What if someone in your business started making payments the moment an invoice arrived—no approvals, no checks?

The result would be catastrophic.

Well, it wouldn’t take long before your cash reserves start vanishing due to frauds, errors and mismatched amounts. Fortunately, robust, automated invoice approval workflows offer a safeguard in B2B payments. These systems ensure each invoice is verified, matched, and approved before payment.

However, the traditional way in which many companies handle invoice approvals is often inefficient and can frustrate your AP team and your vendors.

In the competitive B2B world, it’s a delay businesses can’t afford. Automated invoice approval workflow is a much-needed digital upgrade for businesses of all sizes. In this blog, we’ll dive deep into automated invoice approval workflow—what it is, how it works, its benefits, and how to implement it in your business.

What Is an Invoice Approval Workflow?

An invoice approval workflow is a step-by-step process that organizations use to verify, approve, and process invoices from vendors. This workflow ensures that invoices are accurate, legitimate, and comply with company policies before payment is released.

Most invoices undergo multi-level, cross-departmental approvals—often involving stakeholders from finance, accounting, and legal departments. It helps establish strong internal controls and significantly lowers the risk of errors or fraud.

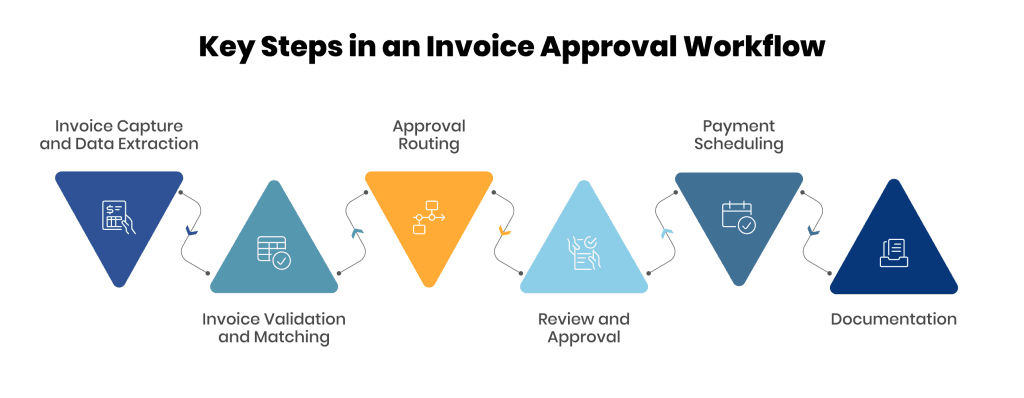

Key Stages in an Invoice Approval Workflow

The approval workflow consists of a series of complex steps. Let’s break down how this process typically unfolds:

- Invoice Capture and Data Extraction

Manual: Invoices are received through various channels such as postal mail, fax, or email. The A P team collects these invoices and manually enters the details such as invoice number, date, vendor information, and amount into ERP or spreadsheets.

Automated: Invoices are automatically captured from emails, online portals, or scanned documents, and AI intelligently extracts critical data points from invoices while analyzing the context, regardless of the format.

- Invoice Validation and Matching

Manual: The AP team verifies the invoice against corresponding purchase orders, goods receipts, and contract terms to ensure consistency in quantities, prices, and terms. This matching process helps identify discrepancies that may require resolution before approval.

Automated: Automation solutions instantly flag mismatches or other discrepancies, reducing the time spent on manual reviews. It performs an automatic 3-way matching that ensures that the invoice details align with the agreed-upon terms and that the goods or services were received as specified.

- Approval Routing

Manual: Once invoices are verified, they’re categorized based on key criteria such as amount, expense type, or vendor and then manually routed to the appropriate approvers. Routing follows predefined organizational policies. For example, invoices under a specific threshold may go to the department managers, while higher-value invoices may require approval from seniors.

Automated: Automation enforces predefined approval workflows, automatically routing invoices to the correct approvers based on rules (based on amount, department, vendor). Approvers get instant notifications and can approve or escalate with a click. It supports multi-level sign-offs where needed, logs every action for auditability, and significantly speeds up the process by minimizing delays, and enhancing accountability.

