What if as a business you thought you had more money in your account than you actually did? Or if you realized too late that you had idle funds that could have been invested?

To avoid such scenarios and maintain positive financial health for your company, payment reconciliation is essential for every business.

Once payments hit accounts receivable (AR), the AR teams must accurately match those payments to their corresponding invoices, a process that’s often the most time-consuming part of the accounts receivable cycle. Enterprises today grapple with high transaction volumes, complex remittance formats, and multiple data sources, making manual reconciliation inefficient. That’s where modern payment reconciliation software comes in, offering finance leaders end-to-end automation in cash application.

As a CFO in 2025, it’s important to understand the evolving landscape of accounts receivable management and select the right software to streamline payment reconciliation. This blog will equip you with all the ins and outs of payment reconciliation software—from how it works to how to choose the best solution for your organization.

How Does Payment Reconciliation Software Work?

Payment reconciliation is the process of ensuring that a company’s recorded outgoing or incoming payments align with the corresponding invoices or financial records. It typically involves verifying data from bank statements, invoices, accounting systems, and ERP platforms to ensure that all transactions are accurately accounted for. Payment reconciliation software automates this arduous process of matching transactions, identifying discrepancies, and updating financial records.

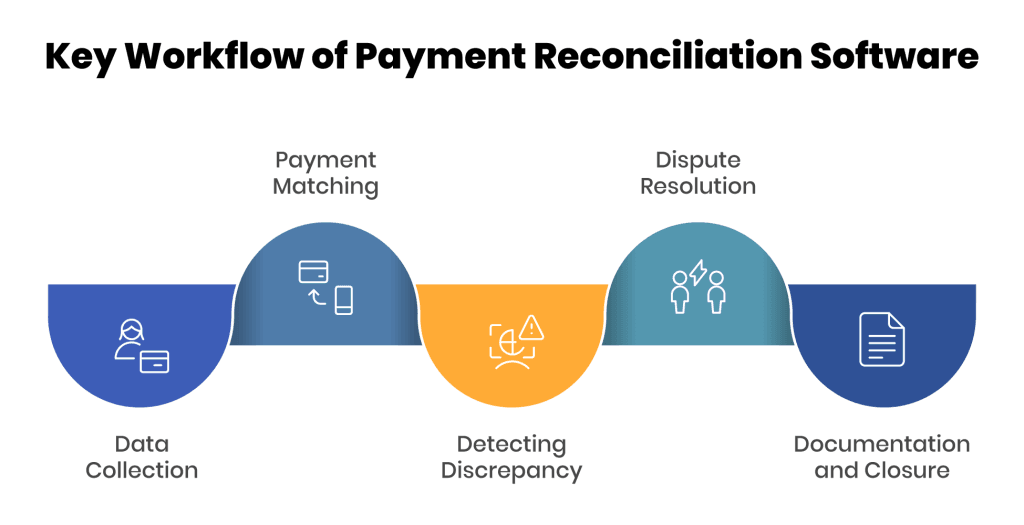

Key Workflow Explained:

- Data Collection

The software automatically collects all relevant documents, such as bank statements, invoices, remittances, and internal accounting records, from various sources, including ERPs and spreadsheets.

For example, if an enterprise receives 1,000 payments daily across five different banks, manually consolidating that data would be very difficult. The software seamlessly ingests this information in real time, eliminating manual effort.

- Payment Matching

Once the data is ingested, the software uses intelligent algorithms and predefined matching rules to automatically reconcile each payment with the corresponding invoice. It can also handle partial payments, overpayments, and consolidated payments by applying smart logic to break down or group transactions accordingly.

Example: A payment of ₹1,20,000 from Z1 Enterprises could be matched against two invoices of ₹70,000 and ₹50,000.

- Detecting Discrepancy

After matching transactions, the software automatically flags inconsistencies such as unmatched payments, duplicate entries, missing invoices, or incorrect amounts. It automatically highlights these discrepancies for review, helping AR teams quickly identify the root cause. The software ensures no anomalies go unnoticed by providing detailed insights and exception reports.

