In today’s world where businesses increasingly look for pace, speed and efficiency, digitisation and automation become the key to success.

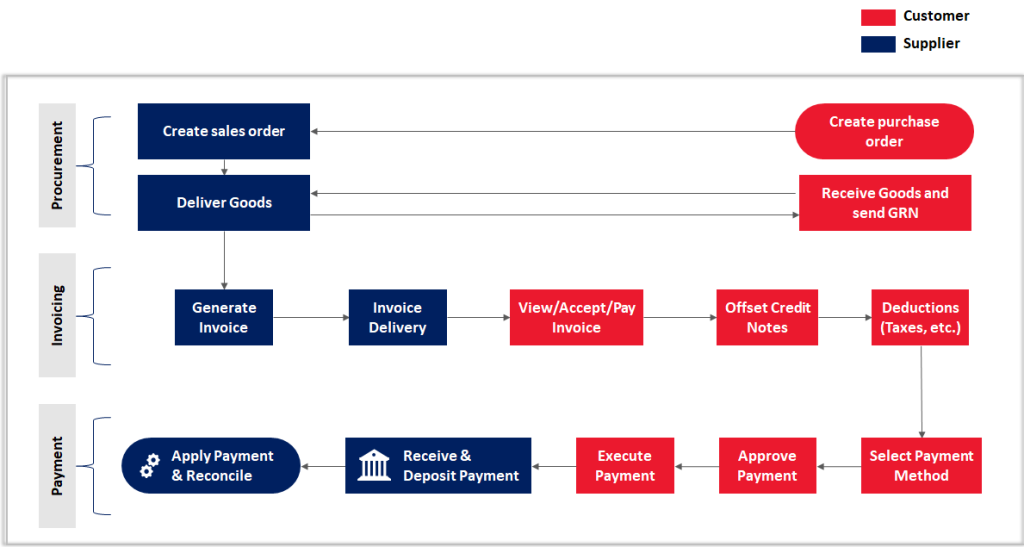

When it comes to receiving or sending invoices, paying those invoices, ensuring deductions are valid, paying your vendors or reminding your debtors, automation can provide a host of benefits to your business, helping you save costs, time and improve the effectiveness of your operations.

Challenges faced by businesses

Many businesses still send invoices only with the goods being delivered thereby delaying the entire acceptance and payment process. Even those that send invoices online, typically via email, face challenges as buyers struggle to track them amidst hundreds of emails received daily.

On top of it, in a vast and geographically diverse country like India, coordinating with buyers to confirm receipt of invoices and sending regular payment reminders is a considerable challenge.

Additionally, while large corporate buyers often pay on time, their payment information is sent in proprietary formats, requiring suppliers to spend significant time reconciling remittance details and applying cash. The complexity often renders bots ineffective in resolving these issues.

Similarly, the same business house receiving raw materials or other supplies from their vendors, face challenges as buyers, because of varying invoice formats from vendors. Buyers must verify invoices for accuracy in terms of items ordered, agreed rates, and quantities received.

New initiatives in B2B finance digitization and automation

While financial technology players have entered this specialized market in recent years, India’s vast scale and the large number of business entities necessitated a centralized initiative to democratize the B2B payment landscape.

Building on the success of the BBPS retail model, NPCI has now introduced Bharat Connect to digitize and automate the B2B space.

What is Bharat Connect?

Bharat Connect is a centralized platform that connects business entities through an Operating Unit and an Agent Institution, standardizing the exchange of invoice and payment information between sellers and buyers.

- The Operating Unit is a regulated financial entity registered with Bharat Connect, responsible for verifying KYC details of business entities and facilitating payments.

- The Agent Institution handles customer acquisition and provides the technology platform to enable seamless interaction between businesses and the Bharat Connect platform.

Global PayEX, a leader in receivables and payables automation, welcomes NPCI’s Bharat Connect initiative and aims to work as an Agent Institution in partnership with an Operating Unit to bring working capital efficiency to businesses in India.

Standardization and improved efficiency

- For Sellers: Bharat Connect allows sellers to upload invoices onto a secure, centralized platform via an Agent Institution. Buyers connected to Bharat Connect can retrieve these invoices directly into their ERP systems for processing.

- For Buyers: Buyers can engage with an Agent Institution to retrieve all invoices from the centralized Bharat Connect platform across all their sellers, ensuring streamlined processing.

The way forward – Automate your CFO’s office

Onboard your Buyers and Suppliers with us and ensure that your invoices are delivered/received and paid on time.

Leverage automation to send customized payment reminders to your Buyers (Debtors), assist them in availing early payment discounts, facilitate invoice financing, and enable necessary deductions for streamlined payments. Finally, reconcile payments effortlessly with seamless, end-to-end straight-through processing directly from your ERP or accounting system.

For your Suppliers, we provide real-time access to Purchase Orders and Goods Receipts. They can upload invoices, track their status in real time, and rely on our platform to validate them against your predefined acceptance rules. You’ll never miss out on early payment discounts offered by Suppliers, and our solutions ensure on-time payments directly through your ERP, fostering stronger vendor relationships.

How does it work?

Current Manual Process

Automated via Bharat Connect

What should you do?

When approached by Agent Institutions/Operating Units, evaluate multiple providers. Assess their functional features, technology, implementation timelines, integration methodologies, and pricing. It is better to opt for a SaaS model as the initial costs are reasonable and increase only as your business volumes grows thus making it worth it.