Imagine if, one day, your company missed a vendor payment deadline, which caused an agitated supplier to cut off deliveries. As a result, product shipments would get stuck, customer orders would be delayed, and business operations would come to a standstill — all because of just one missed payment.

As we go through 2025, efficient accounts payable management has become essential for business continuity. Still, many companies rely on outdated methods that consume precious time and resources.

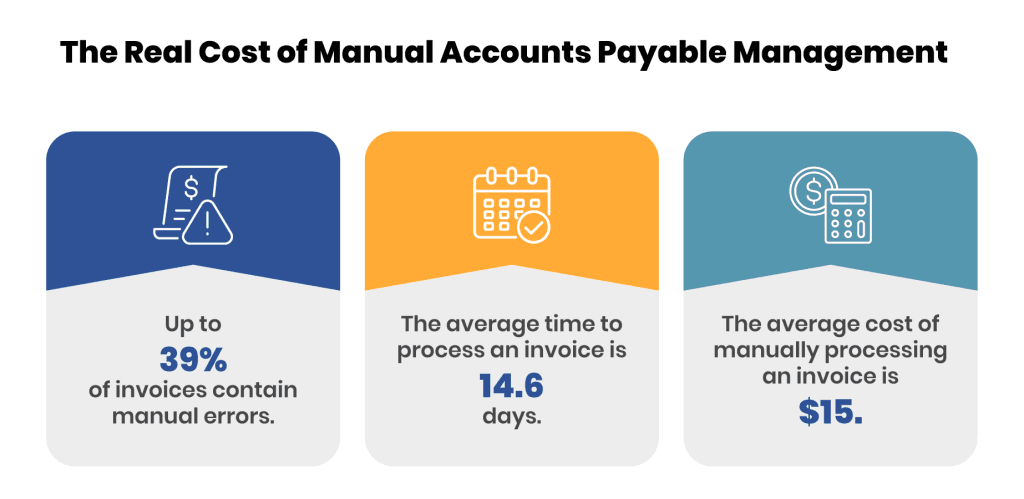

Source: DocuClipper

As businesses scale and supply chains grow more complex, the demand for advanced AP automation solutions surges. These solutions leverage state-of-the-art technologies to transform manual processes into swift, error-free workflows. The marketplace is full of AP software, but the challenge lies in finding the perfect solution that matches your business’s unique needs and growth plans.

In this blog, we will explore the best AP automation solutions, their capabilities, the challenges they solve, and a curated list of the top 10 software for CFOs to consider.

What is AP Automation Software?

AP automation software is a digital solution designed to streamline and automate the entire invoice-to-payment cycle. It handles everything from receiving and interpreting invoices to processing payments and storing records for compliance.

By reducing manual intervention, it speeds up processing times, minimizes errors, and ensures timely payments, enabling finance teams to operate more efficiently and maintain healthier vendor relationships.

How AP Software Works?

