Technology alone doesn’t drive transformation—adoption does.

At Global PayEX, we’ve learned that even the most advanced AR and AP automation solutions can only deliver results when they’re embraced on the ground. In the complex world of B2B finance, especially across dealer-distributor networks, many users are still getting comfortable with digital tools.

That’s why we invest in more than just product innovation—we invest in people. Our support agents are on a mission to ensure every user, regardless of their tech comfort level, is empowered to make the most of our platform.

In this article, we walk you through a day in the life of a Global PayEX support agent—the unsung champions of digital adoption who turn automation into impact.

Onboarding a New Dealer

The first task of the day is to onboard new dealers for our clients. It is one of the most crucial responsibilities of a support agent, especially since many clients are hesitant to make the digital shift. Let’s take a closer look at the customer onboarding process.

What’s Holding Dealers Back from Going Digital?

Despite the ongoing technological transformation, many dealers remain hesitant to embrace digital payment platforms due to several key concerns:

- Strong attachment to traditional workflows: Many dealers are habituated to paper invoices, cheques, and manual signatures, making them wary of switching to digital systems.

- Fear of security risks: Sharing banking details or transacting online raises concerns about data safety and financial fraud.

- Low digital confidence: First-time users often struggle with using new apps or platforms, fearing they might make mistakes.

Onboarding Process: Then vs. Now

Back in 2016, the process began when a client shared a list of dealers that needed to be onboarded. Our support agents would visit each dealer in person, explain the system, collect their signatures and a canceled cheque, and then forward the documents to the bank. Since many dealers were initially hesitant, the process often required multiple visits to convince them and address their concerns before they were finally ready.

It was followed by a waiting period, often up to three weeks, until NPCI confirmed the mandate. Only then could the dealer be added to the client’s ecosystem.

“Customer onboarding is not just about getting a form signed; it is about earning the dealer’s trust,” shares a Global PayEX support agent.

Fast-forward to today, the scenario has undergone a transformation. With the help of advanced technology, the onboarding process is now quicker and more seamless than ever.

Customer onboarding, which once took up to 21 days, now happens instantly. All you need to do is download the app, and you’re ready to get started.

To ensure a smooth experience, we provide easy-to-follow onboarding materials, including explainer videos, infographics, and step-by-step guides. These cover everything from downloading and logging in to navigating and using the app so dealers can get started confidently from day one.

Training & Troubleshooting

Once the customer onboarding is complete, the support agent shifts focus to training and troubleshooting—an intensive phase that demands time and expertise.

Query Resolution

For a support agent, this phase demands the utmost patience. Calls start rolling in—dealers may feel hesitant to initiate payments or get stuck during credit adjustments. The support agent steps in and resolves these issues over a call, ensuring that even the slightest doubts are clarified. Over time, this methodical support builds the dealer’s confidence, turning hesitation into comfort.

Whether an old dealer requests a refresher or a new one struggles with the basics, support agents are always ready to step in and offer round-the-clock assistance.

Training Sessions

One of their core responsibilities is conducting in-person training sessions for the sales team of the company that supplies products to dealers. These aren’t just one-off demos; they’re deep-dive walkthroughs of the platform. Whether checking invoice statuses, uploading payment proofs, or understanding how to raise a credit note, support agents walk the sales team through every step in a clear, hands-on manner. Salespersons then pass this knowledge along to the dealers they manage. However, in cases where dealers aren’t closely connected to the sales team or require more guidance, support agents personally train them, tailoring their approach to the dealer’s level of comfort with digital tools.

Previously, support agents would train each dealer individually. However, as the number of dealers grew significantly during COVID-19, this structured knowledge transfer plan was introduced, where training is first delivered to the corporate’s sales teams, who then pass the knowledge to dealers to ensure a broader reach.

What Success Looks Like

The real measure of success for a support agent is when the dealer no longer needs assistance. Dealers who previously needed extensive assistance became self-sufficient, logging in, navigating the portal, and completing payments without external help.

“They’ve stopped calling us daily and now manage everything themselves.” shares a Global PayEX support agent.

It is a subtle yet powerful indicator of adoption and the support team’s exceptional effort.

