India’s financial sector is one of the fastest-growing sectors in the economy, driven by rapid digitization, fintech innovation, and a growing appetite for automation. Yet, amid all the progress, one seemingly routine process continues to create friction: remittance advice processing in B2B payments.

Despite being a critical part of the accounts receivable cycle, remittance advice is often handled manually, riddled with inconsistencies, and difficult to reconcile across disparate systems. The main reason behind this persistent challenge is the lack of standardization in formats and communication methods.

This blog dives into the core challenges businesses face while processing remittance advices in India and explores how AI-powered automation can transform this process.

What is Remittance Advice Processing?

Remittance advice, also known as payment advice, is a document sent by a buyer to inform the seller that a payment has been made. It includes details like the amount paid, invoice numbers, payment date, mode of payment, and any deductions or adjustments.

Remittance advice processing refers to the task of receiving, interpreting, and matching remittance advice to the corresponding invoices. It enables finance teams to know who has paid, how much, when, and against which invoice.

Industry-Wise Breakdown: Why Processing Remittance Advice is so Difficult?

In high-volume industries, payments often come via multiple channels, such as bank transfers and third-party gateways, without consistent or structured remittance information. This lack of standardization turns a routine task into a complex and time-consuming challenge. Here’s how it plays out across key industries:

- Healthcare: Payments from insurance providers and government schemes come in various formats, making reconciliation slow and prone to errors.

- E-commerce: Managing refunds, COD transactions, and delays from payment gateways leads to fragmented remittance data and unmatched entries.

- Telecom: The sector handles numerous micro-payments from customers, often spread across multiple accounts and lacking clear reference details.

- NBFCs: Customers pay through various digital and manual modes, making remittance aggregation difficult. Finance teams struggle to consolidate and match it accurately to the right accounts.

- Logistics & Education: Payments often arrive with missing or mismatched remittance data, requiring teams to spend hours verifying and applying remittances correctly.

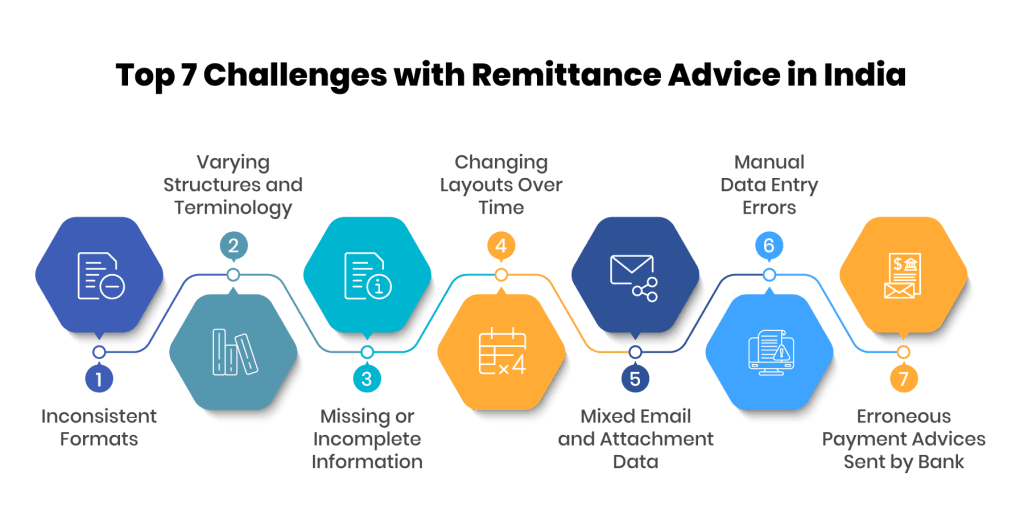

Common Challenges with Remittance Advices in India

There has been a growth in digital payments, but processing remittance advices continue to be a silent hurdle for many businesses. For CFOs and finance teams, it’s a source of constant roadblock that impacts efficiency and visibility. Understanding the root of these issues is the first step toward resolving them.

- Inconsistent Formats

Vendors send remittances in various formats, including PDFs, Excel files, emails, and scanned documents, often changing formats without notice. Smaller buyers might just send invoice numbers and amounts in email text, skipping formal remittance advice altogether.

- Varying Structures and Terminology

Different vendors use different terms and structures for invoices, transaction numbers, amounts, and UTRs (Unique Transaction Reference). Without a standard format, legacy systems struggle to correctly identify and match payment data.

- Missing or Incomplete Information

Missing UTRs, invoice numbers, or payment amounts are common issues. Sometimes, only partial invoice references or total sums without breakdowns are provided, making accurate reconciliation nearly impossible.