- Review and Approval

Manual: Once the invoice reaches the approvers, they examine the details, confirm the validity of the charges, and either approve or reject the invoice, all manually. This step may involve physical signatures or email confirmations, depending on the organization’s procedures.

Automated: Automation offers approvers with a digital interface containing all necessary invoice data. Approvers can review the invoices digitally with all details in one place and get reminders if they don’t act in time, ensuring faster decisions and seamless workflow tracking.

- Payment Scheduling

Manual: Once an invoice is approved, it is forwarded to the finance team for payment execution. Payments are manually scheduled based on vendor terms, due dates, early-payment discounts, and preferred payment methods.

Automated: An automated system takes over the end-to-end payment scheduling. It automatically reads payment terms, sets disbursement dates, and selects the appropriate payment method. This ensures timely payment disbursements and helps capture early-payment discounts.

- Documentation

Manual: After payment, all related documents, including the invoice, approval records, and payment confirmation, are filed and stored for future reference and auditing purposes. This archival process ensures compliance with regulatory requirements and facilitates financial reporting.

Automated: With automation, records are updated in real-time, and a clear audit trail is automatically generated. It simplifies reporting, enhances transparency, and ensures that your financial data is always accurate and audit-ready.

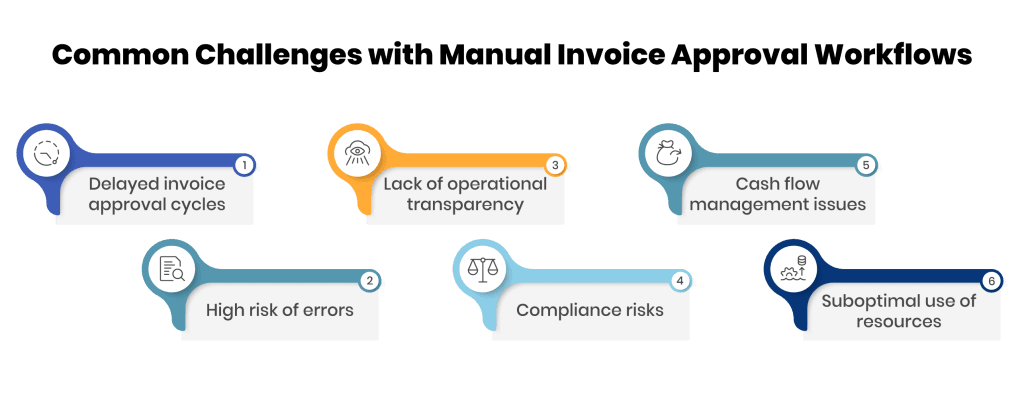

Common Challenges with Manual Invoice Approval Workflows

The manual invoice approval workflows often create significant roadblocks for businesses. This section will explore the common challenges businesses face due to manual invoice approval workflows.

- Delayed invoice approval cycles

Manual routing of invoices often results in significant delays, especially when approvers are unavailable, overwhelmed, or unaware of pending tasks. According to a study by Ardent Partners, 49% of businesses consider delayed invoice approvals as their biggest challenge in AP management. These delays usually stem from limited visibility into approval queues and overreliance on emails or paper-based communication. Such delays can lead to missed payment deadlines and gradually strain vendor relationships.

- High risk of errors

Manual invoice approval processes are prone to oversight – approvers may miss discrepancies, approve duplicates, or overlook mismatches with purchase orders due to time pressure.

Such approval errors can lead to overpayments, fraud, or incorrect payments. Physical paper-based documents further increase risks of misrouted approvals and delays in resolving issues.

- Lack of operational transparency

Manual workflows make it hard to track invoice approvals in real time, leading to delays, missed deadlines, and lost invoices. The underlying cause is the fragmentation of systems and the reliance on manual updates, which create communication and tracking gaps.

Example: An invoice stuck in an approver’s inbox may go unnoticed for days, resulting in a late payment and missed early payment discounts.

- Compliance risks

Manual invoice approvals often lack standardized controls needed for compliance with internal policies and external regulations. This can lead to missed steps, poor documentation, inconsistent approvals, and unclear audit trails—raising the risk of financial penalties or audit issues.