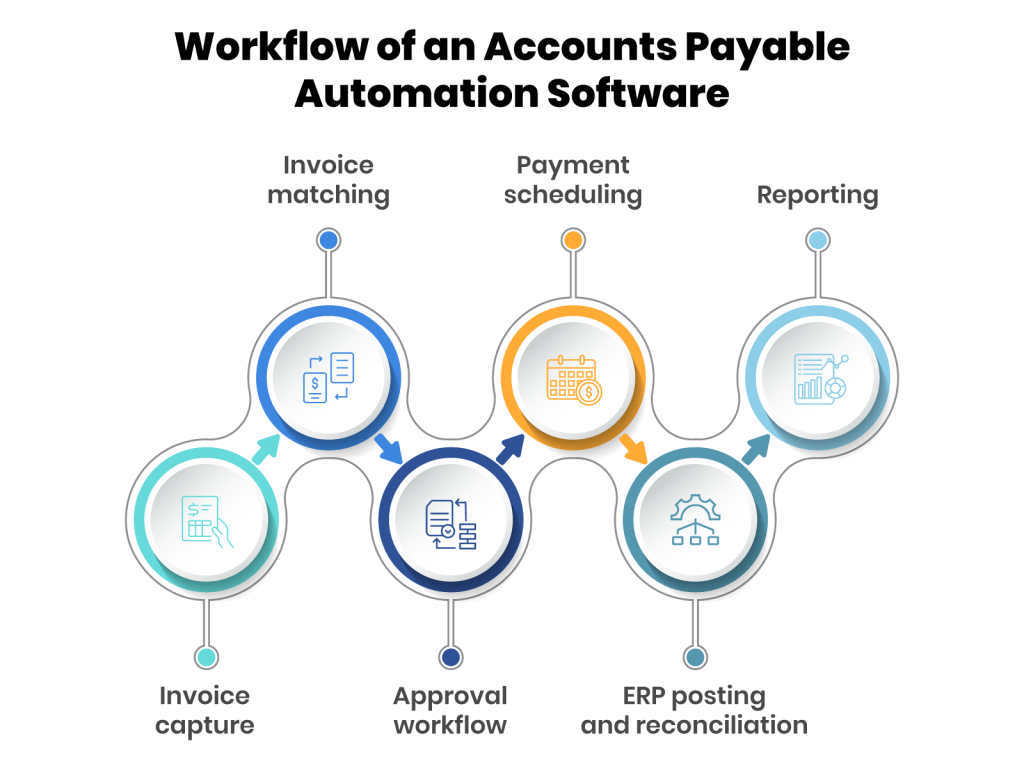

- Invoice capture: The first step is digitizing incoming invoices. AI models read, interpret and convert invoices into digital data. It allows vendors to also submit e-invoices directly from vendor portals.

- Invoice matching: After capturing invoice data, the software automatically compares and matches invoices against corresponding purchase orders and delivery receipts.

- Approval workflow: Based on predefined rules set by the organization, the software routes invoices to the relevant personnel for approval. It automatically alerts and sets reminders to expedite the approval process.

- Payment scheduling: Once an invoice is approved, the AP automation solution facilitates payments scheduling based on due dates, early-payment discounts, or cash flow preferences—via the preferred payment method.

- ERP posting and reconciliation: After a payment is done, an AP software can match payment confirmations or bank data with invoices to ensure they are marked as paid.

- Reporting: All transactions are automatically logged into the ERP via data sync. The software maintains accurate records for audits and built-in dashboards offer real-time insights into invoice status, aging, and cash flow impact.

Benefits of Accounts Payable Automation Solutions for Common AP Challenges

Every finance team knows the struggle of lost invoices, delayed approvals, and month-end chaos. With the right tools in place, what once felt overwhelming can finally be managed with clarity and ease. In this section, we will break down the benefits of accounts payable automation by addressing the common challenges faced by AP teams.

| Manual AP Challenge | Benefit of AP Automation |

| ➞ Slow invoice processing: Involving multiple steps, the process is slow and often delayed due to paper-based workflows and manual follow-ups. | ➞ Accelerated processing: AP automation digitizes the procure-to-pay cycle, cutting invoice processing time from days to minutes. |

| ➞ Error-prone invoice entry: Manual keying of invoice data increases the likelihood of human errors, such as incorrect amounts or duplicate entries. | ➞ Accurate data capture: AI models capture data directly from invoices. It eliminates the need for manual input and minimizes the chances of errors. |

| ➞ Potential fraud: Manual processes make it easier for fraudulent invoices to slip through due to the lack of checks and limited visibility. | ➞ Built-in fraud prevention controls: AP automation flags any discrepancies and maintains audit logs. It reduces the risk of fraud and improves compliance. |

| ➞ Long approval cycles: Approval often requires multiple manual checks and sign-offs, slowing down payments. | ➞ Faster invoice approvals: It uses configurable workflows that route invoices instantly to the right approvers, significantly speeding up approvals. |

| ➞ Blind spots in AP operations: It is difficult to manually track invoice status, payments, and overall cash flow, which allows only for reactive decision-making. | ➞ Real-time analytics: Automation solutions provide live dashboards that give finance teams clear visibility into payment statuses, aging reports, and future cash flow needs. |

| ➞ High cost-per-invoice: Manual processing requires significant time and resources for data entry, paper handling, and follow-ups, driving up operational expenses. | ➞ Lower operational costs: By digitizing invoices and automating routine tasks, it cuts labor costs and eliminates the need for physical documents, resulting in substantial savings. |