- Dispute resolution

The system routes disputes to assigned AR team members. They can review flagged transactions, trace the origin of errors, and take corrective action. The system may suggest possible solutions, like adjusting invoice amounts or reapplying payments. Variations due to bank charges, or foreign exchange rates, are handled automatically.

Example: A short payment due to an early payment discount might be flagged for manual review.

- Documentation and Closure

After the issue is resolved and payment matching is executed, the software automatically updates the financial records in real-time to reflect accurate information, ensuring the reconciliation process remains error-free. The reconciliation process is closed, and a comprehensive report is generated for auditing purposes. This final report serves as an official record of the completed reconciliation.

Benefits of Using Payment Reconciliation Software

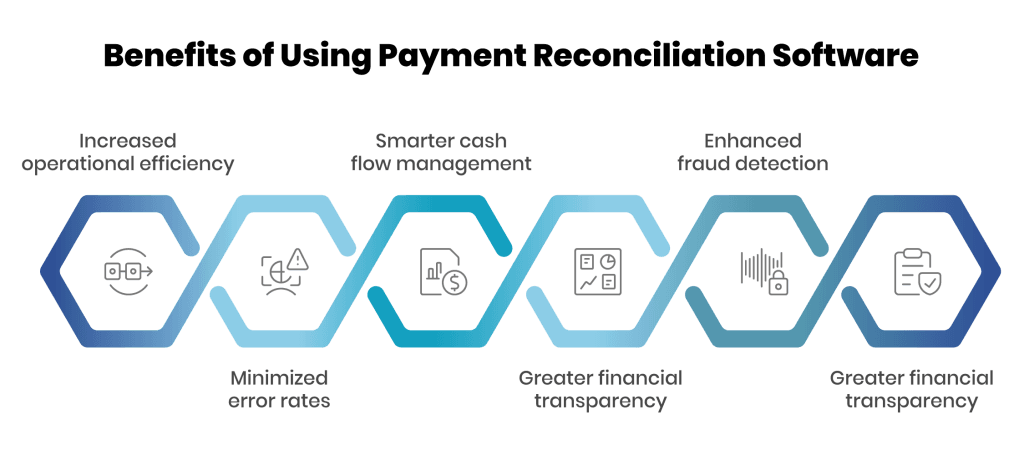

In a survey, 97% of finance leaders agreed that automatic payment reconciliation is important for their business. AR teams struggle with payment reconciliation, especially during the end of the month. At that time, there remains intense pressure on cash reconciliation to be quick and accurate for financial close. Some of the benefits of using a payment reconciliation software are as follows:

- Increased operational efficiency

The software cuts reconciliation time from days to minutes, regardless of transaction volume. It eliminates the bottlenecks of handling multi-format remittances and reconciling split payments. This eases month-end workload spikes and frees finance teams for strategic activity.

- Minimized error rates

Manual reconciliations are prone to typing mistakes and formula errors. Payment reconciliation software minimizes this risk by using AI algorithms to collect data and auto-match transactions. It instantly flags discrepancies for quick resolution.

- Smarter cash flow management

Automated payment reconciliation enables businesses to manage cash flow more strategically by ensuring that all payments are accounted for in real-time. With accurate data, CFOs can plan expenses and make timely financial decisions to improve liquidity and avoid shortfalls.

- Greater financial transparency

Payment reconciliation software syncs with ERPs and banking platforms to execute cash reconciliation and update financial records in real time. It provides a centralized dashboard for detailed reconciliation reports for finance leaders. Such transparency allows CFOs to conduct scenario modeling and stakeholder reporting with confidence.

- Enhanced fraud detection

The software identifies fraudulent activity by flagging transactions that deviate from established patterns, such as unauthorized payments. Unlike manual reviews, which are prone to oversight, it uses AI to detect subtle signs of potential fraud. This early warning system enables swift action to protect against threats.

- Compliance and audit readiness

The software ensures compliance with legal and regulatory requirements, mitigating the risk of penalties and legal challenges. It generates detailed audit trails for internal reviews and external audits. Centralizing data enables auditors to easily access supporting evidence and verify transactions.