- Cash flow management issues

Manual workflows can severely impact cash flow management by creating a lack of visibility into payment schedules and approval statuses. This uncertainty makes it challenging for businesses to forecast future expenses accurately, leading to difficulties in planning for upcoming expenses.

- Suboptimal use of resources

AP teams often spend excessive time on repetitive tasks like reviewing and verifying invoice data, instead of focusing on strategic activities like vendor relationship management. This misallocation hampers productivity and limits their ability to contribute to business growth. Chasing approvals and resolving errors further adds to the inefficiency and slows down the process.

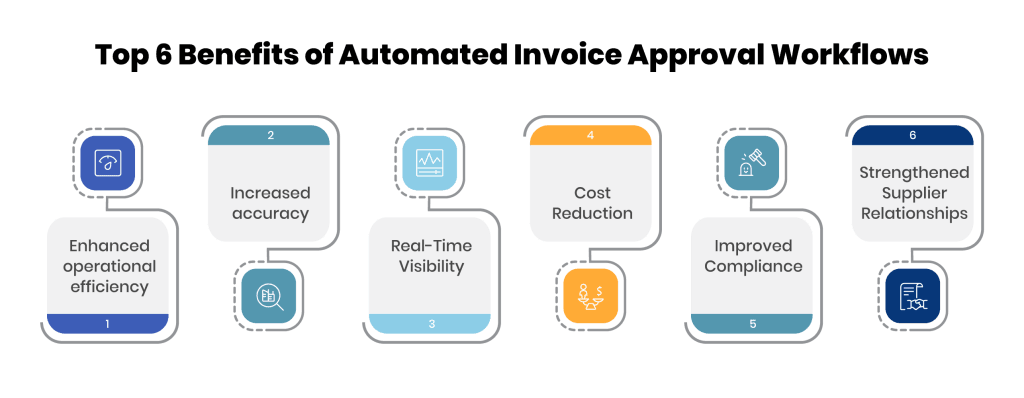

Why Your Business Needs Automated Invoice Approval Workflows

Nowadays, businesses manage high-volume, multi-geography transactions. Manual invoice approvals can stall their cash flow. Adopting automated invoice approval workflow empowers your organization to process millions of invoices in just a few seconds. Gartner reports that automation can reduce invoice processing costs by up to 75%. Here’s why an automated invoice approval workflow is now a must-have, not a nice-to-have.

1. Enhanced operational efficiency

Automation digitizes the invoice approval process. Invoices are routed to the approvers, and automated reminders are sent to ensure timely actions, enabling businesses to scale without adding headcount.

2. Increased accuracy

Automated workflows reduce human errors by accurately capturing and validating invoice data using intelligent extraction techniques and predefined validation rules. By integrating with the ERP system, only verified invoices progress through the approval pipeline.

3. Real-Time Visibility

Provides real-time tracking of invoice statuses, enabling finance teams to monitor approvals, identify bottlenecks, and make prompt, informed decisions. Custom reports are generated, offering a bird’s-eye view of invoice approval progress.

4. Cost Reduction

Automation reduces administrative overhead by eliminating manual data entry, printing, and physical storage of documents. It reduces processing costs and frees your finance team to focus on high-value tasks like budgeting and financial analysis.

5. Improved Compliance

By embedding predefined rules and approval hierarchies into the system, every invoice is processed consistently, reducing the risk of non-compliant approvals. It also ensures that key compliance elements like audit trails and tax calculations are maintained.

6. Strengthened Supplier Relationships

Ensures vendors are paid on time in accordance with agreed terms. This reliability helps avoid late fees or strained communications and positions your company as a dependable client.

