AUTOMATED INVOICE APPROVAL SYSTEM

Automate

Invoice Approvals.

Cut Delays.

Gain Control.

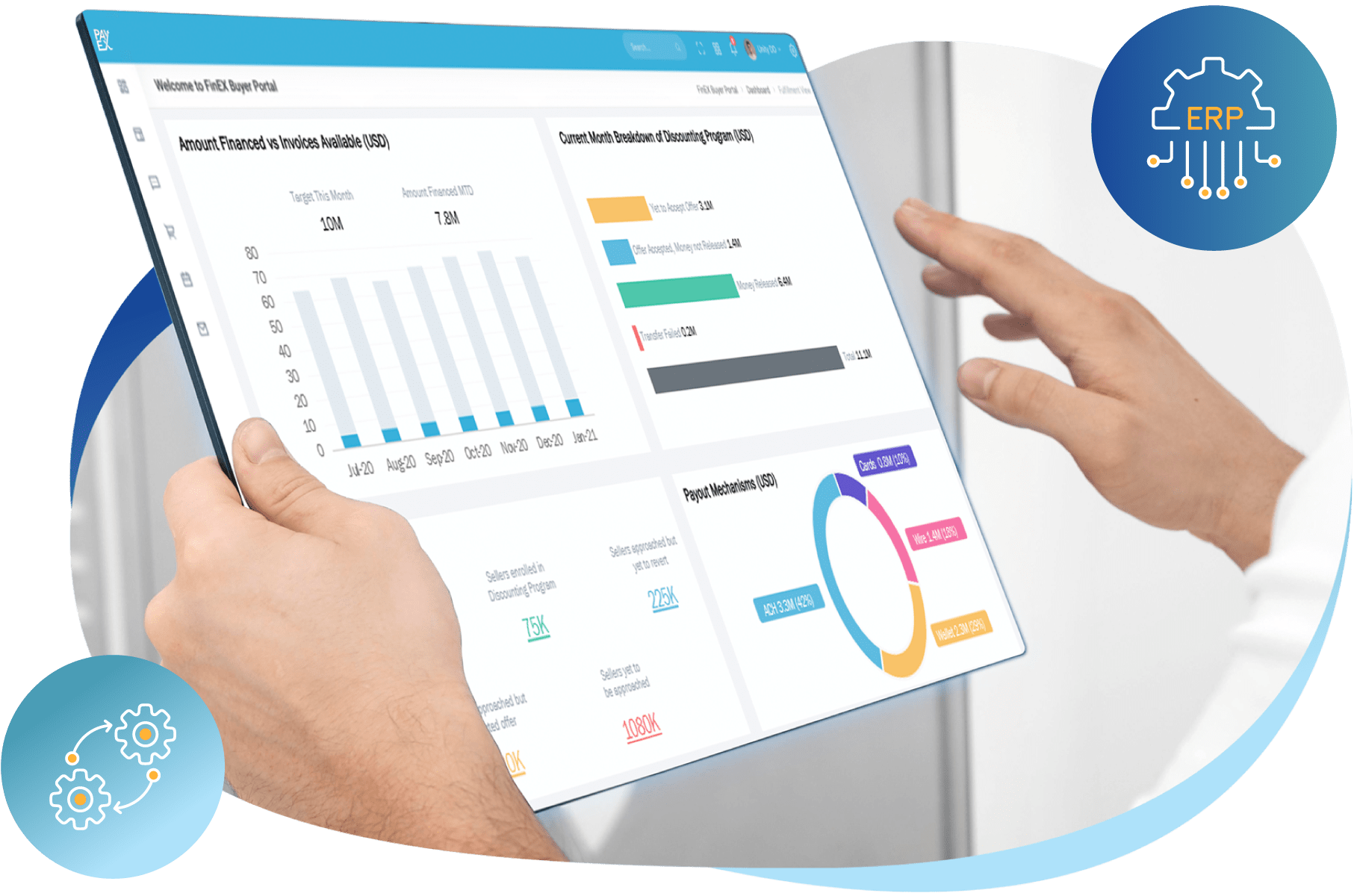

Simplify complex invoice approval workflows, eliminate bottlenecks, and ensure compliance—all while reducing approval time by up to 70%. Global PayEX’s AI-driven approval engine syncs with any ERP to bring speed, accuracy, and real-time visibility to your AP process

4.7/5

4.7/5

AUTOMATED INVOICE APPROVAL SYSTEM

Book a Free Demo

- Get a 30-min customized free demo

- By submitting this form, I consent to Global PayEX sending me marketing communications and processing my personal information in accordance with the privacy policy.