- Changing Layouts Over Time

Even agreed-upon remittance formats can shift — columns rearranged, or fields moved, causing systems to misread data and create errors.

For example, if the invoice number column shifts by just one position in an Excel file, legacy systems can misapply payments or skip them entirely.

- Mixed Email and Attachment Data

Remittance advice details may be split between the email body and attachments, which might be password-protected or zipped, complicating data extraction.

- Manual Data Entry Errors

Manual data entry can lead to incorrect or mismatched invoice numbers, sometimes belonging to other buyer accounts, which disrupts reconciliation. In high-volume environments, even a single keystroke error can result in the misapplication of payments worth lakhs.

- Erroneous Payment Advices Sent by Bank

Banks send payment advice in set formats, but often with errors, such as repeated invoice numbers. A single duplication in UTR or invoice references can cause payments to remain unapplied for days until manually resolved.

How AI-Powered Automation is Transforming Remittance Advice Processing

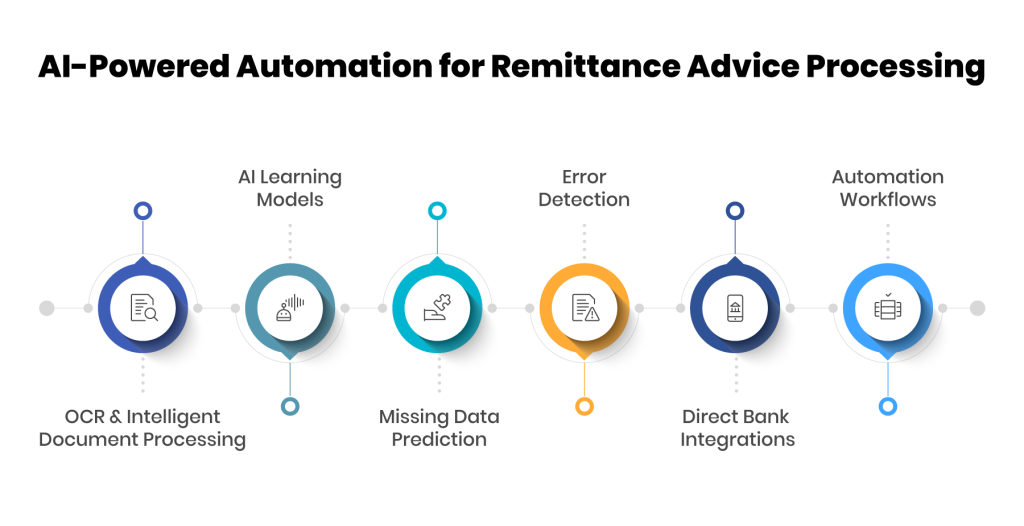

The challenges of remittance advice processing can’t be solved with traditional tools. That’s why leading Indian businesses are turning to AI-powered automation solutions designed specifically to tackle these pain points head-on. Here are the key capabilities that make these solutions effective in handling real-world complexities of remittance advices:

- OCR & Intelligent Document Processing:

Extracts remittance details from emails, scanned documents, PDFs, and even images, regardless of layout or language, eliminating the need for manual data entry.

- AI Learning Models:

Continuously adapts to changing remittance formats, column shifts, and vendor-specific terminologies without the need for reprogramming.

- Missing Data Prediction:

Analyzes historical trends and invoice patterns to intelligently fill in gaps, such as missing UTRs or invoice references.

- Error Detection:

Automatically flags duplicate invoice numbers, mismatches, or out-of-sequence entries, helping finance teams proactively resolve issues before they escalate.

- Direct Bank Integrations:

Pulls structured payment advice directly from banks via secure APIs or file transfers, bypassing email chains.

- Automation Workflows:

Automates repetitive tasks such as remittance aggregation, interpretation, and matching to streamline reconciliation.

The Future-Proof Strategy for Processing Remittance Advices

As digital payments grow more complex and multi-channel, processing remittance advice has become a hidden bottleneck in the order-to-cash cycle. Finance teams are under pressure to reconcile payments faster and ensure accuracy. Without modern tools, these challenges compound, delaying cash application and hurting financial agility.

Advanced platforms such as AlgoriQ by Global PayEX are built to solve exactly these challenges. By seamlessly integrating with existing ERP, AlgoriQ intelligently extracts, matches, and reconciles remittance data, delivering:

- Faster reconciliation — from days down to minutes

- Fewer errors and manual interventions

- Better compliance and audit readiness

- More accurate and actionable financial data

Finance leaders who delay investing in such solutions risk falling behind. As competitors embrace automation to boost efficiency, sticking to manual processes will only widen the gap, making it harder to scale and lead in India’s fast-moving financial landscape.

Want to know more about our solutions? Talk to our experts.