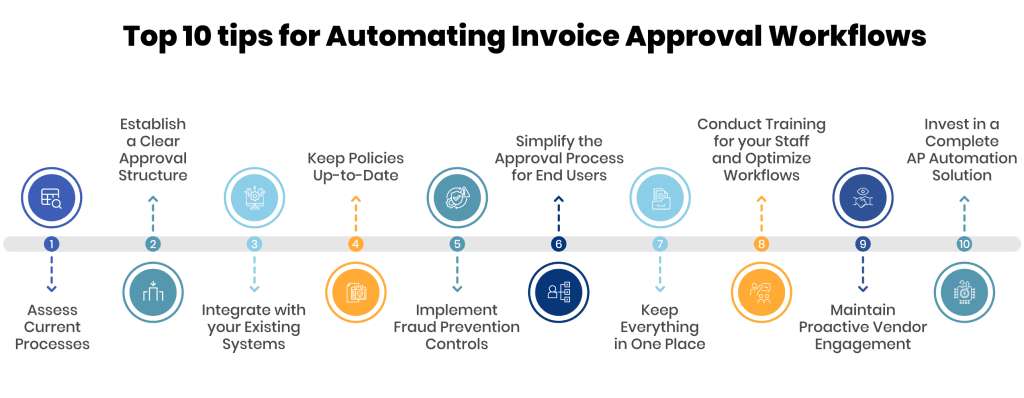

10 Tips for Automating Invoice Approval Workflows

Implementing automation in your invoice approval process can significantly streamline your AP management. Yet, for many organizations, the transition to automation is fraught with delays, missteps, or underutilized systems – not due to a lack of intent, but because they miss critical planning and execution details. To help you avoid common pitfalls, here are 10 practical, expert-backed tips actionable tips to ensure smooth and successful shift to automated invoice approvals:

- Assess Current Processes

Begin by mapping out your existing invoice approval workflow to identify inefficiencies. Use these insights to choose a solution that aligns with your business needs and offers the functionalities required for a smoother workflow.

- Establish a Clear Approval Structure

Not all invoices require the same level of review. Create a tiered approval system where low-value invoices can follow a streamlined path while high-value ones can be escalated to the senior management.

Example: set a threshold such that invoices below $5,000 require only a finance manager’s approval, whereas invoices exceeding that amount may require multi-level approvals involving department heads or senior executives.

- Integrate with your Existing Systems

For a smooth invoice approval workflow, your automation solution must integrate effortlessly with your existing ERP and accounting systems. This integration enables real-time data sync.

- Keep Policies Up-to-Date

Regularly review and update your accounts payable policies to reflect your evolving business needs and regulatory changes. Updating your invoice approval rules ensures compliance, minimizes errors, and supports smoother automation.

- Implement Fraud Prevention Controls

Choose an automation solution with built-in fraud detection features such as role-based access and audit trails. While automation reduces manual errors, strategic human oversight including periodic audits and exception reviews, are also essential to protect your business from fraud.

- Simplify the Approval Process for End Users

Make it easy for approvers by choosing a solution that provides a user-friendly interface. Implement mobile and email-based approvals so decision-makers can quickly review and respond to invoices without navigating a complex system and avoid related delays.

- Keep Everything in One Place

Use a unified dashboard to manage all invoice approvals. A centralized system also helps track key metrics like approval cycle times and error rates. Access to real-time consolidated data will empower your team to quickly identify bottlenecks and resolve issues instantly.

- Conduct Training for your Staff and Optimize Workflows

Regular training is crucial for ensuring that your team is comfortable with the new solution. Moreover, periodically review your workflows to incorporate feedback and evolving business needs; this proactive approach ensures the system remains efficient over time.

- Maintain Proactive Vendor Engagement

Keeping your vendors in the loop and ensuring technology adoption support for them is crucial when transitioning to automated invoice approvals. Communicate how the new system works, what changes to expect, like updated payment timelines or invoice submission formats and how it benefits them. Equip vendors with access to a self-service portal where they can easily check invoice and payment statuses.

- Invest in a Complete AP Automation Solution

Instead of isolating invoice approvals, opt for an end-to-end accounts payable solution such as PayEX AP. This broader approach automates everything from invoice capture to payment reconciliation, offering comprehensive efficiency gains across your finance operations.

