In today’s automated accounts payable (AP) landscape, the ability to process invoices, match them against purchase orders (POs) and proof of delivery (POD) documents is table stakes. Businesses now have access to a wide range of AP solutions tailored to specific needs based on region, banking partnerships, ERP systems, budget, or unique workflow requirements.

However, the leaders in this space are not just focused on automation—they’re unlocking greater value from existing payment flows. One key area of untapped potential is discount optimization. For every $1 billion spent on purchase orders, approximately $3 million in early payment discounts remain unclaimed, representing significant savings opportunities for proactive organizations.

Types of Discounts in Accounts Payable

Broadly, AP discounts fall into two categories:

1) Pre-Negotiated Discounts

These are embedded within the procurement cycle, often reflected in the purchase order and formalized in the payment terms. These discounts are usually easier to manage because they’re pre-agreed, regardless of whether they’re explicitly mentioned on the invoice.

The main challenge with pre-negotiated discounts lies in capturing the actual savings while accounting for price or quantity variances. For example, a 2% discount for paying within 10 days needs to be correctly applied to the adjusted amount after reconciling any discrepancies in the invoice.

Key considerations for pre-negotiated discounts:

- Ensure discount terms are clearly documented in supplier contracts

- Establish automated verification processes for invoice accuracy

- Track discount capture rates to identify missed opportunities

- Train AP staff to recognize and apply applicable discounts

2) Dynamic (or Early Payment) Discounts

These are discounts offered directly on the invoice, outside the formal payment terms. This is essentially a legal tender—an offer from the supplier to pay early in exchange for a discount.

Historically, companies struggled to capture these opportunities due to manual processing delays. With modern electronic invoicing and Purchase-to-Pay automation, businesses can now approve invoices faster and take advantage of these valuable discounts.

Handling these discounts effectively requires a system capable of:

- Accurately reading the invoice data

- Capturing discounts that might apply to specific line items

- Understanding the conditions attached to the discount (e.g., “Offer valid if paid in full before March 31, 2025”)

Examples:

- An invoice where the discount applies to the total amount (at the invoice level)

- An invoice with discounts applied to specific line items (line-item level)

The ROI of Early Payment Discounts

The return on investment for early payment discounts is compelling.

Consider this scenario:

If a buyer receives a 2% discount for paying a 30-day invoice after 10 days, they effectively earn a 2% return on their money for a 20-day period. This translates to an equivalent of over 36% annual return on capital—far exceeding what that same cash would earn in traditional investments.

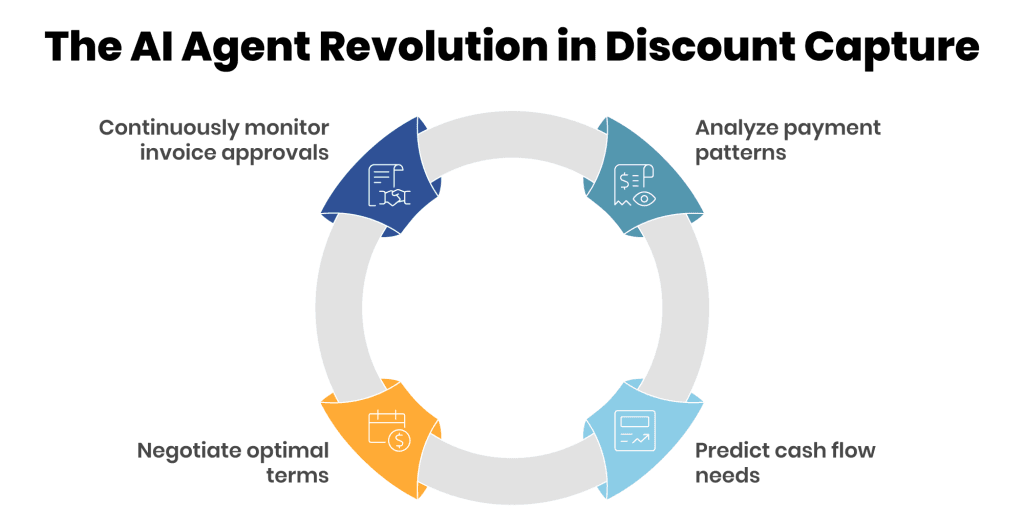

The AI Agent Revolution in Discount Capture

The emergence of AI agents represents a game-changing opportunity for accounts payable teams seeking to maximize discount capture. These intelligent systems can:

- Continuously monitor invoice approvals: AI agents can track approval workflows in real-time, identifying invoices approaching discount deadlines and escalating them to ensure timely payment.

- Analyze payment patterns: By examining historical payment data and supplier behavior, AI agents can identify new discount opportunities that might otherwise go unnoticed.

- Predict cash flow needs: AI-powered forecasting allows for strategic planning of early payments, balancing discount capture with working capital requirements.

- Negotiate optimal terms: Advanced AI agents can even suggest the most advantageous payment terms based on your company’s cash position and supplier relationships.

As one industry solution demonstrates, AI agents can simulate various payment scenarios and recommend accelerating payments to secure discounts, effectively transforming accounts payable into a cost-saving powerhouse. One construction firm using this approach saw a 20% reduction in days payable outstanding without straining supplier relationships.

Gain-Share Pricing Models: A New Partnership Approach

Rather than paying a fixed monthly fee for AP automation software, consider partnering with solution providers who offer gain-share pricing models. In this approach, the provider receives a percentage of the actual discounts captured through their system.

