

- Match incoming payments to the right invoice

- This ambiguity increases the need for manual follow-up and slows down the reconciliation process.

3. Language and Communication Barriers

With invoices pouring in from Germany, France, Italy, Spain, and more, regional language usage is common. Some critical fields like ‘reference document’ or ‘payment terms’ are written in local dialects:

- This results in delays, as finance teams need to run translations or rely on internal subject matter experts (SMEs).

- Misinterpretations can lead to mis-posted entries or duplicate payment risks.

4. Incomplete or Non-Compliant Invoice Formats

One of the most persistent issues in managing dealer invoices is the lack of complete information. Europe invoicing rules mandate the inclusion of specific data points such as:

- Invoice date

- Delivery date

- Supplier and customer VAT numbers

- Taxable and non-taxable amount breakdowns

Invoices that omit any of these fields may be deemed non-compliant during audits or tax filings.

5. Format Inconsistencies

There is no universal invoice format across Europe. Dealers may send invoices in:

- Excel

- Scanned paper copies

- Images of JPG/PNG formats

Such inconsistencies create hurdles for automated systems, leading to manual interventions. It slows down invoice processing and increases the likelihood of human error, which impacts overall efficiency and timely payments.

6. Delayed or Backdated Invoices

Dealers sometimes delay invoice submissions or backdate documents, affecting:

- Period-end accruals

- Internal controls

- Payment timelines

These backdated invoices can raise compliance red flags during financial reviews, potentially leading to regulatory scrutiny or penalties. Managing these issues requires vigilant monitoring and clear communication between companies and their dealers.

7. Address Mismatches

Inaccuracies in the ‘bill to’ vs. ‘ship to’ address fields are common. For tax jurisdiction purposes, the correct classification of these fields is essential, especially for cross-border deliveries.

8. Erroneous Submissions

Dealers sometimes resend the same invoice multiple times or issue corrected versions without mentioning that a previous one exists. It leads to:

- Confusion in identifying which version is valid

- Risk of double entries

- More back-and-forth to verify with local business teams

9. Duplicate Submissions

When invoices go unpaid or are returned, dealers may resend them without indicating that they are reissued. It leads to duplicate entries, confusion in accounts payable, and potential double payments.

Conclusion

Handling European invoices demands a strong understanding of regional regulations, tax implications, and operational discipline. Companies working with EU-based dealers must establish robust invoice validation processes, language support mechanisms, and clear communication channels to reduce errors and ensure compliance.

As invoice volumes increase with globalization, embracing AI-powered automation and implementing standardized processing workflows will be critical in streamlining cross-border invoicing and minimizing financial risk.

Platforms with built-in e-invoicing compliance capabilities, such as Global PayEX, help businesses navigate these complexities effortlessly by aligning processes with evolving European regulations.

Talk to our experts to learn more about our solutions.