10 Best AP Automation Solutions for 2025

After a detailed evaluation of functionality, integration capabilities, and industry fit, we’ve compiled a list of the top 10 accounts payable automation solutions. This curated list will help CFOs find the right software to manage accounts payable efficiently and gain greater financial control.

1. Global PayEX

Overview: Global PayEX has developed PayEX AP, a powerful AI-powered accounts payable automation solution that streamlines the end-to-end invoice-to-payment cycle. Featuring intelligent 3-way matching, real-time analytics, built-in e-invoicing compliance, a mobile app, and many other advanced features, it delivers unmatched control and efficiency.

What sets PayEX AP apart is its unique embedded channel financing ecosystem, which provides dynamic discounting options through integrated lending partners within the platform.

Best suited for: Businesses of all sizes across all industries

Pros:

- The self-service vendor portal provides real-time invoice and payment visibility

- Customizable workflows support multi-level and cross-department approvals

- Automated payouts help capture up to 75% more early payment discounts

- AI-driven fraud detection and built-in audit trails ensure security and compliance

- The consolidated AP dashboard provides visibility into AP health and payment schedules

- Multi-currency support simplifies global transactions by automatically handling currency conversions and exchange rate variations

Cons:

- It may exceed the needs of very small, low-volume AP teams.

- Being a cloud-first solution, PayEX AP depends on stable internet access.

2. Stampli

Overview: Stampli is a cloud-based AP automation platform that leverages artificial intelligence to streamline invoice processing. It centralizes communications, approvals, and documentation, allowing efficient collaboration across departments.

Best suited for: Businesses handling a high volume of invoices regularly

Pros:

- Self-service vendor portals to submit invoices and check payment statuses.

- Customizable approval workflows

- Quick implementation with a user-friendly interface.

Cons:

- International payments can be challenging and often require third-party integrations to manage effectively

- ACH payments take up to 5 business days after processing

3. Sage

Overview: Sage Intacct’s AP automation solution is a part of its ERP suite. The solution excels in managing multiple business entities while maintaining strict controls and compliance features.

Best suited for: Mid-sized businesses and large enterprises

Pros:

- Strong compliance and audit features.

- Advanced multi-entity and multi-currency support.

- Seamless integration with other Sage modules.

Cons:

- Steep learning curve for new users.

- Higher cost compared to other competitors.

4. NetSuite

Overview: Oracle NetSuite provides an integrated cloud ERP system with AP automation features. It automates invoice processing, payment approvals, and vendor management, offering real-time financial insights and scalability for growing businesses.

Best suited for: Large enterprises

Pros:

- End-to-end automation within a single ERP platform

- Real-time visibility into financial operations

- Advanced security and compliance features

Cons:

- Complex implementation process

- Lacks advanced automation features

5. ApprovalMax

Overview: ApprovalMax is a cloud-based platform that automates the accounts payable process within a single system. It enhances financial control, improves cash flow visibility, and minimizes manual workload.

Best suited for: Mid-market to large businesses or growing enterprises, particularly in healthcare, hospitality, property development, and construction industries.

Pros:

- Customizable multi-step approval workflows.

- Real-time budget information

- Batch payment approvals

Cons:

- Not feature-rich like other solutions

- ApprovalMax Pay, which performs payment execution, is only available for Xero UK businesses

6. AvidXchange

Overview: AvidXchange offers a comprehensive AP solution that includes invoice management and payment processing. It also connects customers to a network of suppliers across diverse industries.

Best suited for: Mid-market businesses

Pros:

- Industry-specific customization.

- Payment processing through multiple methods.

- Enhanced visibility into payment processes.