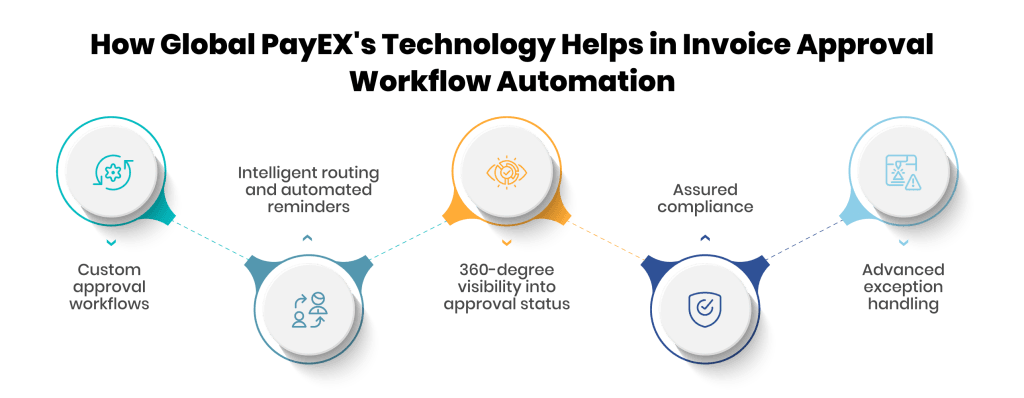

How Global PayEX’s Technology Helps in Invoice Approval Workflow Automation

Global PayEX offers an AI-powered Accounts Payable Automation solution, PayEX AP, tailored for businesses of all sizes to digitize the invoice approval process. ERP-agnostic by design and equipped with pre-built connectors, PayEX AP has consistently delivered measurable improvements to businesses worldwide. It offers:

- Custom approval workflows

Allows businesses to create custom invoice approval workflows specific to their operations. It applies approval rules for both PO and non-PO invoices, triggering requests based on pre-defined invoice value thresholds.

- Intelligent routing and automated reminders

It enables automatic routing to the right approvers based on predefined rules, ensuring a smooth and accurate approval flow. Once routed, approvers receive email notifications with the option to review and approve directly from their inbox. It triggers automated reminders to prompt timely action if an approval exceeds the defined time limit.

- 360-degree visibility into approval status

Provides a real-time view of invoice approval status through a centralized dashboard with role-based access controls. PayEX AP enables your AP team to track key performance indicators such as DPO and approval cycle times to uncover insights and make more informed business decisions.

- Assured compliance

Ensures security and compliance with AI-powered fraud detection, automated tax calculations, and detailed audit trails. The system keeps your organization audit-ready while minimizing risk across the invoice approval lifecycle.

- Advanced exception handling

PayEX AP enables businesses to detect and manage invoice approval exceptions automatically through predefined, rule-based workflows. These rules help route exceptions to the appropriate departments, ensuring quick resolution and uninterrupted processing.

Use Case: JSW’s Transformation Story with Automated Invoice Approval Workflows

JSW, one of India’s leading steel exporters and the largest manufacturer of galvanized steel products, manages a vast network of over 25,000+ vendors. The AP team previously spent up to two days each week manually routing paper invoices for approval, a time-consuming process that became unsustainable with the company’s rapid growth.

JSW implemented PayEX AP to streamline its invoice approval workflows and overcome this challenge.

After implementation, the system enabled automatic role-based approval routing, instantly notifying the relevant approvers with the option to accept or reject invoices directly. Additionally, the AP team received all supporting documents for pending approvals in a unified digital repository.

As a result, JSW achieved a 90% reduction in invoice processing time, significantly improving efficiency.

Invoice Approval Workflow FAQs

Q1: What is an invoice approval workflow?

An invoice approval workflow is a process to review, verify, and authorize invoices before payment is issued. It routes invoices through the appropriate stakeholders, ensuring accuracy, compliance, and protection against errors, fraud, or unauthorized transactions.

Q2: Who approves the invoices?

There are multiple departments involved in the approval process. It usually begins with the AP team receiving the invoice, followed by a review from department heads. Final approval often rests with the finance team or senior management.

Q3: Why should businesses automate their invoice approval workflow?

Automation digitizes invoice approval workflows to reduce errors, ensure compliance, and offer real-time insights into the approval status, leading to faster payments and better vendor relationships.

Q4: Can automated invoice approval workflows integrate with existing ERP systems?

Yes, solutions like PayEX AP are designed to integrate seamlessly with existing ERP systems, ensuring consistent data flow and minimizing disruptions.

Q5: Do automated invoice approval workflows pose any security risks?

No, advanced automated solutions are equipped with features like encrypted data storage, multi-factor authentication, and access controls, safeguarding sensitive financial data.