Must-Have Features in a Payment Reconciliation Solution

In 2025, strategic CFOs are taking tangible actions to ignite digital transformation by embracing automation technologies. However, prior to selecting a payment reconciliation tool, finance leaders must gain a solid understanding of which features are absolute necessities:

- AI-Powered Matching Engine

Intelligent transaction matching uses AI to enhance the accuracy of payment matches across diverse data sources. It supports up to n-way matching with context-based logic, even with incomplete remittance data and varied document formats.

- Advanced Reporting and Analytics

A payment reconciliation solution should offer built-in reporting and analytics such as scheduled reports, real-time dashboards with drill-down capabilities, and actionable insights. It gives a consolidated view of reconciliation performance and transaction status.

- Real-Time Data Processing Capabilities

Payment reconciliation solutions continuously monitor transaction data and instantly run matching algorithms as records are ingested. Instead of batch processing at day-end, they perform real-time reconciliation within seconds.

- Automated Anomaly Detection

This feature detects anomalies across large volumes of transactions. The solutions are trained to recognize typical transaction patterns and flag any deviations if found, such as duplicate payments or suspicious entries. It helps finance teams prioritize high-risk exceptions.

- Built-in Data Security and Compliance

A reconciliation solution must safeguard financial data through enterprise-grade security protocols and follow global standards such as GDPR and PCI DSS compliance. The system should provide encrypted reports and maintain past activity logs for audits.

- Seamless Integration Capabilities

A must-have feature in payment reconciliation solutions is its ability to integrate with multiple data sources, such as banks, ERPs, and other internal systems. This connectivity ensures smooth data flow, enabling real-time payment reconciliation.

- Customizable Rules for Complex Scenarios

Every business operates with distinct reconciliation workflows. A robust solution should allow finance teams to define and apply custom matching rules that align with their business logic. It ensures flexibility without forcing teams to adapt to rigid software constraints.

Best Payment Reconciliation Software Providers in 2025

To help businesses navigate the landscape of payment reconciliation solutions, we have compiled a list of the top five solution providers revolutionizing the B2B payments space.

1. Global PayEX

G2 rating: 4.9 out of 5

Global PayEX has built an award-winning, AI-powered payment reconciliation solution, AlgoriQ, tailored for high-volume, complex receivables environments. It provides real-time, n-way matching with 95%+ straight-through cash posting to ERP, reducing payment advice processing time by 100%.

The platform supports multi-currency and multi-bank setups and includes unique features such as an in-built deductions management module and tax reconciliation module, setting it apart in the market.

Perfect for mid-sized businesses and large enterprises, AlgoriQ enables scalable, touchless automation across all industries.

| Positive Aspects | Drawbacks |

| ➟ Shortest end-to-end deployment time ➟ Multiple integration options available suiting each client’s needs ➟ Provides AI-based decision support that auto-suggests resolution actions for disputes | ➟ More features than small businesses typically need |

2. BlackLine

G2 Rating: 4.5 out of 5

BlackLine focuses on enterprise-level financial automation, offering a suite of tools for financial close management, including payment reconciliation. It automates payment matching and discrepancy alerts. BlackLine is best suited for large enterprises.

| Positive Aspects | Drawbacks |

| ➟ Advanced reporting capabilities ➟ Imports general ledger and sub-ledger balances automatically ➟ Offers reconciliation templates | ➟ Integration with third-party systems is challenging ➟ Less intuitive solution ➟ Implementation timeline is comparatively longer |

3. Xero

G2 Rating: 4.3 out of 5

Xero is a cloud-based accounting tool with built-in reconciliation features for small and medium-sized businesses. It offers a clean interface and integrates with various apps for simplified operations.

| Positive Aspects | Drawbacks |

| ➟ Easy-to-use solution ➟ Stores secure audit trails ➟ Automatic transaction matching | ➟ Limited capability to handle complex reconciliation requirements for large enterprises ➟ Higher cost for advanced features ➟ Limited offline functionality |

4. Quickbooks

G2 rating: 4 out of 5

A popular accounting software that provides multi-currency reconciliation capabilities. It is best suited for small and mid-size organizations rather than large enterprises.