Cons:

- Limited global payment capabilities outside of the United States

- Relies on its call center for onboarding new vendors

7. MineralTree

Overview: MineralTree provides a centralized AP automation and accounting platform that requires an average of 2.1 months for implementation. It offers features like invoice capture, approval workflows, and payment execution and integrates with various systems to enhance financial operations.

Best suited for: Mid-market or enterprise firms processing 500+ invoices/month, specifically in healthcare, professional services, and manufacturing industries.

Pros:

- Fast payment processing of large volumes of transactions

- Advanced Security and fraud prevention

- Self-service vendor portals

Cons:

- Customization may require additional support.

- Limited integration capabilities for niche accounting systems.

8. Coupa

Overview: Coupa is a comprehensive spend management platform that includes AP automation as a part of its suite. It focuses on unifying procurement, invoicing, and expense management to give businesses greater control over their financial operations.

Best suited for: Large enterprises with multi-entity operations, particularly in manufacturing, healthcare, and financial services.

Pros:

- Global payment capabilities

- Robust analytics and reporting tools.

- Customizable workflows to fit complex business needs.

Cons:

- Implementation can be complex and time-intensive.

- Teams need proper training to leverage the features fully.

9. QuickBooks

Overview: QuickBooks Online is a cloud-based accounting solution that offers basic AP automation features. It facilitates invoice tracking, bill payments, and vendor management within an intuitive interface.

Best suited for: Small and medium-sized businesses

Pros:

- User-friendly interface

- Cost-effective for small businesses

- Accessible from multiple devices

Cons:

- Limited customization options

- Lacks advanced automation features

10. Nanonets

Overview: Nanonets Flow is an all-in-one AP automation platform that simplifies invoice processing with OCR, AI-driven data extraction, customizable approval workflows, ERP integrations, and real-time reporting. Its intuitive interface helps businesses save time and minimize errors.

Best suited for: Small and mid-market organizations.

Pros:

- Seamless integration with popular ERPs

- Customizable approval workflows

- Automated 3-way matching and dispute detection

Cons:

- Steep learning curve for new users

- Lacks extensive vendor management tools

Your Complete Guide to Selecting the Best AP Automation Solution by Business Size

Small Businesses

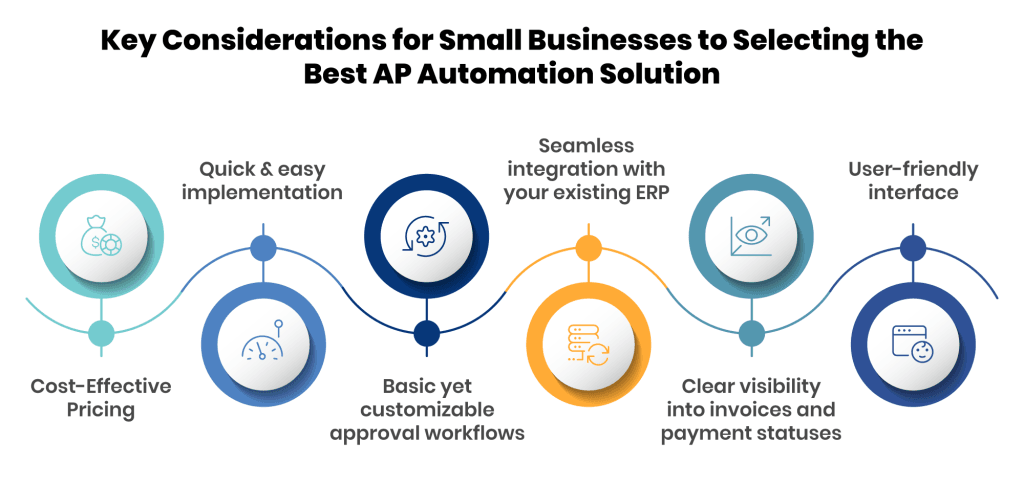

Small businesses often operate with low budgets and lean finance teams, making it essential to find an affordable and easy-to-use solution. The ideal software should offer quick implementation and require minimal training without compromising functionality.