Gain-share models work particularly well when a “partnership” approach is needed to achieve mutually beneficial results. This model inspires both the service provider and client to work together creatively and gives the provider flexibility in delivery.

Key benefits of gain-share arrangements include:

- Aligned incentives: Your provider is motivated to maximize discount capture

- Reduced upfront costs: Lower initial investment as payment is tied to realized savings

- Scalable pricing: Costs naturally scale with the value received

- Shared risk: The provider only profits when you do

When evaluating potential gain-share partners, look for those with proven track records in discount optimization and transparent reporting mechanisms to track captured savings.

The Need for a Smarter AP Solution

To fully leverage these discounts, your AP system should not only automate invoice processing but also track missed discount opportunities over time. This data provides valuable insights into potential savings left on the table and areas for process improvement.

Key metrics to monitor include:

- Discount realization rate: The percentage of eligible discounts actually captured

- Average cost per invoice: How processing costs affect overall discount value

- Invoice processing time: How quickly invoices move from receipt to approval

- Percentage of invoices with captured discounts: Tracking performance over time

By automating the end-to-end AP process, finance teams gain access to more robust analytics and metric tracking that allows for a more strategic approach to discount management.

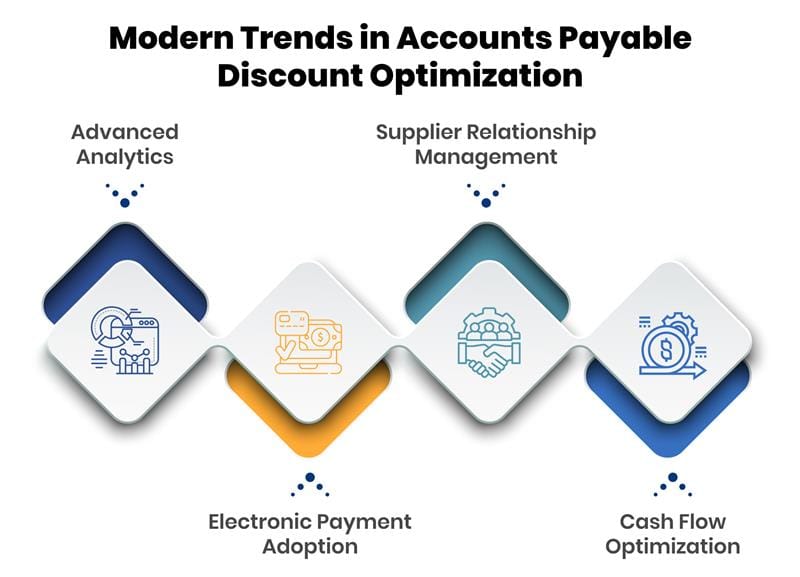

Modern Trends in AP Discount Optimization

Several trends are reshaping how businesses approach discount capture:

- Advanced Analytics: Today’s AP systems analyze payment patterns and supplier behavior, identifying opportunities for negotiating better terms and optimizing discount capture.

- Electronic Payment Adoption: The shift toward electronic payments accelerates processing and enables faster discount capture.

- Supplier Relationship Management: Forward-thinking companies view discount programs as opportunities to strengthen supplier relationships rather than just cost-saving measures.

- Cash Flow Optimization: While many companies delay payments to maximize free cash flow, this approach isn’t always beneficial. Delayed payments can erode supplier relationships, resulting in slower deliveries, less flexibility, and stricter payment terms in the future.

The Cash Flow Dilemma: Financing Discounts Strategically

Even with discounts on offer, a common challenge arises: What if your organization lacks the immediate cash flow to take advantage of these offers?

This is where alternative financing solutions can help. Smaller banks or specialized financial partners often provide invoice financing or factoring services. Here’s how it can work:

Scenario: Vendor A offers a 2% discount for payment by March 5. On an annualized basis, that’s equivalent to a double-digit return on your money.

If you lack the available cash to pay early, you could approach a bank or financing partner to fund the payment in exchange for a smaller fee, allowing you to still benefit from a portion of the discount.

To secure even better rates, consider offering a post-dated ACH transaction as collateral, reducing the lender’s risk and improving your financing terms.

Implementation Guide for Discount Optimization

To maximize discount capture in your organization, follow these steps:

- Assess Current Performance: Evaluate your current discount capture rate and identify missed opportunities.

- Implement AP Automation with AI: By leveraging AI in accounts payable, departments can capitalize on more early payment discounts since the technology pinpoints crucial areas for assessing cash flow and discount conditions.

- Create a Discount Strategy: Develop a framework for evaluating which discounts to pursue based on ROI.

- Standardize Payment Terms: Work toward consistency in payment terms with suppliers.

- Establish Performance Metrics: Set up dashboard tracking of key discount metrics.

- Develop Supplier Communication Plan: Proactively engage suppliers about discount opportunities.

- Review and Improve: Regularly analyze performance data and refine your approach.

Final Thoughts

Discounts in accounts payable are more than just cost-saving opportunities—they’re a strategic lever for optimizing working capital and strengthening supplier relationships. By adopting an intelligent AP solution powered by AI agents and exploring creative financing options and gain-share partnerships, businesses can unlock significant savings and drive financial efficiency.

In today’s competitive environment, leaving discounts on the table is no longer an option. The organizations that systematically track, capture, and optimize payment discounts gain a meaningful advantage in profitability and supplier relationships.

Next Steps:

- Audit your current discount capture performance

- Evaluate AI-powered AP automation capabilities

- Explore gain-share pricing models with solution providers

- Develop a roadmap for discount optimization

- Schedule discussions with key suppliers about discount opportunities