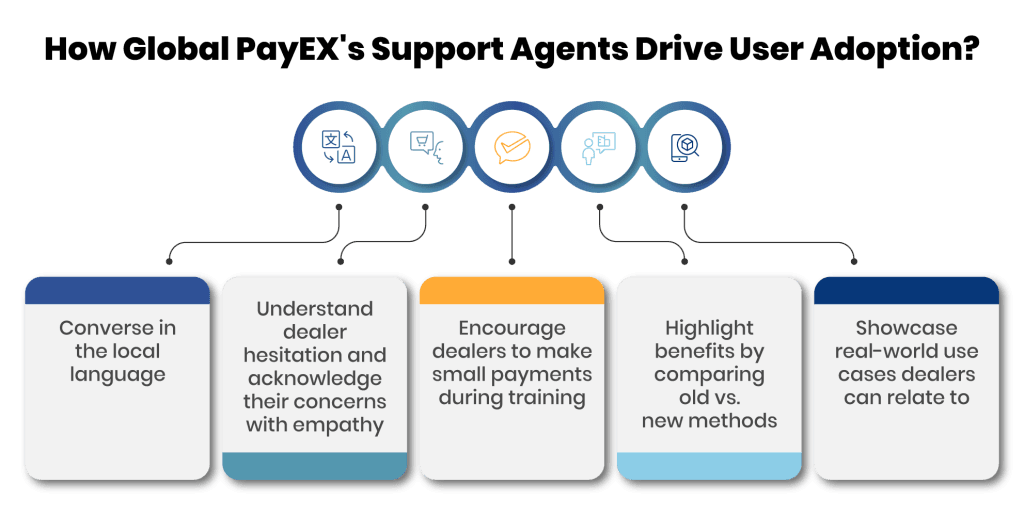

Driving Adoption

Convincing dealers to move away from traditional methods has never been an easy task. Many dealers are reluctant to use the platform even after onboarding and initial training sessions. They’d hesitate, delay, or simply ignore the setup. Our support agents work hard every day to smoothen the adoption process.

In response to rising demand, Global PayEX digitized the customer onboarding process and introduced multiple payment options, giving dealers greater flexibility for making payments. At the same time, changes in the training process have sped up onboarding and led to greater adoption of the platform.

Demonstrating Value Through Real-World Examples

For many dealers, what drives adoption isn’t the advanced features; it is real, relatable examples showing how Global PayEX solutions solve everyday problems.

For instance:

- A dealer used to call their sales manager to ask, “Has my invoice been uploaded?” or “When’s the payment due?”

Now, our support agents show them how they can check invoice status directly from the self-service payment portal anytime, anywhere.

- A dealer who used to visit the bank every Friday to submit cheques is shown how they can now pay directly from the platform.

The support agent highlights how it makes the entire payment process faster and more convenient.

These real-world examples resonate more than any technical walkthrough. And for every use case, there’s a clear outcome:

- Time saved

- Less dependency on others

- Greater visibility over invoices

- Immediate payment confirmation and auto-generated receipts

Support agents are trained to connect these benefits to each dealer’s workflow. For one, the highlight might be time saved; for another, it might be having digital proof of payment for audits. They also use success stories from other clients to build confidence.

“Before, we used to say to the dealers, ‘Please try it once.’ Now, they say, ‘Why didn’t we switch earlier?” shares a Global PayEX support agent.

Wrapping Up the Day

After a day spent actively assisting dealers and resolving their queries, it’s time to reflect, report, and prepare for the next.

1. Dealer Interactions & Reporting Feedback

Every interaction—whether successful onboarding or a hesitant ‘maybe later’ gets logged. Support agents update their reports through the internal system, noting:

- Dealer name and location

- What was explained (onboarding, payments, features)

- Dealer response and concerns (e.g., prefers cheque)

- Any transactions completed

This data flows into a central system, giving the marketing and operations teams valuable insights into user pain points, feature requests, and adoption trends.

2. Sharing Learnings with the Central Team

After logging, support agents usually sync with their manager to discuss:

- What’s working: For example, “Dealers appreciate being able to offset credit notes.”

- What’s not: For example, “Dealers are sometimes confused about how to offset debit notes.”

- What needs to change: For example, “The training video should have local language subtitles.”

These insights are shared with marketing and operations teams to help them refine training materials, UI tweaks, and support documents, as field feedback is the fastest way to improve the product.

3. Planning the Next Day

Before signing off, support agents prepare for what’s next:

- A training session with sales teams and newly onboarded dealers

- Scheduling a follow-up with a dealer who wanted to “try it next week.”

- Reviewing new dealer onboarding requests

- Checking for product updates and new features

With tomorrow’s agenda ready, the support agent ends the day knowing their role is far more than transactional.

The Bigger Picture: Why This Role Matters

Technology alone doesn’t drive adoption. What makes the difference is human connection. Dealers may download the app, but it won’t become a habit unless someone patiently shows them how to use it, answers their questions in their language, and stands by them when something doesn’t work.

That’s why support agents are so crucial. They simplify what seems complicated, guide the dealers through the first few payments, and, most importantly, stay available. That reassurance helps hesitant dealers take the leap. And once they do, convenience speaks for itself. The combination of great technology and accessible support makes Global PayEX stand out.

If you are looking to simplify your business’s AR and AP processes with powerful automation backed by hands-on, human-first support, talk to our experts. Let’s make adoption seamless together.