When evaluating, focus on features that address your finance team’s daily challenges.

Key Considerations:

- Cost-Effective Pricing: Choose solutions with transparent, affordable pricing that fits your budget without hidden fees or surprise costs.

- Quick & easy implementation: Ensure setup and onboarding is quick so that you can start benefiting from automation without long and complex implementation and training.

- Basic yet customizable approval workflows: Look for simplified payment approvals with easy-to-use workflows that can be tailored to fit your business needs.

- Seamless integration with your existing ERP: Ensure it connects smoothly with your ERP to keep data synchronized automatically to avoid duplicate entries or manual reconciliation.

- Clear visibility into invoices and payment statuses: Look for real-time tracking to help you manage cash flow, avoid late payments, and stay on top of vendor obligations.

- User-friendly interface: Select a solution that is easy for your team to learn and provides reliable, responsive customer support whenever needed.

Top Picks:

- Quickbooks

- Global PayEX

- Nanonets

Mid-Sized Businesses

Mid-sized businesses sit at a crucial growth stage, beyond basic needs but not quite operating at enterprise scale. With growing vendor networks, higher invoice volumes, and increasing compliance requirements, these companies need an AP automation solution that offers robust functionality without the overhead of enterprise-grade systems.

The best AP automation solution for mid-sized businesses should deliver intelligent automation, scalability, and control without requiring deep technical resources or extensive implementation timelines.

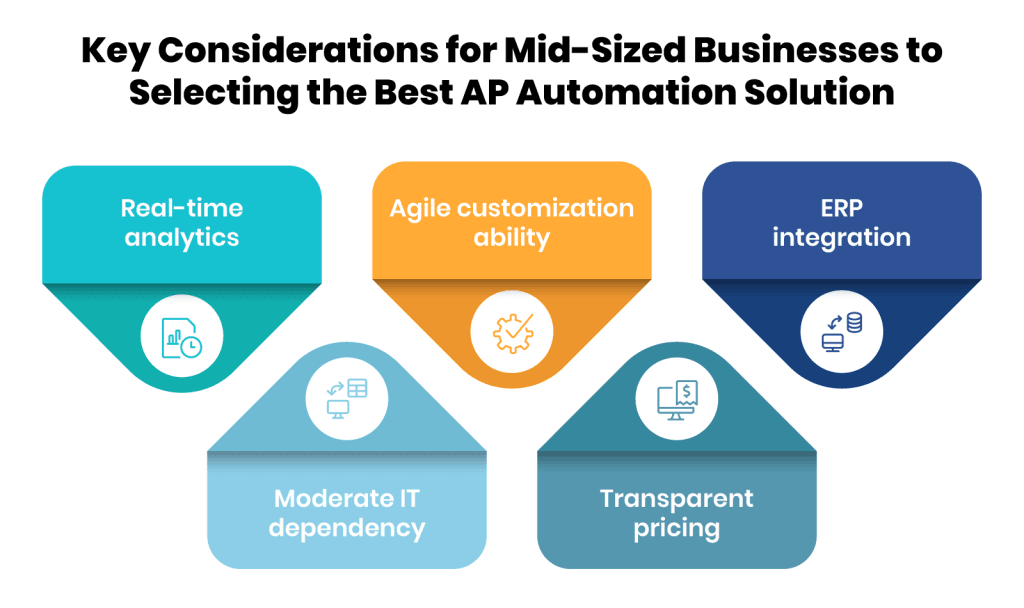

Key considerations:

- Real-time analytics: Get actionable insights with intuitive dashboards for cash flow, DPO, and payment status.

- Moderate IT dependency: Opt for solutions with low-code configuration and responsive vendor support to minimize reliance on internal IT teams.

- Agile customization ability: Flexible and adaptable, the solution should be easily customized to accommodate growing invoice volumes and fit evolving AP processes without rigid constraints.

- Transparent pricing: Avoid platforms that price like enterprise tools. Seek pricing models that support growth without extra charges per invoice or user.