| Positive Aspects | Drawbacks |

| ➟ 24/7 customer support ➟ Quick migration of existing financial data ➟ User-friendly interface | ➟ Limited customization abilities ➟ Reporting function crashes sometimes depending on file size ➟ Some users say the interface changes too frequently |

5. FloQast

G2 Rating: 4.6 out of 5

FloQast focuses on financial close automation with built-in reconciliation features. It offers automated payment matching and provides audit-ready workflows, mainly for internal finance team collaboration. It is best suited for medium to large enterprises.

| Positive Aspects | Drawbacks |

| ➟ Robust reporting features ➟ Excellent customer support ➟ Seamless integration with ERP | ➟ Advanced features come at an extra cost ➟ Certain modules take time to navigate ➟ Lacks the ability to detect and send alerts of anomalous transactions |

6. Sage Intacct

G2 Rating: 4.3 out of 5

Sage Intacct offers reconciliation tools with multi-currency support and integration across its ERP ecosystem. It supports real-time visibility into cash flow while ensuring financial accuracy and compliance.

It is best suited for mid-sized companies and large enterprises.

| Positive Aspects | Drawbacks |

| ➟ Seamless integration capabilities for Sage Intacct users ➟ Real-time reporting ➟ Enterprise-grade security measures | ➟ Higher cost for advanced features ➟ Requires time for end-to-end implementation ➟ Demands greater user expertise to use |

7. Zoho

G2 Rating: 4.4 out of 5

Zoho Books is part of the Zoho business suite, offering basic reconciliation automation and customizable matching rules. It serves large to mid-sized businesses looking to digitize core finance workflows.

| Positive Aspects | Drawbacks |

| ➟ Easy-to-use interface ➟ Provides automated 3-way matching ➟ Robust security measures | ➟ Requires training for new users ➟ Extra cost for advanced features ➟ Some users report delays in customer support response times |

Real-World Use Cases

Use Case 1:

Payment Reconciliation Automation for a Multinational Company

TTK Prestige Limited is a multinational company specializing in kitchen and home appliances. Previously, the company relied on a fully manual process for managing AR, which led to evident challenges in reconciling the large volume of payments. It led to delays, errors, and laborious payment handling.

TTK Prestige implemented AlgoriQ to automate its end-to-end cash reconciliation process.

Impact:

- 90% Accurate Cash Reconciliation

- $500K Worth Transactions Reconciled

- 80% Increase in Employee Productivity

- 90% Payments Applied Automatically

Use Case 2:

Streamlining Cash Application for a Leading Apparel Brand

Page Industries is the exclusive licensee for the manufacture, distribution, and marketing of the JOCKEY® brand in India, Sri Lanka, Bangladesh, Nepal, and the UAE. The company’s payment accounting process was highly resource-intensive, requiring 3-5 days each month.

To streamline the cash reconciliation process, Page Industries chose Global PayEX’s AI-powered cash application solution, AlgoriQ.

Impact:

- 90% Reduction in Manual Efforts

- 7x Faster Cash Reconciliation

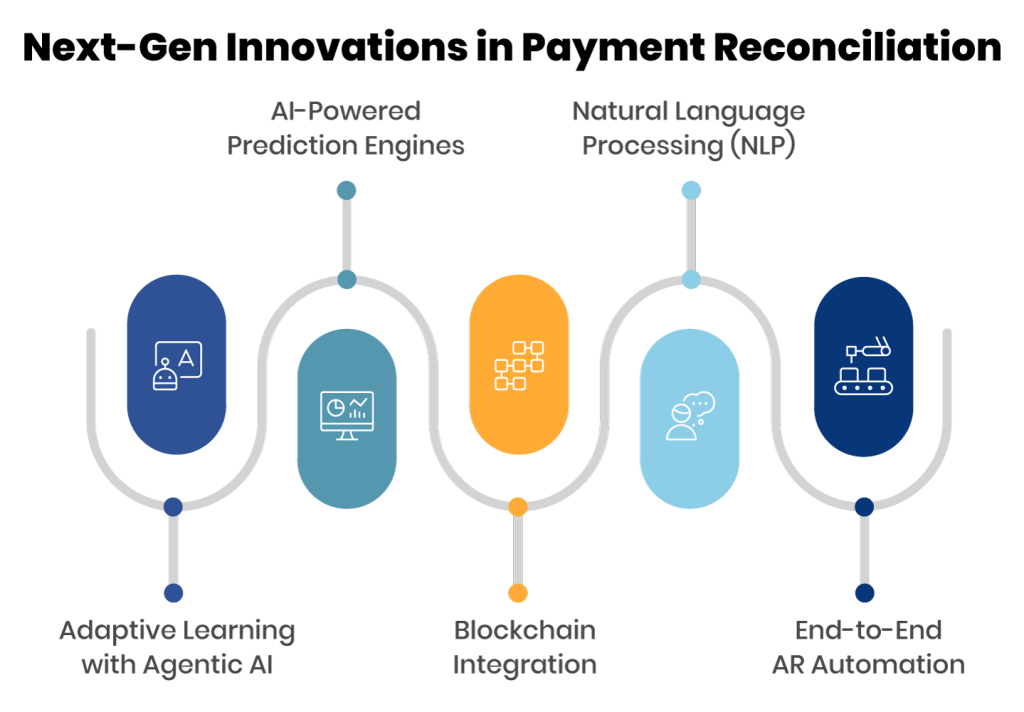

Next-Gen Innovations in Payment Reconciliation

The payment reconciliation landscape is witnessing transformative technological innovations that promise to revolutionize how businesses manage their financial data. Here are some key trends that are shaping the future of B2B payment reconciliation:

1. Adaptive Learning with Agentic AI

- Learns from each reconciliation to improve accuracy over time

- Continuously refines matching algorithms based on past data

- Adapts to changing financial patterns and complexities

2. AI-Powered Prediction Engines

- Predicts invoice-payment matches, even without clear references

- Analyzes past customer behavior and transaction history

- Flags potential reconciliation issues early for proactive resolution

3. Blockchain Integration

- Enhances transparency and auditability through a decentralized ledger

- Secures all transactions with immutable records

- Minimizes errors and fraud and ensures a reliable financial trail

4. Natural Language Processing (NLP)

- Interprets unstructured remittance advice and bank statement narration fields

- Extracts key details like partial payments, even from unclear text.

- Maps payments to correct invoices despite formatting errors or missing references

5. End-to-End AR Automation

- Integrates all AR functions into a single, unified platform

- Uses AI to extract remittance data, match payments, and manage exceptions

- Eliminates silos for a streamlined, automated reconciliation process

As we move through 2025, forward-thinking enterprises recognize the strategic advantage payment reconciliation software offers to thrive in this competitive landscape. Relying on manual reconciliation will only lead to inefficiencies, errors, and mounting operational challenges. By embracing intelligent payment reconciliation solutions, finance leaders can streamline operations, meet rising demands, and refocus efforts on strategic priorities. It’s time for CFOs to modernize and lead with accuracy, agility, and confidence.

Frequently Asked Questions (FAQs)

1) What is payment reconciliation software?

Payment reconciliation software automates the process of matching and verifying financial transactions across various systems, ensuring that payments are accurately recorded and reconciled.

2) Why do businesses need payment reconciliation software?

Manual reconciliation is time-consuming and error-prone. Payment reconciliation software automates the process, improving efficiency, accuracy, and compliance while enabling better cash flow management.

3) Who should use payment reconciliation software?

Any organization with high transaction volumes can benefit significantly from payment reconciliation software.

4) Is payment reconciliation software secure?

Most leading payment reconciliation software providers comply with financial industry security standards like PCI DSS and GDPR compliance to ensure data is encrypted, secure, and protected from unauthorized access. Always check for certifications and security protocols before choosing a solution.

5) How long does implementation take?

The implementation period varies based on the complexity of the scope. Leading software providers like Global PayEX typically complete the implementation of the Cash Application module within two weeks for standardized payment advice.