- ERP integration: Ensure seamless connectivity with your existing ERP or accounting system to enable smooth data flow and end-to-end automation.

Top Picks:

- Global PayEX

- Sage Intacct

- AvidXchange

Enterprises

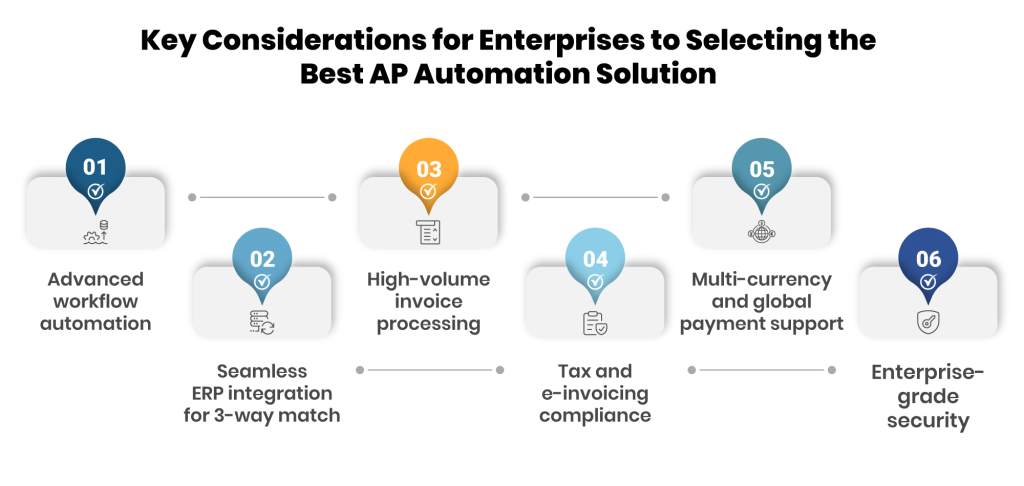

Enterprises manage thousands of invoices across multiple departments, legal entities, and geographies. For enterprise finance teams, the goal isn’t just automation; it’s about ensuring control, compliance, visibility, centralization, and standardization across the organization. The best AP automation solution should simplify complexity and empower teams to make smarter, faster decisions. When evaluating AP software for a large organization, focus on capabilities that go beyond the basics and align with enterprise-level needs.

Key Considerations:

- Advanced workflow automation: Enables custom routing, exception handling, and approvals across departments, locations, and hierarchies.

- Seamless ERP integration for 3-way match: Real-time, bi-directional syncing with your ERP systems ensures consistency and minimizes reconciliation issues.

- High-volume invoice processing: AI-driven capture and matching to handle thousands of invoices without delays or manual intervention

- Tax and e-invoicing compliance: Must adhere to regional e-invoicing mandates (like Europe’s PEPPOL) and support tax rule configurations.

- Multi-currency and global payment support: Required for cross-border transactions, including FX handling and local payment rail integrations.

- Enterprise-grade security: Look for solutions certified for PCI-DSS and GDPR compliance to ensure secure data handling and regulatory adherence.

Top Picks:

- Global PayEX

- NetSuite

- Coupa

How Global PayEX is Leading the Future of AP Automation in 2025

Businesses can no longer afford to let outdated AP processes slow them down. Whether you’re a small business seeking to eliminate manual data entry, a mid-sized company looking to scale operations, or an enterprise aiming to streamline complex workflows, AP automation is the key to driving efficiency and growth.

Global PayEX is redefining the future of accounts payable automation by delivering a deeply intelligent and seamlessly integrated solution built for modern finance teams. With its AI-powered approach, PayEX AP goes beyond traditional automation, bringing speed, accuracy, and control to every stage of the invoice-to-payment cycle. Its ability to adapt to unique business needs positions Global PayEX as a forward-thinking partner in financial transformation, helping businesses of all sizes elevate their AP function.

Are you ready to help your finance team work smarter, not harder? Talk to our experts today and take the first step toward intelligent AP automation.